Discover 3 ASX Penny Stocks With Market Caps Over A$30M

As the Australian stock market opens modestly higher, buoyed by a late Christmas rally in the U.S., investors are keeping an eye on precious metals and currency movements that are providing a boost to local materials companies. Penny stocks, though often seen as relics of earlier market days, remain relevant for those seeking opportunities in smaller or less-established companies that can offer significant value. By focusing on robust financials and clear growth trajectories, these stocks present potential opportunities for investors looking to explore beyond traditional large-cap investments.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$117.5M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$66.99M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.775 | A$48.26M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.87 | A$471.83M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.075 | A$37.83M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.85 | A$3.62B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.38B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.84 | A$123.06M | ✅ 4 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.48 | A$228.68M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.21 | A$129.42M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 430 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Hartshead Resources (ASX:HHR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hartshead Resources NL is involved in the exploration and development of oil and gas properties in the United Kingdom, with a market capitalization of A$36.59 million.

Operations: The company generates revenue of A$2.15 million from its oil and gas development and exploration activities.

Market Cap: A$36.59M

Hartshead Resources, with a market cap of A$36.59 million, is involved in oil and gas exploration but remains pre-revenue with minimal earnings. Despite reducing losses by 26.7% annually over the past five years, it remains unprofitable and experiences high share price volatility. Positively, Hartshead is debt-free and has sufficient cash runway for over a year based on current free cash flow trends. Recently, ACAM GP Limited announced plans to acquire Hartshead for A$40 million at a significant premium to its last closing price, pending shareholder approval and regulatory consents expected in early 2026.

- Click here and access our complete financial health analysis report to understand the dynamics of Hartshead Resources.

- Assess Hartshead Resources' previous results with our detailed historical performance reports.

IPD Group (ASX:IPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IPD Group Limited, with a market cap of A$446.56 million, is an Australian company that distributes electrical infrastructure.

Operations: The company generates revenue through its Products Division, which accounts for A$334.53 million, and its Services Division, contributing A$20.16 million.

Market Cap: A$446.56M

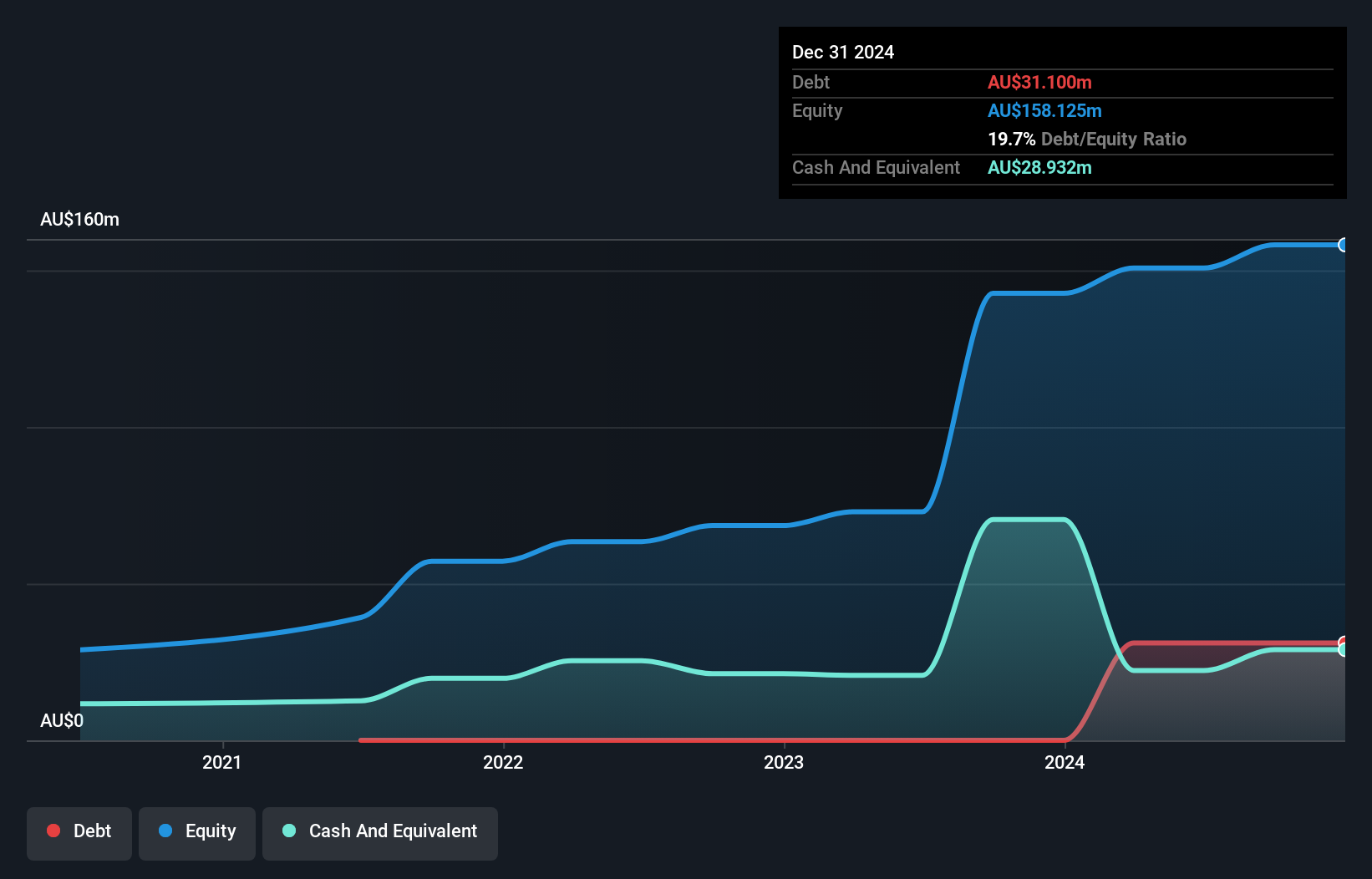

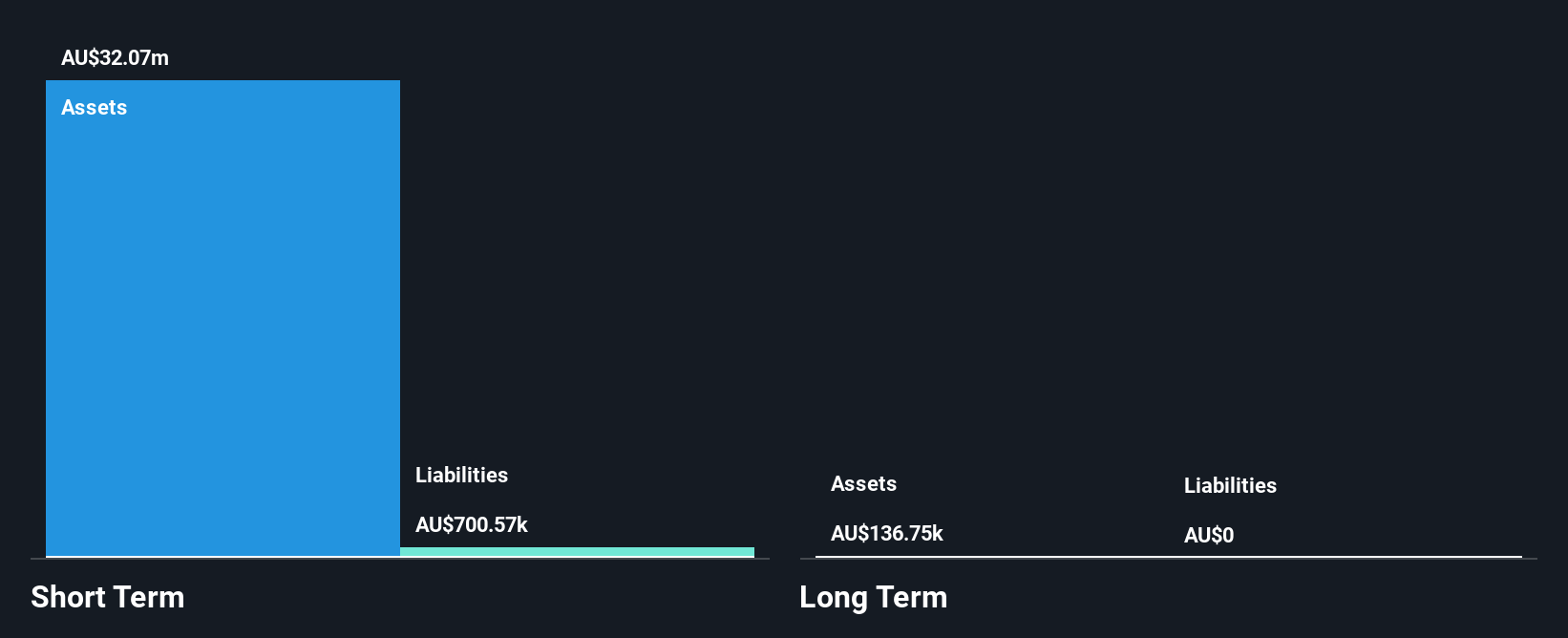

IPD Group, with a market cap of A$446.56 million, boasts strong financial health, evidenced by its short-term assets exceeding both short and long-term liabilities. The company maintains more cash than total debt and its interest payments are well covered by EBIT. Despite a slight decline in net profit margins from 7.7% to 7.4%, IPD's earnings have grown significantly over the past five years at an average rate of 31.9% annually, though recent growth has slowed to 17.1%. The board and management team are experienced, while the stock trades below estimated fair value, indicating potential for investors mindful of volatility risks inherent in penny stocks.

- Click to explore a detailed breakdown of our findings in IPD Group's financial health report.

- Understand IPD Group's earnings outlook by examining our growth report.

LTR Pharma (ASX:LTP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LTR Pharma Limited is a clinical-stage pharmaceutical company focused on developing an intranasal spray for treating erectile dysfunction in Australia, with a market cap of A$119.89 million.

Operations: The company generates revenue from its Medical Research and Development segment, amounting to A$1.51 million.

Market Cap: A$119.89M

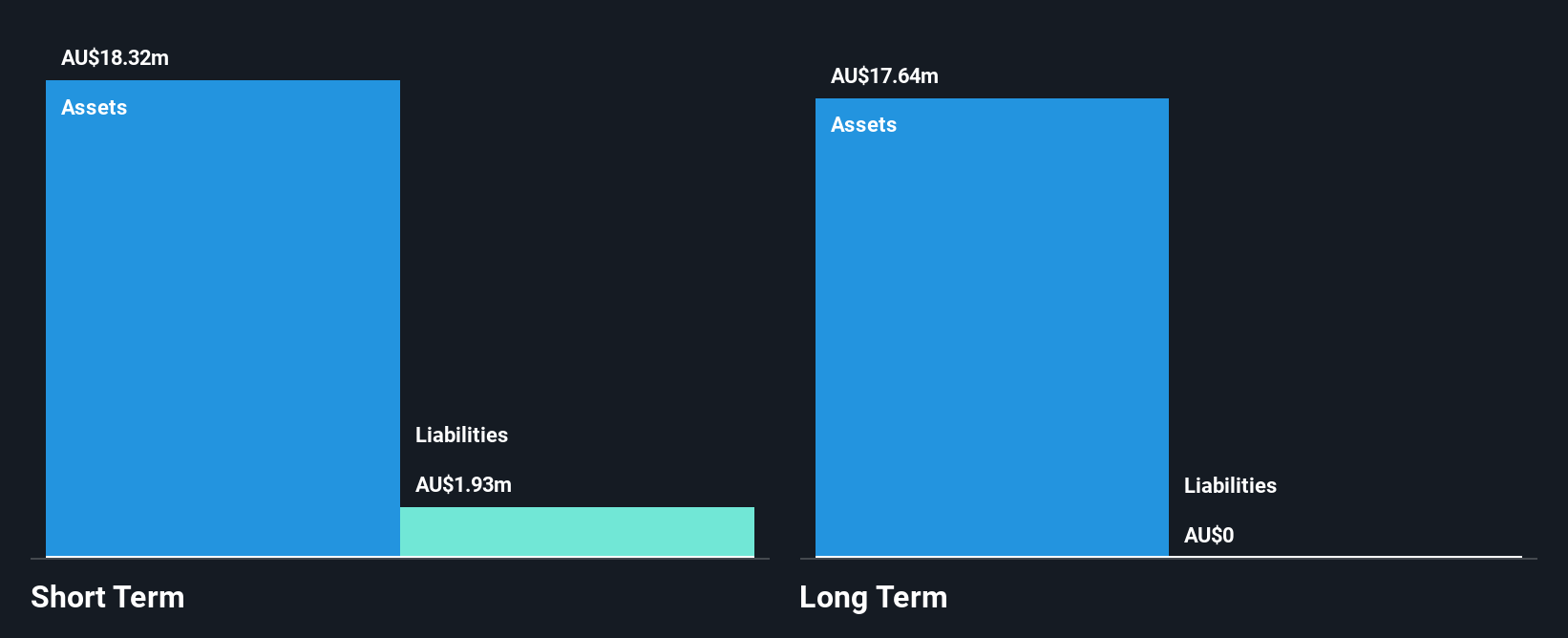

LTR Pharma, with a market cap of A$119.89 million, is currently pre-revenue and unprofitable, focusing on developing an intranasal spray for erectile dysfunction. Despite its financial challenges, the company is debt-free and has a substantial cash runway exceeding three years based on current free cash flow trends. Its short-term assets significantly surpass its liabilities, providing some financial stability. However, the management team and board are relatively inexperienced with average tenures under two years. Recent participation in industry conferences suggests ongoing efforts to engage stakeholders and potentially attract future investment opportunities amidst high volatility risks.

- Click here to discover the nuances of LTR Pharma with our detailed analytical financial health report.

- Examine LTR Pharma's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 427 more companies for you to explore.Click here to unveil our expertly curated list of 430 ASX Penny Stocks.

- Want To Explore Some Alternatives? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal