US stock outlook | Futures of the three major stock indexes have plummeted, and the market is waiting for GDP and consumer data to be released

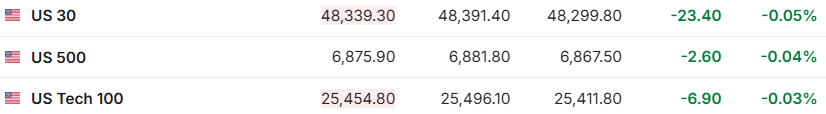

1. On December 23 (Tuesday), the futures of the three major US stock indexes fell sharply before the US stock market. As of press release, Dow futures were down 0.05%, S&P 500 futures were down 0.04%, and NASDAQ futures were down 0.03%.

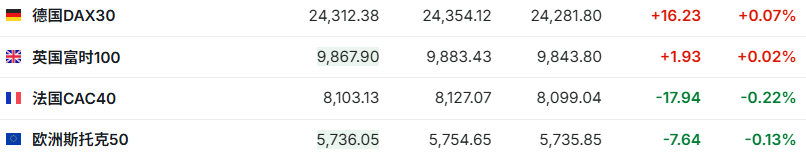

2. As of press release, the German DAX index rose 0.07%, the UK FTSE 100 index rose 0.02%, the French CAC40 index fell 0.22%, and the European Stoxx 50 index fell 0.13%.

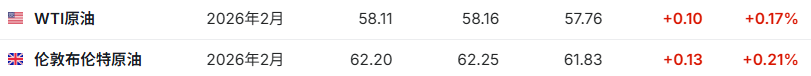

3. As of press release, WTI crude oil rose 0.17% to $58.11 per barrel. Brent crude rose 0.21% to $62.20 per barrel.

Market news

The US GDP for the third quarter was announced tonight. The US economy is likely to grow at a faster pace in the third quarter, mainly due to steady consumer spending and business investment. However, due to rising living costs and the recent government shutdown, economic growth seems to have weakened somewhat. According to survey estimates, GDP may have grown at an annualized rate of 3.3% in the last quarter. In contrast, the economic growth rate in the second quarter was 3.8%. The US Department of Commerce's Bureau of Economic Analysis (BEA) will also announce the initial value of corporate profit and gross domestic income (GDI) for the third quarter, which is an indicator that measures economic growth from a revenue perspective. The non-partisan Congressional Budget Office (CBO) estimates that the recent government shutdown could reduce GDP by 1.0 to 2.0 percentage points in the fourth quarter. The CBO expects that most of the decline in GDP will eventually be recovered, but it is estimated that losses of 7 billion to 14 billion US dollars will still be irreparable. Although the upcoming third-quarter GDP data may not clearly reflect the current situation due to the long period of time, traders will also pay attention to consumer data, as the November data shows a sharp decline in consumer confidence.

Bank of America CEO: AI's marginal influence is strong, and it may become a new engine for the US economy. Bank of America CEO Brian Moynihan said on Monday that this year's surge in artificial intelligence (AI) investment may have a greater impact on the US economy. “AI investment has been gaining momentum throughout the year and is likely to be a bigger contributor next year and beyond,” Moynihan said in an interview. “The role of AI is becoming more obvious, and while not all (economic growth) is due to AI, it is having quite a strong marginal impact.” He pointed out that the Bank of America expects the domestic economy to grow by 2.4% next year, which is faster than the growth rate of about 2% in 2025. Moynihan acknowledged that the labor market continues to weaken, but he believes this is more of a sign of normalization.

Oppenheimer: The “Santa Claus Market” of US stocks has arrived, and the “January effect” can be expected! The “Santa Claus Market” from December 24 to January 5 has always brought good returns to investors. Since 1928, the S&P 500 index has risen by an average of 1.6% during this period. Over the past 97 years, the probability of the index rising in these seven days was as high as 77% (75 years). Ari H. Wald, head of technical analysis at Oppenheimer, pointed out that this performance is in stark contrast to any typical seven-day cycle, where the average increase was only 0.2% and the probability of increase was 57%. Also, when the “Santa Claus Market” fails to appear, the performance for the next one to two quarters is often below average. Looking ahead to January, Oppenheimer analysts have found some encouraging signals based on the index's position relative to its 200-day moving average.

“Santa takes you home”: The Trump administration tripled voluntary repatriation bonuses to speed up mass evictions. The Trump administration announced that if illegal immigrants agree to leave the US voluntarily before the end of this year, they will receive a bonus of 3,000 US dollars and travel expenses paid by the government. This is the latest move launched by the US government to speed up mass evictions and cut enforcement costs. According to the US Department of Homeland Security statement, undocumented immigrants applying for voluntary repatriation through the “CBP Home” app will be covered by the Department of Homeland Security's travel arrangements and expenses, and may be exempt from civil fines they may face due to overstay. This grant of $3,000 is three times the amount announced in May of this year ($1,000). This policy is part of an accelerated eviction operation during the year-end holidays. The Department of Homeland Security warned illegal residents in a tweet posted on the X platform: “Santa Claus is taking you home (GOING HO HO HOME)”.

Bank of America survey: Fund managers were almost “full” on New Year's Eve, and cash levels fell to a record low of 3.3%. According to Bank of America's latest fund manager survey, fund managers' cash levels have dropped sharply to 3.3% of the asset management scale, a record low. At the same time, investors' confidence in economic growth, stocks, and commodities is bursting. The combined exposure of these two types of assets, which generally performed well during the economic expansion period, has reached the highest level since February 2022.

Individual stock news

Novo Nordisk (NVO.US) oral weight loss pills have been approved by the FDA, and Eli Lilly's “war on diet pills” has entered a new round. Novo Nordisk shares rose 7.5% before the market on Tuesday after the US Food and Drug Administration (FDA) approved its weight loss pills. This gave the company a competitive edge in the rapidly evolving obesity treatment market. This approval puts Novo Nordisk in a leading position in the competition to develop potent oral diet pills. Currently, the company is working to reclaim the market share seized by LLY.US (LLY.US). Novo Nordisk faced huge supply chain challenges when it launched its injectable drug Wegovy in 2021, but the company said it was more prepared this time around. CEO Mike Dusta said in November that the company now has “more than enough pills” and will “go all out” to launch the product.

A software issue caused Amazon (AMZN.US) Zoox to recall the vehicle again, and the autonomous driving safety alarm sounded again. The US National Highway Traffic Safety Administration (NHTSA) said on Tuesday that Zoox, Amazon's autonomous driving division, is recalling 332 cars in the US due to errors in its autonomous driving system (ADS) software. NHTSA said that Zoox is currently recalling certain autonomous driving system (ADS) vehicles equipped with software versions released before December 19. When these vehicles approach or are at an intersection, they may cross the yellow center line and then drive in or stop in front of oncoming traffic, which greatly increases the risk of collisions. The agency further added that Zoox has updated the Autonomous Driving System (ADS) software for related vehicles free of charge. Back in May of this year, the company initiated a vehicle recall involving 270 vehicles.

Former richest man Ellison is down! It provided more than $40 billion in personal guarantees for the Warner Brothers (WBD.US) merger and acquisition case, or destabilize the Oracle (ORCL.US) wealth empire. Oracle's founder and former world's richest man Larry Ellison has amassed the world's third-largest fortune by holding onto his company's shares. He seldom sells his holdings and relies on loans to finance tens of billions of dollars in investments and living expenses. He confirmed on Monday that he will provide over $40 billion in irrevocable personal guarantees for Paramount Sky Dance Company (PSKY.US)'s offer to acquire Warner Bros. Discovery (WBD.US). A personal guarantee of over $400 million would be Larry Ellison's biggest investment to date. This could force the billionaire to cut his Oracle holdings and reshape his wealth map by transferring huge wealth into the hands of an unproven, debt-ridden media giant led by his 42-year-old son.

From caution to entry: JPMorgan Chase (JPM.US) is preparing a cryptocurrency trading service. According to people familiar with the matter, J.P. Morgan Chase is considering providing cryptocurrency trading services to institutional customers, a move that highlights the growing participation of Wall Street banks in the digital asset sector. According to related reports, J.P. Morgan Chase is conducting a comprehensive evaluation of its market business with the aim of exploring the types of services it can launch to further expand its influence in the cryptocurrency market. The scope of these services may cover various fields such as spot trading and derivatives trading. However, relevant efforts are currently still in the preliminary exploration stage, and the formulation of specific plans will depend on whether there is sufficient demand in the market to support the launch of any specific product. If the initiative is finally implemented, it will be another key milestone in the process of digital assets being adopted at the broader institutional level.

After receiving multiple acquisition proposals, ZIM.US (ZIM.US) rose nearly 9% before the market. Star Shipping rose nearly 9% before the market. According to the news, after trading on December 22, EST, Estar Shipping issued an announcement disclosing the latest status of its strategic evaluation process: In the evaluation of strategic options carried out over the past few months, Star Shipping's board of directors received bid proposals from a number of strategic investors to acquire all of the company's common shares in circulation. The Board is currently evaluating these proposals.

Key economic data and event forecasts

21:30 Beijing time: The initial value of the US real GDP annualized quarterly rate for the third quarter (%), the preliminary annualized quarterly rate of the US core PCE price index for the third quarter (%), and the initial value of the monthly annualized quarterly rate of US durable goods orders in October (%).

22:15 Beijing time: The monthly rate of US industrial output in October (%).

23:00 Beijing time: US December Chamber of Commerce Consumer Confidence Index

02:00 a.m. Beijing time the next day: The total number of US drills (ports) for the week ending December 26.

05:30 a.m. Beijing time the next day: Changes in US API crude oil inventories for the week ending December 19 (10,000 barrels)

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal