3 Promising UK Penny Stocks With Market Caps Under £50M

The United Kingdom's stock market has recently been impacted by global economic factors, notably the sluggish recovery of China's economy, which has affected major indices like the FTSE 100 and FTSE 250. Amid such broader market challenges, investors often turn their attention to smaller-cap stocks for potential opportunities. Penny stocks, despite being considered a niche area of investment today, continue to offer intriguing prospects for growth when they are backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.185 | £480.11M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.90 | £153.5M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.305 | £334.01M | ✅ 5 ⚠️ 1 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.70 | £130.76M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.865 | £13.06M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6975 | $405.48M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.502 | £181.91M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.445 | £38.36M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £183.46M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 305 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

eEnergy Group (AIM:EAAS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: eEnergy Group Plc operates as a digital energy services company in the United Kingdom and Ireland, with a market cap of £18.59 million.

Operations: The company generates revenue of £29.10 million from its Energy Services segment.

Market Cap: £18.59M

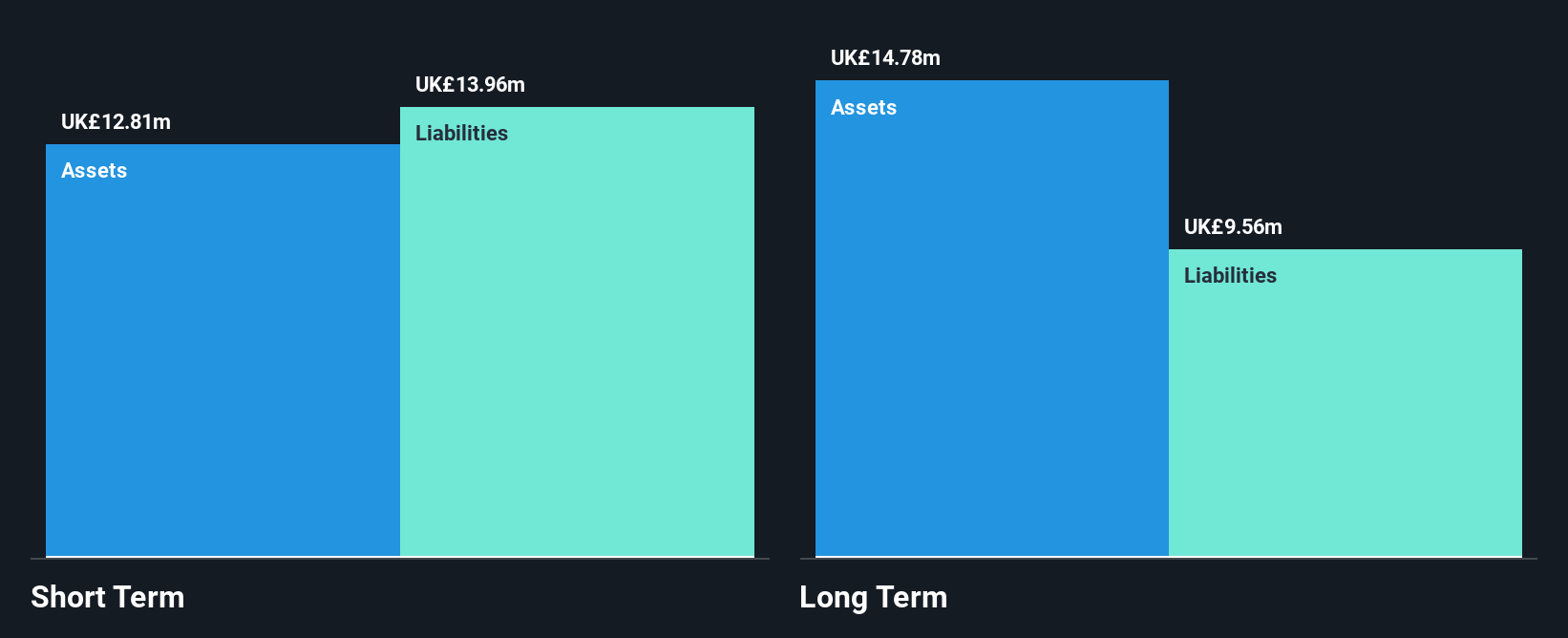

eEnergy Group's financial position reveals challenges typical of penny stocks, with short-term liabilities exceeding assets and ongoing unprofitability. However, the company has positive shareholder equity and a cash runway exceeding three years. Recent developments include securing a £1.5 million unsecured loan to support its expanded solar PV project across 82 schools, expected to boost revenue in fiscal year 2026. Additionally, eEnergy's largest EV charging project with the NHS reflects growing confidence in its capabilities. Despite management changes and increased working capital demands, upgraded revenue guidance suggests potential for future growth amidst volatility.

- Unlock comprehensive insights into our analysis of eEnergy Group stock in this financial health report.

- Assess eEnergy Group's future earnings estimates with our detailed growth reports.

Flowtech Fluidpower (AIM:FLO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Flowtech Fluidpower plc, with a market cap of £33.95 million, distributes engineering components and assemblies within the fluid power industry across the United Kingdom, The Netherlands, Belgium, and Ireland.

Operations: The company generates revenue from various regions, with £84.50 million from Great Britain, £20.27 million from Ireland, and £10.50 million from Benelux.

Market Cap: £33.95M

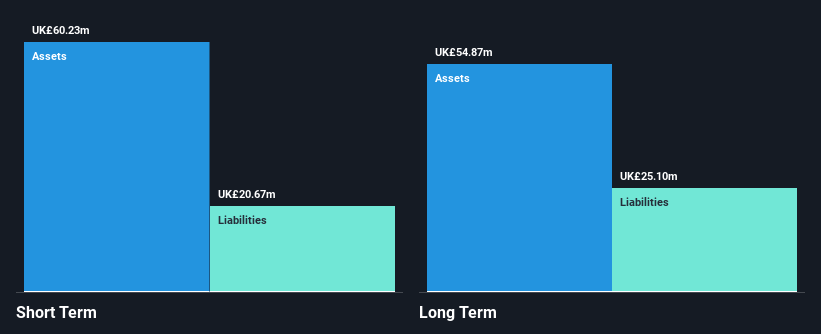

Flowtech Fluidpower plc, with a market cap of £33.95 million, presents both opportunities and challenges typical of penny stocks. The company is currently unprofitable but maintains a stable financial position with short-term assets (£56.9M) exceeding both short-term (£23.2M) and long-term liabilities (£26.0M). Despite this, its net debt to equity ratio is high at 44.1%. Management's average tenure of 6.9 years brings seasoned expertise to the table, while the recent auditor change to Cooper Parry Group Limited signals potential shifts in financial oversight strategies as it navigates future growth prospects amidst industry volatility.

- Click here to discover the nuances of Flowtech Fluidpower with our detailed analytical financial health report.

- Learn about Flowtech Fluidpower's future growth trajectory here.

Palace Capital (LSE:PCA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Palace Capital plc is a real estate investment firm focusing on investments in the property sector, with a market cap of £42.47 million.

Operations: The company generates revenue of £9.18 million from its commercial real estate investments.

Market Cap: £42.47M

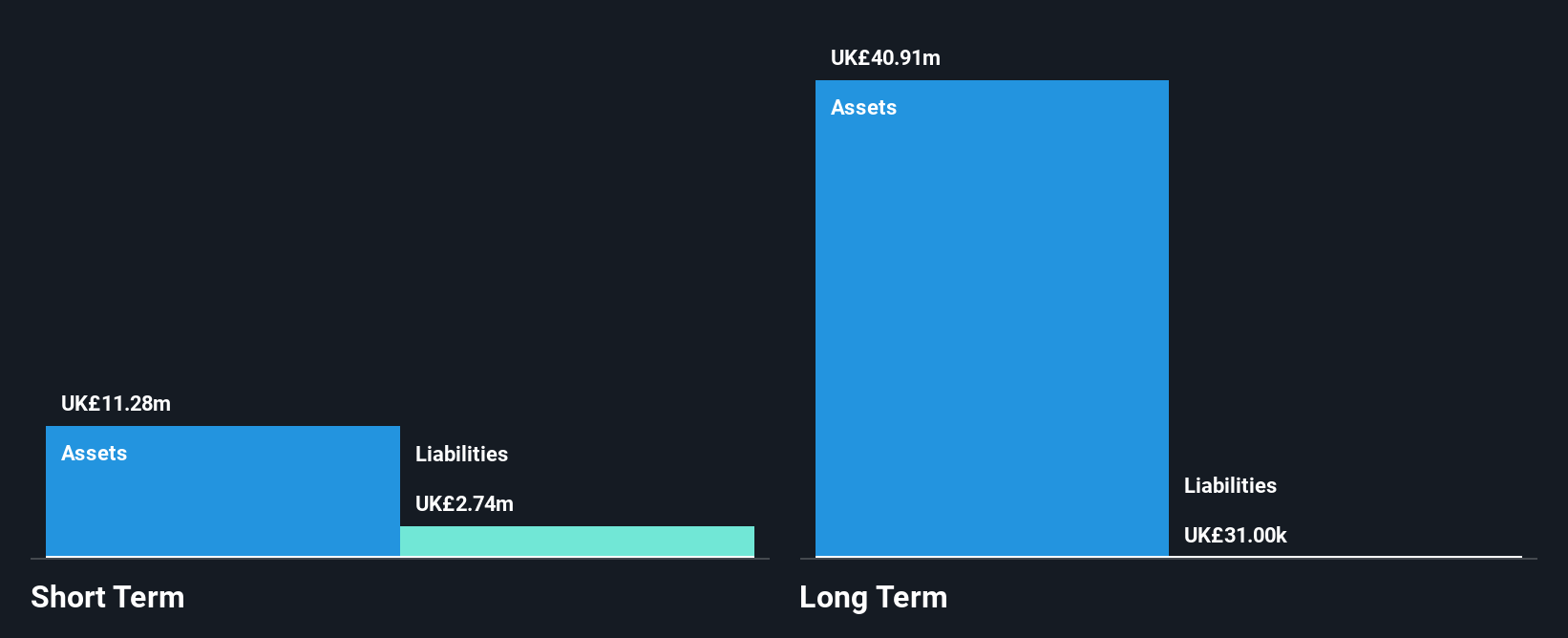

Palace Capital plc, with a market cap of £42.47 million, has recently turned profitable, reporting a net income of £0.275 million for the half year ending September 2025, compared to a loss previously. Its financial stability is supported by short-term assets (£11.3M) exceeding both short-term (£2.7M) and long-term liabilities (£31K), while remaining debt-free enhances its appeal among penny stocks in the UK real estate sector. Despite a large one-off gain impacting recent results and low return on equity (5.3%), it offers an interim dividend of 3.75 pence per share payable in January 2026, though not well covered by earnings or cash flows.

- Click to explore a detailed breakdown of our findings in Palace Capital's financial health report.

- Understand Palace Capital's track record by examining our performance history report.

Next Steps

- Take a closer look at our UK Penny Stocks list of 305 companies by clicking here.

- Searching for a Fresh Perspective? The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal