3 Stocks That May Be Priced Below Their Estimated Worth In December 2025

As the United States stock market experiences a fourth consecutive session of gains, buoyed by better-than-expected GDP data and record highs in commodities like gold and silver, investors are keenly observing opportunities that may arise from these favorable economic conditions. In this context, identifying stocks that appear to be undervalued could present a strategic advantage, as they might offer potential for growth when the broader market is on an upward trajectory.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zymeworks (ZYME) | $27.62 | $52.64 | 47.5% |

| UMB Financial (UMBF) | $119.91 | $233.99 | 48.8% |

| Sportradar Group (SRAD) | $23.35 | $45.49 | 48.7% |

| SmartStop Self Storage REIT (SMA) | $31.70 | $61.01 | 48% |

| QXO (QXO) | $21.96 | $43.29 | 49.3% |

| Perfect (PERF) | $1.74 | $3.43 | 49.2% |

| GeneDx Holdings (WGS) | $140.17 | $273.43 | 48.7% |

| Community West Bancshares (CWBC) | $22.80 | $44.11 | 48.3% |

| Columbia Banking System (COLB) | $29.02 | $57.13 | 49.2% |

| BioLife Solutions (BLFS) | $25.47 | $49.99 | 49.1% |

Let's uncover some gems from our specialized screener.

SolarEdge Technologies (SEDG)

Overview: SolarEdge Technologies, Inc. designs, develops, manufactures, and sells DC optimized inverter systems for solar PV installations globally and has a market cap of approximately $1.74 billion.

Operations: The company's revenue segments include sales of DC optimized inverter systems for solar PV installations across the United States, Germany, the Netherlands, Italy, and other international markets.

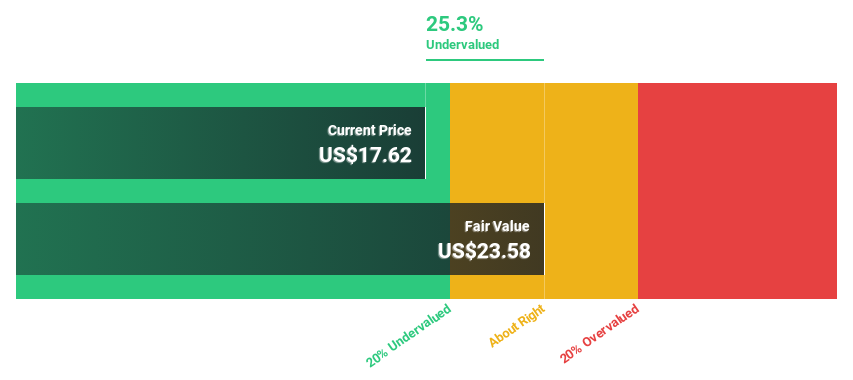

Estimated Discount To Fair Value: 11.8%

SolarEdge Technologies is trading at US$30.91, slightly below its estimated fair value of US$35.05, indicating a modest undervaluation based on cash flows. Despite recent volatility in its share price, the company has demonstrated strong revenue growth potential with a forecasted annual profit growth above market averages. Recent strategic collaborations and expansions into energy storage and data center markets further bolster its long-term prospects, though challenges remain in achieving stable profitability amid evolving market conditions.

- Our comprehensive growth report raises the possibility that SolarEdge Technologies is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in SolarEdge Technologies' balance sheet health report.

Zillow Group (ZG)

Overview: Zillow Group, Inc. operates real estate brands through mobile applications and websites in the United States with a market cap of approximately $16.64 billion.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, amounting to $2.48 billion.

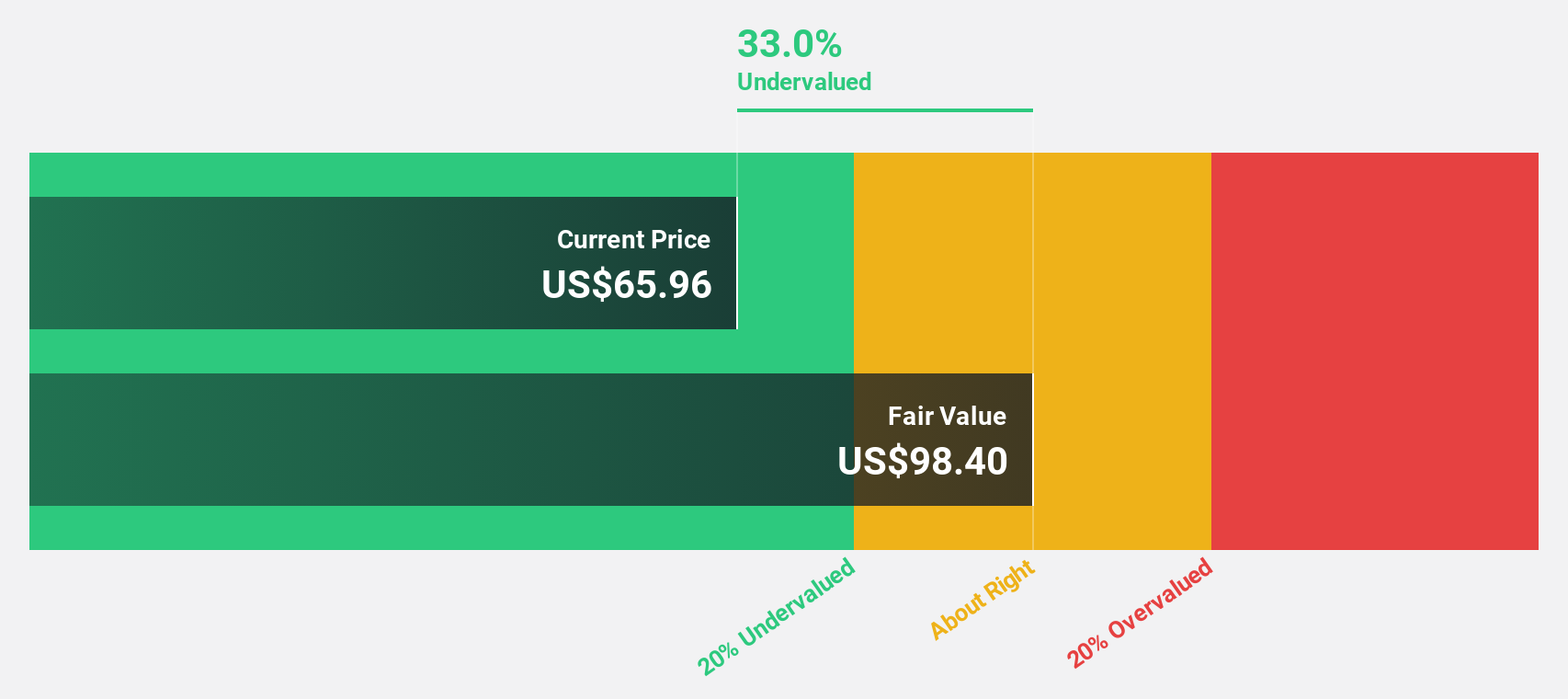

Estimated Discount To Fair Value: 33.4%

Zillow Group is trading at US$67.96, significantly below its estimated fair value of US$102.07, highlighting a considerable undervaluation based on cash flows. The company has reported positive net income and expects revenue growth to outpace the broader market. Recent initiatives like CreditClimb enhance its service offerings, potentially boosting future cash flows despite ongoing legal challenges with CoStar Group over intellectual property rights.

- Our expertly prepared growth report on Zillow Group implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Zillow Group.

BBB Foods (TBBB)

Overview: BBB Foods Inc. operates a chain of grocery retail stores in Mexico and has a market cap of $3.87 billion.

Operations: The company's revenue is primarily derived from the sale, acquisition, and distribution of various products and consumer goods, amounting to MX$72.53 billion.

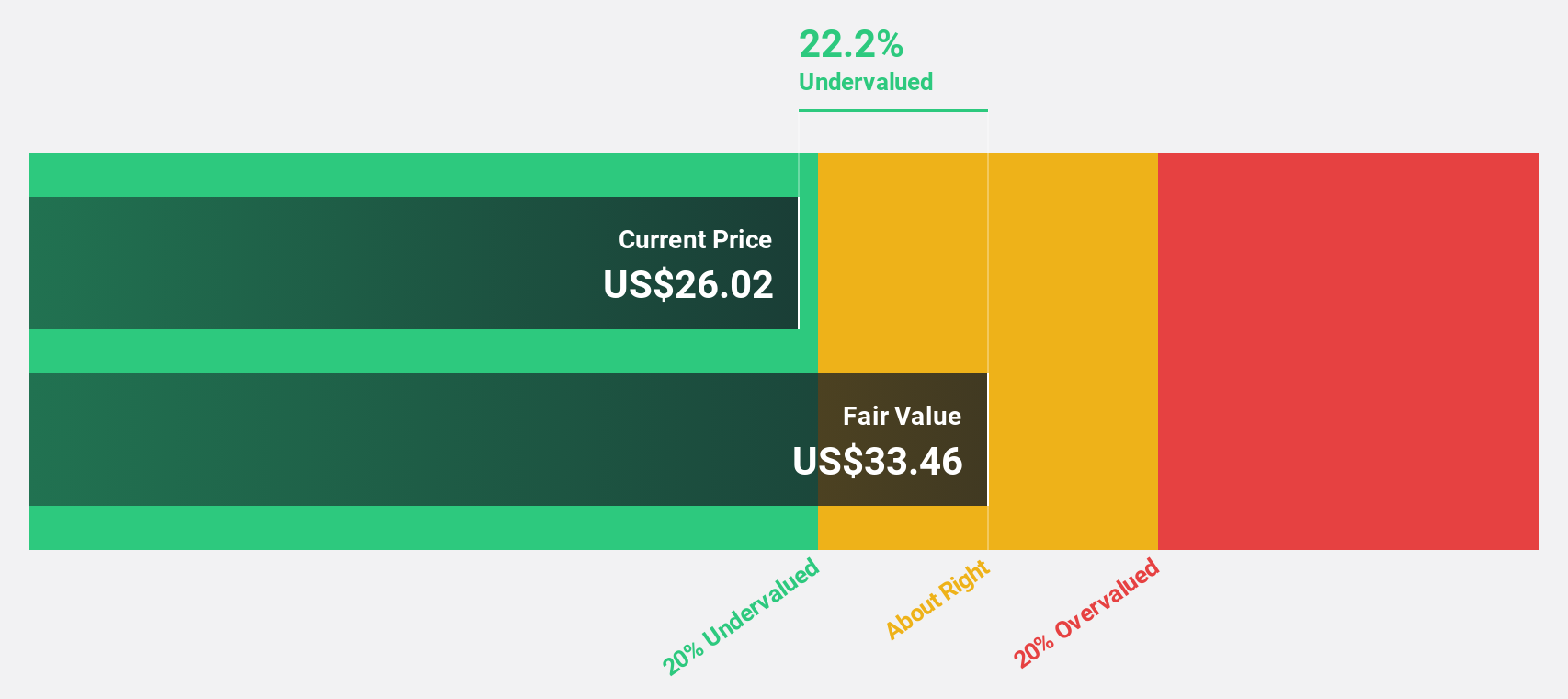

Estimated Discount To Fair Value: 14.9%

BBB Foods is trading at US$35.1, slightly below its estimated fair value of US$41.22, indicating potential undervaluation based on cash flows. Despite recent net losses, revenue has shown significant growth compared to the previous year. The company is forecasted to become profitable within three years with expected annual profit growth above market average and revenue anticipated to grow at 22.9% per year, surpassing the broader U.S. market's growth rate.

- In light of our recent growth report, it seems possible that BBB Foods' financial performance will exceed current levels.

- Navigate through the intricacies of BBB Foods with our comprehensive financial health report here.

Taking Advantage

- Unlock our comprehensive list of 211 Undervalued US Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal