Ingersoll Rand (IR): Reassessing Valuation After Jerome Guillen Joins the Board

Ingersoll Rand (IR) just added former Tesla executive Jerome Guillen to its Board, a governance move that signals fresh thinking on operations, automation, and sustainability. This gives investors another angle on the stock’s long term trajectory.

See our latest analysis for Ingersoll Rand.

The timing is interesting, with today’s 2.32 percent 1 day share price return nudging the stock off year to date weakness. This comes even as the 1 year total shareholder return sits modestly negative and the 3 year total shareholder return still looks robust.

If Guillen’s appointment has you thinking about where the next wave of industrial and automation leaders could come from, it is worth exploring fast growing stocks with high insider ownership for other under the radar opportunities.

With shares still down double digits year to date but trading only a single digit below Wall Street targets, does Ingersoll Rand quietly offer upside from improving execution, or is the market already pricing in the next leg of growth?

Most Popular Narrative Narrative: 7.5% Undervalued

With Ingersoll Rand last closing at $81.12 against a narrative fair value near $87.70, the story leans toward upside if growth delivers.

The company continues building recurring, high margin revenue streams through expansion of aftermarket services and value added lifecycle solutions (aftermarket revenue grew to 37% of total), which increases the stability of net margins and supports long term earnings resilience even if new equipment demand remains variable.

Want to see why this valuation leans on earnings power, not hype? The narrative quietly bakes in richer margins and faster profit growth than headline revenue suggests. Curious how those moving parts add up to that premium future multiple and fair value target? The full breakdown reveals the numbers behind the confidence.

Result: Fair Value of $87.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged industrial spending slowdowns and missteps in larger acquisitions could challenge the premium multiple and undermine the expected margin expansion story.

Find out about the key risks to this Ingersoll Rand narrative.

Another Angle On Valuation

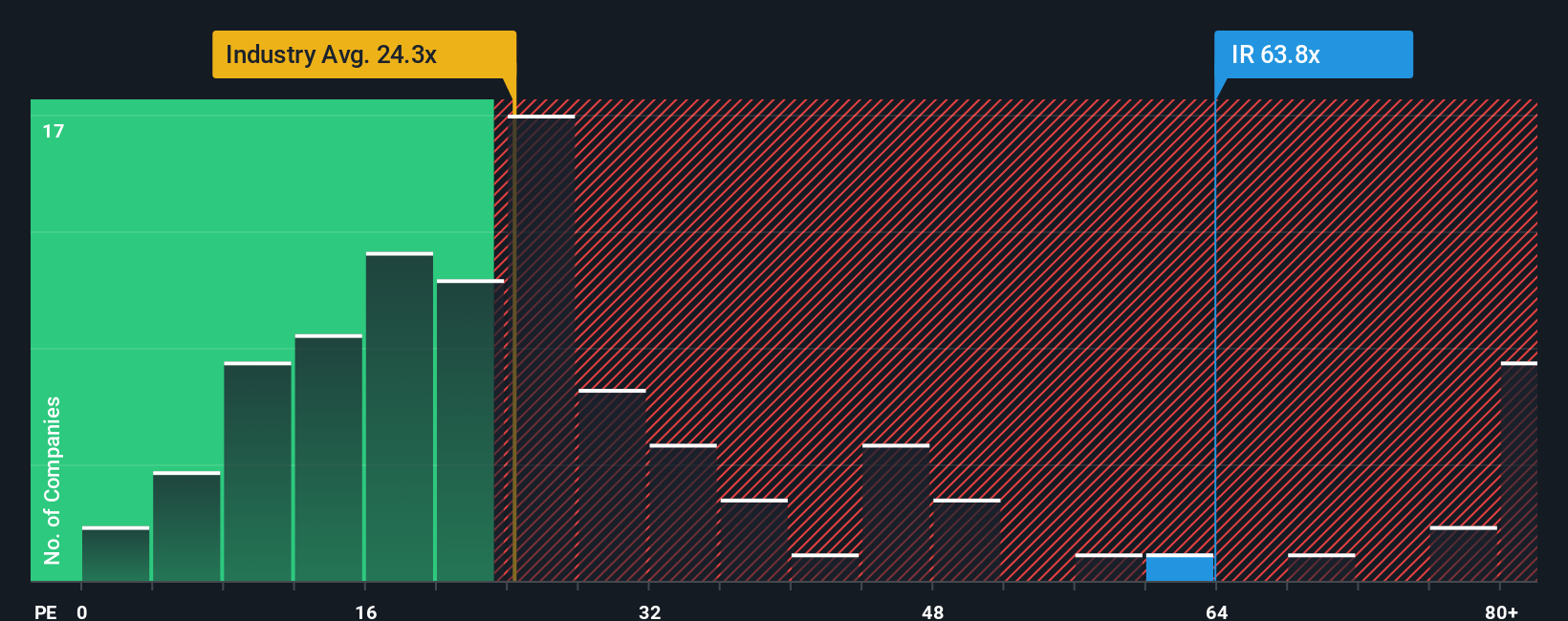

On earnings, the picture looks less generous. Ingersoll Rand trades on a price to earnings ratio of about 58.8 times, more than double the US Machinery average of 25.3 times and well above its fair ratio of 39.6 times, which points to rich expectations baked into today’s price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ingersoll Rand Narrative

If you see the story differently or want to test your own assumptions against the numbers, build a custom view in minutes, Do it your way.

A great starting point for your Ingersoll Rand research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one compelling story, use the Simply Wall Street Screener to uncover fresh opportunities that match your strategy before the market fully catches on.

- Capture powerful growth trends in emerging technologies by scanning these 24 AI penny stocks that could reshape how entire industries operate.

- Strengthen your portfolio’s income engine by targeting these 10 dividend stocks with yields > 3% that aim to keep cash flowing through different market cycles.

- Position ahead of the next potential re-rating by reviewing these 907 undervalued stocks based on cash flows where prices have yet to reflect underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal