3 Asian Growth Companies With High Insider Ownership And 28% Revenue Growth

As the Bank of Japan raises its benchmark interest rate to a 30-year high and China's economic indicators show mixed signals, the Asian markets are navigating through a period of significant economic shifts. In this evolving landscape, growth companies with substantial insider ownership can offer unique insights into potential resilience and long-term value creation.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 116.4% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Underneath we present a selection of stocks filtered out by our screen.

Shenghe Resources Holding (SHSE:600392)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenghe Resources Holding Co., Ltd is involved in the research, development, production, and supply of rare earth and related products both in China and internationally, with a market cap of CN¥37.51 billion.

Operations: Shenghe Resources Holding Co., Ltd generates revenue through its research, development, production, and distribution of rare earth and related products across domestic and international markets.

Insider Ownership: 13.4%

Revenue Growth Forecast: 24% p.a.

Shenghe Resources Holding demonstrates strong revenue growth, forecasted at 24% annually, surpassing the Chinese market's average. Despite slower earnings growth projections of 20.6% compared to the market, recent nine-month results show significant improvement in net income from CNY 92.87 million to CNY 787.6 million year-on-year. The price-to-earnings ratio of 41.6x is favorable relative to the market average, although return on equity remains low at an expected 12.3%.

- Unlock comprehensive insights into our analysis of Shenghe Resources Holding stock in this growth report.

- The valuation report we've compiled suggests that Shenghe Resources Holding's current price could be inflated.

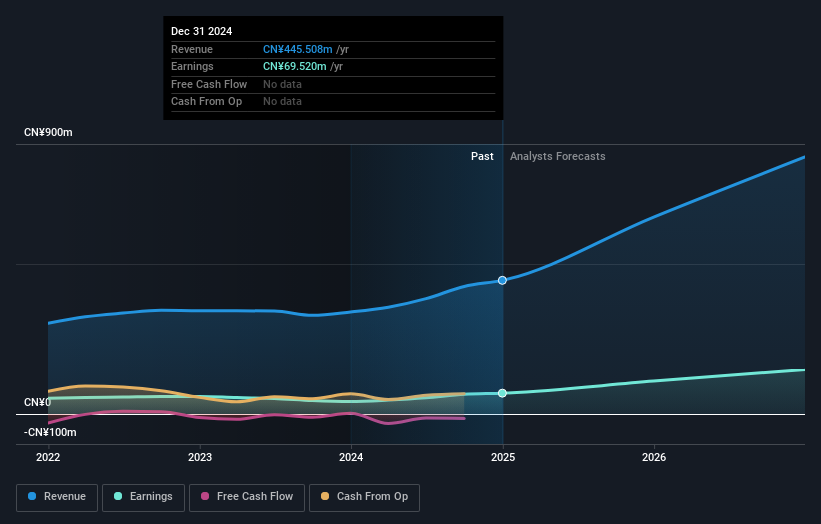

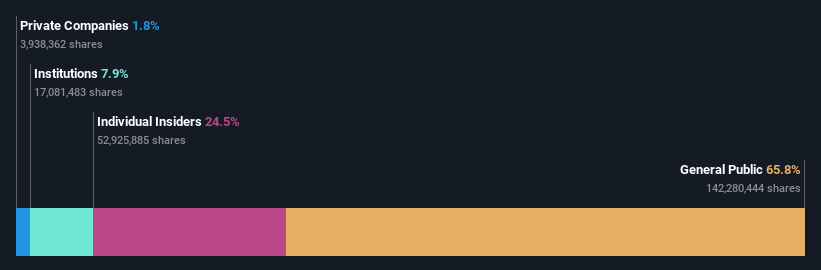

Optowide Technologies (SHSE:688195)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Optowide Technologies Co., Ltd. focuses on the research, development, production, and sale of precision optics and fiber components both in China and internationally, with a market cap of CN¥23.16 billion.

Operations: Optowide Technologies Co., Ltd. generates revenue through its involvement in precision optics and fiber components across domestic and international markets.

Insider Ownership: 36.8%

Revenue Growth Forecast: 28.8% p.a.

Optowide Technologies' revenue is forecast to grow robustly at 28.8% annually, outpacing the Chinese market's average. Earnings are expected to rise significantly by 34.3% per year, surpassing the market's growth rate. However, its return on equity is projected to be low at 13.7%. Recent results for nine months ended September 2025 show revenues of CNY 425.13 million and net income of CNY 63.8 million, reflecting solid financial performance despite share price volatility.

- Navigate through the intricacies of Optowide Technologies with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Optowide Technologies' share price might be too optimistic.

Sichuan Chuanhuan TechnologyLtd (SZSE:300547)

Simply Wall St Growth Rating: ★★★★★★

Overview: Sichuan Chuanhuan Technology Co., Ltd. specializes in the research, development, production, and sale of automotive rubber hose products in China and has a market cap of CN¥8.72 billion.

Operations: The company generates revenue from its Non-Tire Rubber Products segment, totaling CN¥1.48 billion.

Insider Ownership: 23%

Revenue Growth Forecast: 25.3% p.a.

Sichuan Chuanhuan Technology Ltd. is poised for strong growth, with revenue expected to increase by 25.3% annually, surpassing the broader Chinese market. Earnings are also forecasted to grow significantly at 31.4% per year. Despite a recent decline in net income to CNY 137 million for the nine months ending September 2025, insider ownership remains high, suggesting confidence in future prospects. The company recently amended its articles of association at an extraordinary general meeting in November 2025.

- Dive into the specifics of Sichuan Chuanhuan TechnologyLtd here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Sichuan Chuanhuan TechnologyLtd is priced higher than what may be justified by its financials.

Taking Advantage

- Unlock more gems! Our Fast Growing Asian Companies With High Insider Ownership screener has unearthed 629 more companies for you to explore.Click here to unveil our expertly curated list of 632 Fast Growing Asian Companies With High Insider Ownership.

- Curious About Other Options? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal