Assessing Andersons (ANDE) Valuation After Dividend Hike and Aggressive 2028 Earnings Guidance

Andersons (ANDE) just paired a dividend bump with ambitious long term earnings guidance, sending a clear message about how management sees the next few years shaping up for shareholders.

See our latest analysis for Andersons.

That confidence has been reflected in the market already, with Andersons posting a 41.71 percent 3 month share price return and a 149.91 percent 5 year total shareholder return. This suggests momentum is building behind the growth story.

If this mix of income and growth potential has your attention, it could be a good moment to look beyond agriculture and explore fast growing stocks with high insider ownership.

Yet with the share price already up sharply, a richer dividend on the way and ambitious earnings targets in place, investors now face a key question: is Andersons still mispriced, or is the market already baking in that future growth?

Most Popular Narrative: 9.4% Overvalued

With Andersons last closing at 54.70 dollars against a 50.00 dollars fair value in the most followed narrative, the story leans toward optimism but assumes a lot has to go right.

Issuance of 45Z tax credits and progressing carbon sequestration projects at ethanol facilities are set to lower effective tax rates and increase after tax profitability starting in 2026, expanding net income.

Curious how much profit growth these tax perks and renewables bets are meant to unlock, and what future multiple that implies? The narrative quietly bakes in faster earnings, fatter margins, and a lower discount rate, all working together to defend that higher fair value.

Result: Fair Value of $50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that outlook could be quickly tested if commodity cycles remain unsupportive or if big ticket renewables investments fail to deliver expected returns.

Find out about the key risks to this Andersons narrative.

Another View: Multiples Paint A Cheaper Picture

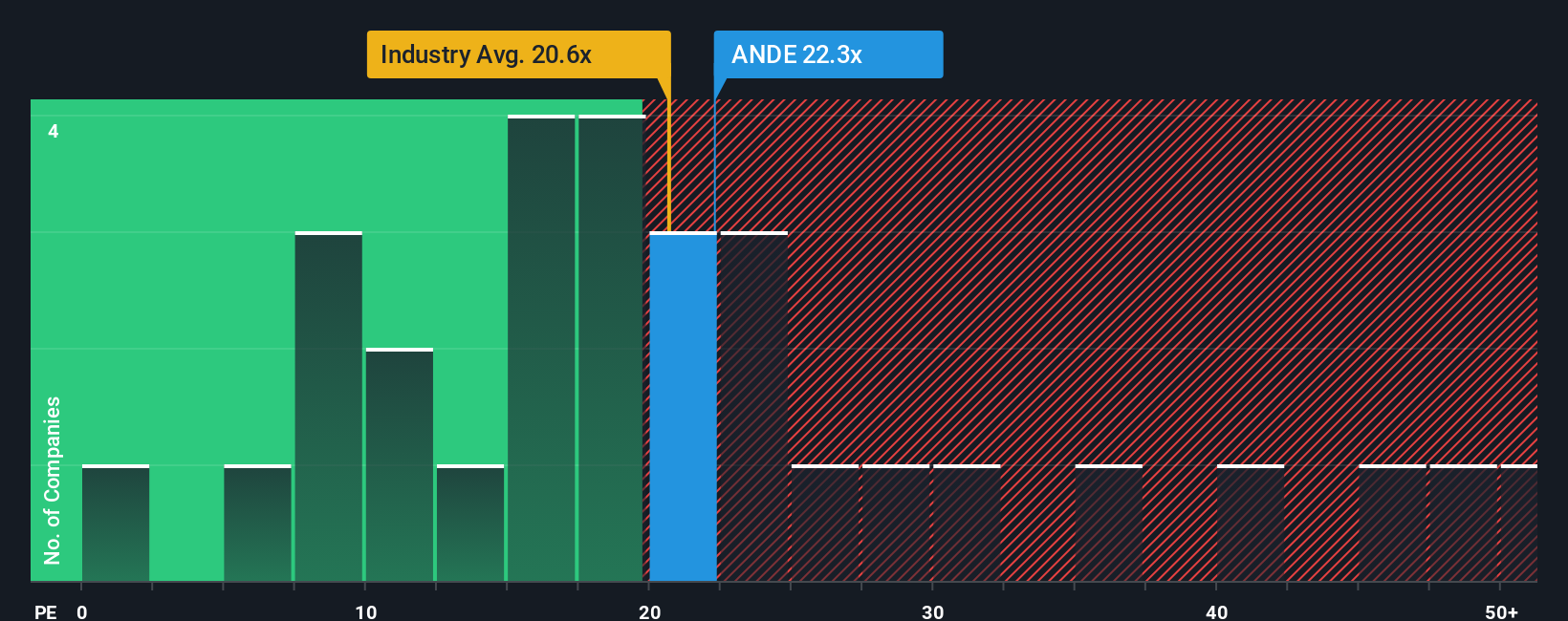

While the main narrative flags Andersons as overvalued versus a 50 dollars fair value, its 25 times price to earnings looks less stretched beside peers at 30.9 times and a fair ratio of 41.6 times. If the market drifts toward that fair ratio, today’s entry could still work, or is the earnings risk too high to bet on mean reversion?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Andersons Narrative

If you see the story differently or want to stress test the assumptions with your own numbers, you can build a custom view in minutes using Do it your way.

A great starting point for your Andersons research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Use the Simply Wall St Screener now to uncover fresh stocks, sharpen your edge, and avoid leaving your next big winner to chance.

- Capitalize on underpriced potential by targeting companies flagged as misaligned with their cash flow outlook using these 902 undervalued stocks based on cash flows.

- Ride powerful secular trends by zeroing in on innovators transforming automation, data, and software with these 24 AI penny stocks.

- Strengthen your portfolio’s income engine by focusing on steady payers and rising distributions through these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal