AeroVironment (AVAV) Valuation Check After Bullish New Analyst Coverage and Defense Tech Growth Hopes

AeroVironment (AVAV) just caught fresh attention after KeyBanc initiated coverage with an upbeat view on its role in defense technology and space, helping the stock climb even as recent earnings and guidance remained mixed.

See our latest analysis for AeroVironment.

The latest 1 day share price gain of 5.09 percent to 255.39 dollars caps a volatile few months. Recent contract wins in lasers, maritime robotics, and electronic warfare have offset earlier weakness, and the 1 year total shareholder return of 58.43 percent signals that momentum is still broadly intact.

If AVAV’s run has you rethinking your defense exposure, this could be a smart moment to explore other opportunities across aerospace and defense stocks for potential next movers.

With shares already up more than 60 percent this year and trading at a steep discount to bullish analyst targets, is AeroVironment still mispriced or is the market already factoring in years of defense tech growth?

Most Popular Narrative Narrative: 36.8% Undervalued

With AeroVironment’s fair value estimate sitting well above the 255.39 dollars last close, the most followed narrative argues the market is underappreciating its long term earnings power.

The company's strategic focus on developing modular, interoperable, and software-defined platforms, including the newly launched AV Halo open software ecosystem, directly aligns with the accelerating adoption of AI-powered autonomy and network-centric warfare, enabling future premium pricing, increased service revenues, and gross margin expansion as these high-value platforms are deployed at scale.

Want to see how this vision turns into numbers? The narrative incorporates aggressive revenue scaling, expanding margins, and a lofty future earnings multiple. Curious which assumptions really drive that upside case?

Result: Fair Value of $404.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on AVAV overcoming execution risks around integrating BlueHalo and avoiding margin pressure if defense budgets, competition, or technology shifts cut profitability.

Find out about the key risks to this AeroVironment narrative.

Another View On Valuation

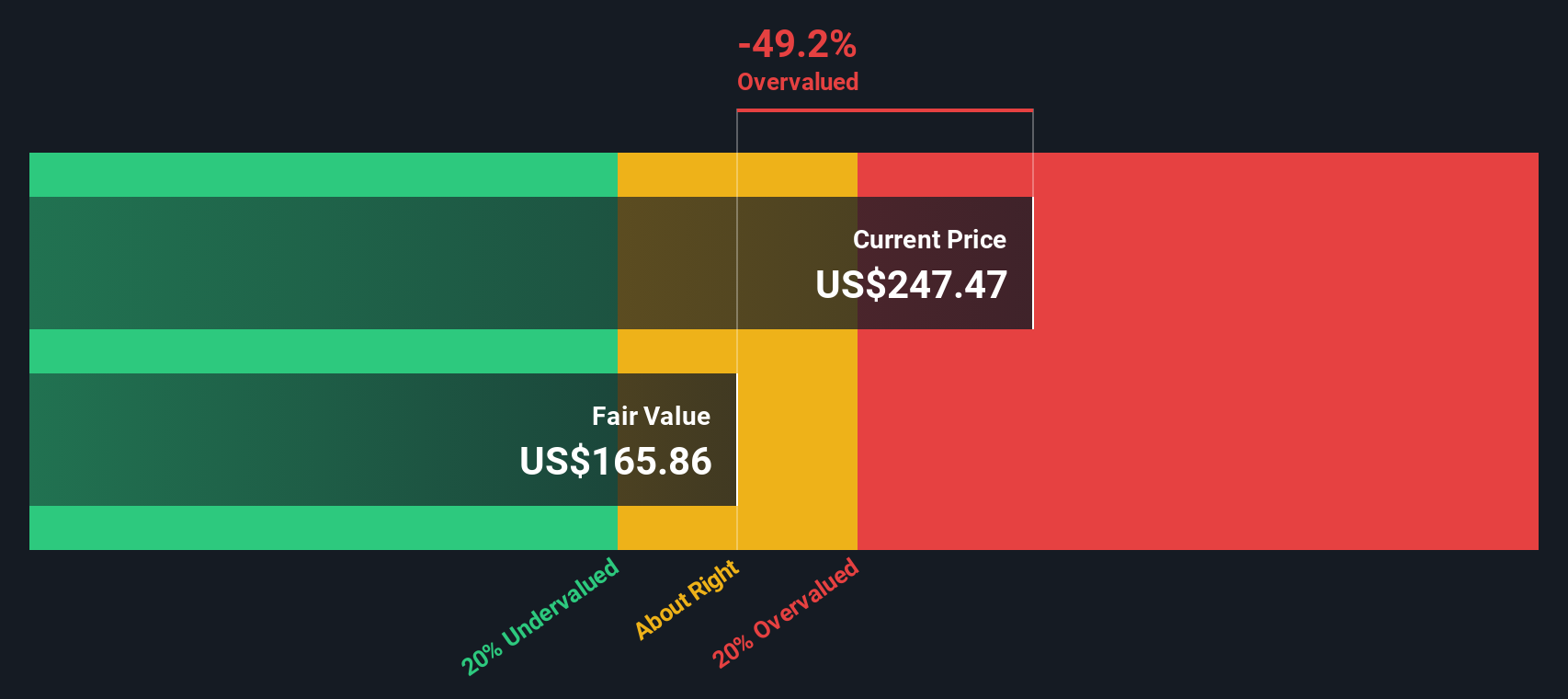

While the narrative model points to a fair value near 404 dollars, our SWS DCF model is more cautious and suggests AVAV is actually overvalued at current levels, with fair value closer to 201.86 dollars. If cash flows prove less explosive than hoped, today’s price could leave little margin for error.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AeroVironment Narrative

If you see the story differently or want to stress test your own assumptions, you can build a complete narrative yourself in just minutes: Do it your way

A great starting point for your AeroVironment research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next opportunities with targeted stock ideas from Simply Wall Street, built to match different strategies and risk levels.

- Seek potential market mispricing by targeting companies that appear inexpensive based on future cash flows with these 902 undervalued stocks based on cash flows before they become widely recognized.

- Position yourself at the front of developments in artificial intelligence by scanning these 24 AI penny stocks, which focuses on businesses involved in automation, data intelligence, and next generation software.

- Enhance your portfolio’s income potential by focusing on companies with consistent payments using these 10 dividend stocks with yields > 3% and stay informed about available dividend yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal