3 Asian Dividend Stocks To Watch With Up To 3.7% Yield

As the Bank of Japan raises interest rates to levels not seen in three decades and China's economic indicators reveal mixed signals, investors are closely monitoring the Asian markets for potential opportunities. In this environment, dividend stocks can offer a more stable income stream, making them an attractive option for those looking to navigate uncertain economic conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.24% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.14% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.67% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.30% | ★★★★★★ |

Click here to see the full list of 1022 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

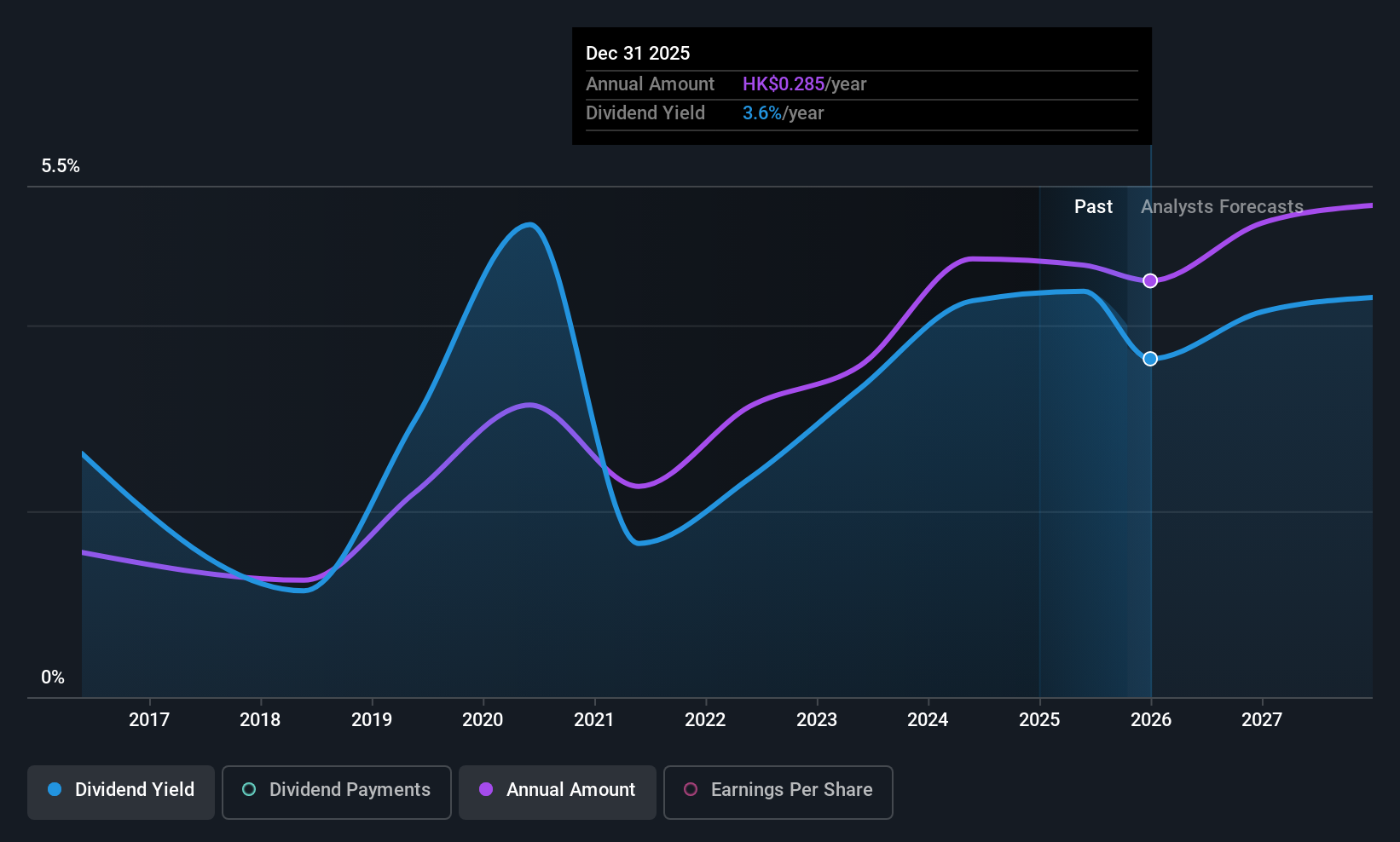

CIMC Enric Holdings (SEHK:3899)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CIMC Enric Holdings Limited specializes in providing transportation, storage, and processing equipment and services, with a market cap of HK$18.02 billion.

Operations: CIMC Enric Holdings Limited generates revenue from three primary segments: Liquid Food (CN¥4.02 billion), Clean Energy (CN¥18.93 billion), and Chemical and Environmental (CN¥2.98 billion).

Dividend Yield: 3.4%

CIMC Enric Holdings offers a dividend with a payout ratio of 46.7%, indicating solid earnings coverage, and a cash payout ratio of 65.5%, suggesting reasonable coverage by cash flows. However, the dividend yield is relatively low at 3.37% compared to top-tier payers in Hong Kong. Despite growth over the past decade, dividends have been volatile and unreliable, experiencing significant drops exceeding 20%. Recent shareholder meetings focused on financial services agreements may influence future financial strategies.

- Delve into the full analysis dividend report here for a deeper understanding of CIMC Enric Holdings.

- Our valuation report here indicates CIMC Enric Holdings may be overvalued.

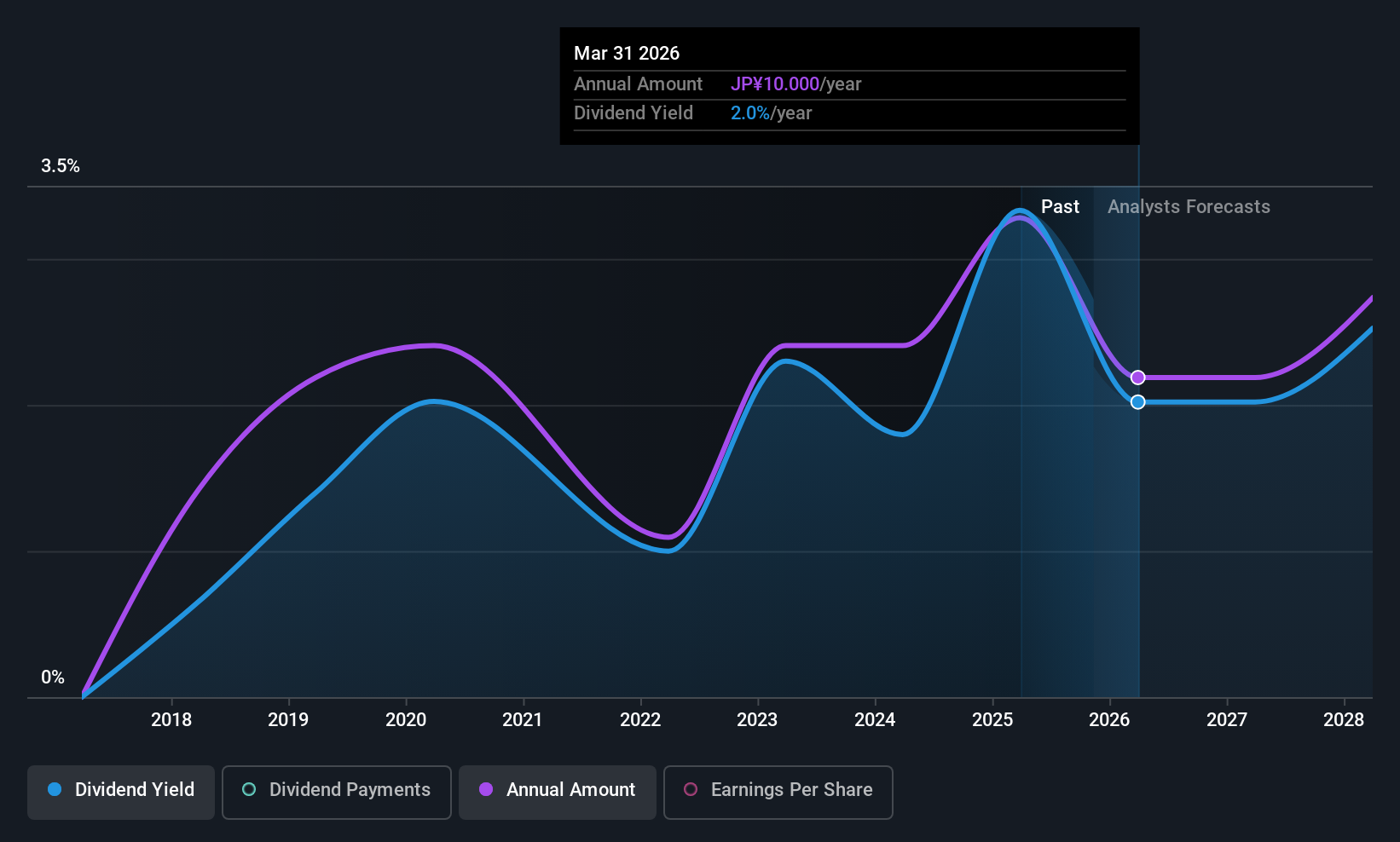

CMK (TSE:6958)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CMK Corporation develops, produces, and markets various printed wiring boards across Japan, China, Southeast Asia, Europe, the United States, and internationally with a market cap of ¥38.07 billion.

Operations: CMK Corporation's revenue segments are comprised of ¥34.68 billion from China, ¥59.90 billion from Japan, ¥35.10 billion from Southeast Asia, and ¥3.88 billion from Europe and America.

Dividend Yield: 3.7%

CMK's dividend yield of 3.75% ranks in the top 25% in Japan, yet its dividends have been volatile and unreliable over the past decade, with significant annual drops. Although dividend payments are covered by earnings due to a payout ratio of 53.1%, they are not supported by free cash flows, raising sustainability concerns. Earnings forecasts suggest a decline over the next three years, while recent profit margins have decreased from last year’s figures.

- Get an in-depth perspective on CMK's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, CMK's share price might be too optimistic.

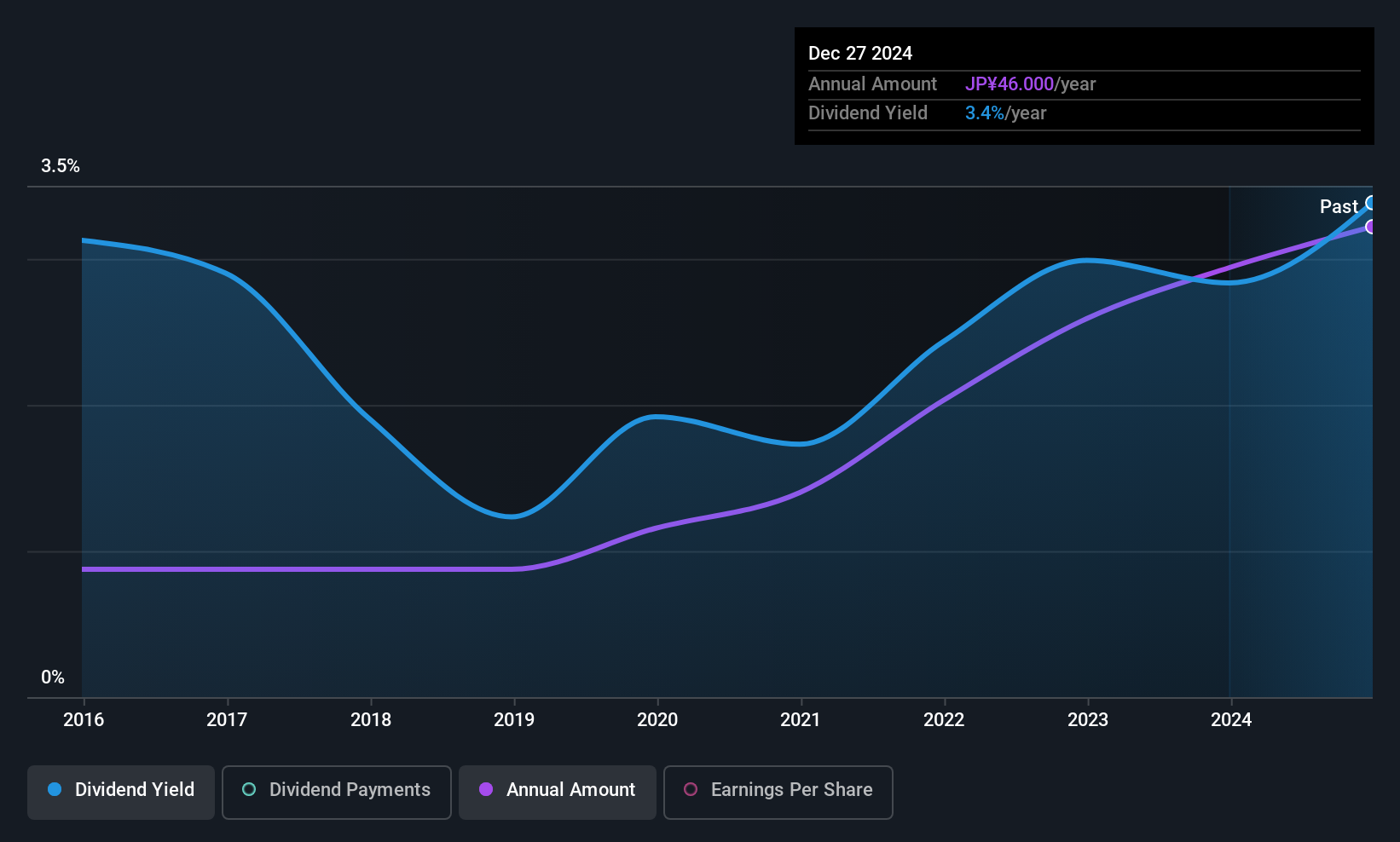

ISB (TSE:9702)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ISB Corporation provides embedded software development services for mobile, medical, and automotive applications in Japan, with a market cap of ¥210 billion.

Operations: ISB Corporation's revenue is derived from its Security System segment, generating ¥5.65 billion, and its Information Service segment, contributing ¥31.18 billion.

Dividend Yield: 3%

ISB's dividends have been stable and growing over the past decade, with a reliable yield of 3%, though below Japan's top quartile. The payout ratio stands at 43.3%, indicating strong earnings coverage, while a cash payout ratio of 70.8% suggests adequate cash flow support. Currently trading at 28.4% below its estimated fair value, ISB may offer potential value for dividend-focused investors despite not leading in yield rankings. Recent board discussions on strategic changes could impact future operations.

- Click here and access our complete dividend analysis report to understand the dynamics of ISB.

- Our valuation report unveils the possibility ISB's shares may be trading at a discount.

Next Steps

- Discover the full array of 1022 Top Asian Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal