As the economy “repels” expectations of interest rate cuts, technology stocks “take flight” the S&P 500 Index takes four consecutive days

The Zhitong Finance App learned that on Tuesday, after rising technology stocks offset investors' concerns that strong growth in the US economy might delay interest rate cuts, the S&P 500 index closed up 0.5% to 6909.79 points, rising for the fourth consecutive trading day, setting a record closing high.

The rise in big tech stocks such as Nvidia (NVDA.US), Broadcom (AVGO.US), and Google (GOOGL.US) offset the weakness in the healthcare and essential consumer goods sector. However, the range of increase was narrow, and weighted indices such as the S&P 500 fell 0.3% instead. The Nasdaq 100 Index, which is dominated by technology stocks, rose 0.5%, and the Dow Jones Industrial Average closed up 0.2%. The Chicago Board Options Exchange Volatility Index (VIX) is hovering below 14.

According to the data, the US gross domestic product (GDP) grew 4.3% month-on-month in the third quarter of 2025, higher than the 3.8% growth rate in the second quarter and 3.3% expected by the market. The US Department of Commerce said that the acceleration in economic growth in the third quarter was mainly due to the acceleration in consumer spending growth, as well as the increase in exports and government spending. According to the data, personal consumption expenditure, which accounts for about 70% of the total US economy, increased by 3.5% during the quarter, government consumption expenditure and investment increased by 2.2%, and exports increased by 8.8%. Non-residential fixed asset investment, which reflects corporate investment, increased by only 2.8% during the quarter, which is significantly lower than 7.3% in the previous quarter.

This figure far exceeds market expectations of 3.2%, causing the market to worry that the Fed is less likely to cut interest rates in early 2026. According to data from the Chicago Mercantile Exchange's Federal Reserve Watch Tool, after the report was released, federal funds rate futures traders increased their bets slightly, believing that the Federal Reserve will keep interest rates unchanged at interest rate meetings in January and March next year.

Due to the negative growth of the US economy in the first quarter of this year, economic growth in the fourth quarter is expected to slow significantly due to factors such as the “shutdown” of the federal government. Many research institutes expect the US economy to grow by 2% or less in 2025.

Chris Zaccarelli, chief investment officer at Northlight Asset Management, said: “Trading volume may be relatively light, but until the end of the year, the path of least resistance is still upward.” He called the GDP data released on Tuesday “excellent.”

22V Research economist Peter Williams said, “This data, which is slightly better than our optimistic baseline expectations, weakens the reason for recent interest rate cuts to a certain extent.”

Currently, the market has taken into account the expectation that interest rates will be cut twice in 2026, but the Federal Reserve is expected to face greater political pressure next year to relax its monetary policy. US President Trump said that if the economy performs well, he expects the next chairman of the Federal Reserve to cut interest rates. Treasury Secretary Scott Bessent (Scott Bessent) said that whether the central bank's 2% inflation target should be re-expressed as a range is worth discussing.

After the US government was shut down for a long time, it was difficult for the market to determine the Federal Reserve's interest rate path — especially in the context of interest rate cuts implemented at its last three meetings. Traders are closely watching the latest economic reports. Mona Mahajan, head of investment strategy at Edward Jones, said, “If the market is to continue to perform well at the current level, it is not necessarily necessary to cut interest rates again.”

Stock market volatility has declined markedly. The VIX index is close to a 12-month low, but Citigroup strategists led by Chris Montagu pointed out that investors increased their shorting bets across the US stock market last week.

Cyclical stocks may take over technology stocks to lead US stocks in 2026

As economic growth is expected to accelerate, traders have seen cyclical stocks as potential winners in 2026. Strategists and analysts expect banks such as JPMorgan Chase (JPM.US), equipment manufacturers such as Caterpillar (CAT.US), and retailers such as Gap (GAP.US) and Dollar Tree (DLTR.US) to perform well in 2026.

Michael Kantrowitz, chief investment strategist and head of portfolio strategy at Piper Sandler, said: “Investors have begun to smell the initial signs of bottoming out in the cyclical sector of the economy.”

This means that financial, industrial, and non-essential consumer goods suppliers are expected by Wall Street to become the leading force in the US stock market for another strong year. About 60 economists surveyed forecast an average growth target of 2% for the US economy next year — although this growth rate is not strong, it is enough to drive growth outside of the technology sector.

Michael Kantrowitz added: “As cyclical data improves, value stocks may outperform the market for a long time in 2026. We should plan ahead of time those targets where profit expectations for next year are expected to improve marginally.”

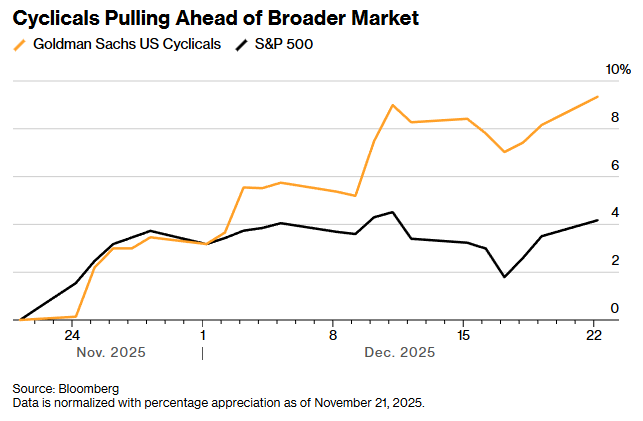

In fact, the trend of changing market styles has quietly emerged. The annual trend of the cyclical stock basket compiled by Goldman Sachs is basically in sync with the S&P 500 index, but the cumulative increase in the past month reached 9.3%, double the 4.2% increase in the S&P 500 index.

Cyclical stocks outperform the market

Furthermore, the performance of cyclical stocks has surpassed defensive stocks. Previously, defensive stocks were the biggest beneficiaries of the small-scale style change triggered by the October-November technology sector pullback. Goldman Sachs's other trading strategy — going long on non-commodity cyclical stocks and shorting defensive stocks — also reached 10% in the past month.

Sam Stovall, chief investment strategist at CFRA, stated in a report to clients: “The influx of capital into non-technology cyclical stocks highlights the market's optimistic expectations for economic expansion.” The agency predicts that the real gross domestic product (GDP) of the US will grow by 2.5% in 2026. “This increase will benefit from a 4.1% increase in retail sales and a fall in the core personal consumption expenditure (PCE) price index to 2.4%.”

Many Wall Street institutions believe that the strong performance of cyclical stocks is sustainable for a long time. Dennis DeBusschere, founder and chief market strategist at 22V Research LLC, said, “The window period for procyclical trading is not limited to just one or two quarters.” His core investment strategy is to go long on banks and retail stocks, short essential consumer goods stocks, and at the same time be optimistic about transportation stocks outside of the aviation sector.

Tom Hainlin, chief investment strategist at US Bank NA, advises clients to increase their exposure to cyclical stocks in their stock portfolios. “We want to increase the allocation of cyclical stocks, but we will not achieve this goal by selling off technology stocks,” he said. He expects the technology sector to continue to lead profit growth in 2026, followed by the raw materials and industrial sector.

A team of Citigroup strategists led by Adam Pickett pointed out in the December 15 report that cyclical stocks will perform better than defensive stocks, and investors are advised to overallocate the financial sector — this is the bank's preferred target in the cyclical sector, while also under-allocating the essential consumer goods sector. The report also mentioned: “The industrial sector also has the potential to raise ratings.” However, Adam Pickett also cautioned that the 2026 cyclical stock upward path is not unhindered. If the US economy overheats, it may cause delays in implementation of interest rate cuts expected by the market, or even a policy shift. “Whether the Federal Reserve can continue to cut interest rates until the end of 2026 is far from certain,” he stressed.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal