Equinix (EQIX) Valuation Check as Earnings Upgrades and AI Infrastructure Tailwinds Lift Investor Expectations

Equinix (EQIX) is back on traders' screens after fresh earnings revisions and a friendlier rate backdrop pushed data center REITs higher, tying its story even closer to the AI infrastructure build out.

See our latest analysis for Equinix.

Despite the upbeat earnings revisions and AI driven tailwinds, Equinix’s share price return has stayed under pressure with a roughly 19.7 percent year to date decline, even though its three year total shareholder return of about 22.7 percent still signals longer term momentum.

If Equinix has you thinking about where digital demand goes next, it is worth exploring other {high growth tech and AI stocks} that could benefit from the same AI and cloud infrastructure wave.

With earnings estimates moving higher, AI demand accelerating and the shares still trading at a steep discount to analyst targets, is Equinix an overlooked value in digital infrastructure, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 21.5% Undervalued

Compared with Equinix’s last close of $757.92, the most followed narrative sees materially higher value, anchored in upgraded growth and profitability assumptions.

The analysts have a consensus price target of $957.0 for Equinix based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1200.0, and the most bearish reporting a price target of just $804.0.

Curious how steady revenue expansion, widening margins, and a rich future earnings multiple all line up to justify that upside potential? The narrative joins the dots. You discover the assumptions.

Result: Fair Value of $965.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained heavy capital spending and reliance on a concentrated hyperscale customer base could pressure free cash flow and weaken the bullish long term growth case.

Find out about the key risks to this Equinix narrative.

Another View on Valuation

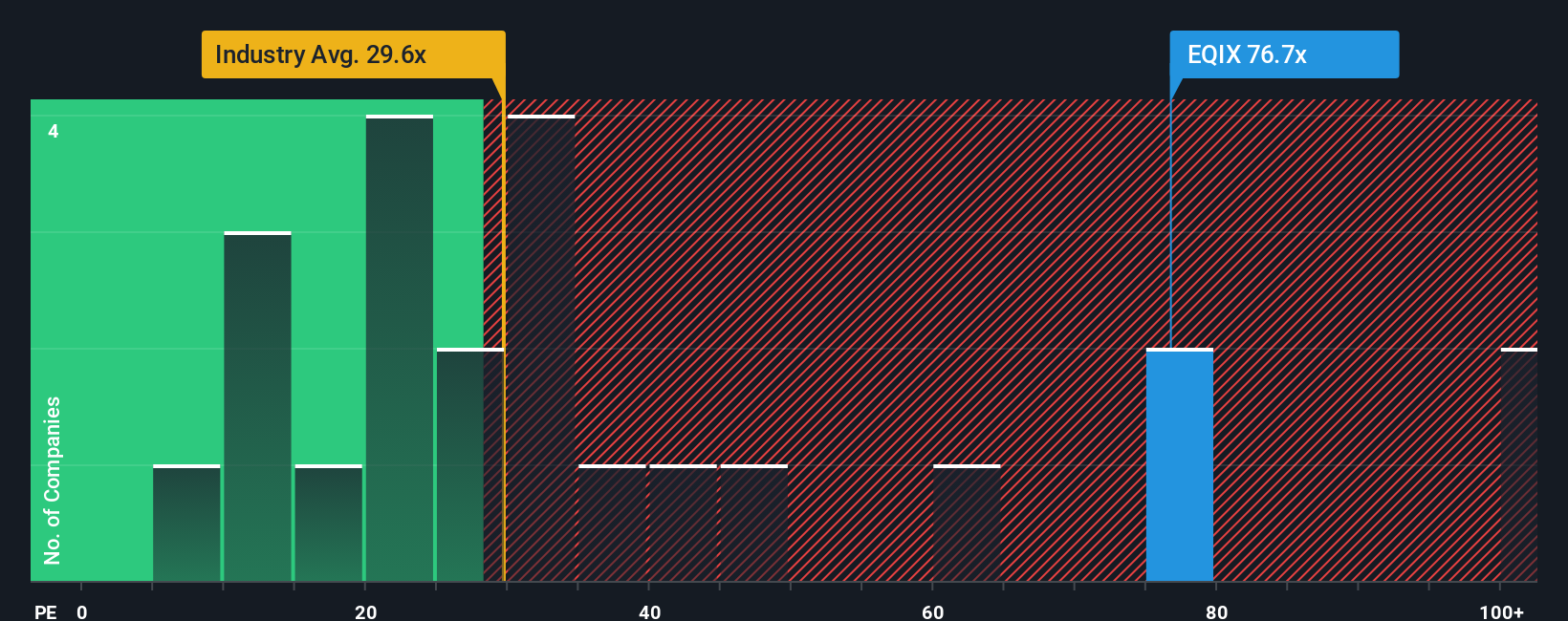

Our valuation checks paint a very different picture. On current earnings, Equinix trades on a 69.5 times price to earnings ratio, more than double the US Specialized REITs average of 27.3 times and well above its 33.7 times fair ratio. This implies meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equinix Narrative

If you see the story differently, or want to dig into the numbers yourself, you can craft a personalized Equinix view in just minutes, Do it your way.

A great starting point for your Equinix research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more opportunity packed ideas?

Before the market’s next big swing leaves you watching from the sidelines, use the Simply Wall Street Screener to uncover fresh, targeted ideas built around your strategy.

- Capture high growth potential by targeting these 24 AI penny stocks positioned at the intersection of intelligent software, data infrastructure and real world adoption.

- Seek reliable income streams with these 10 dividend stocks with yields > 3% that can support compounding returns through changing rate cycles and market moods.

- Position yourself early in emerging digital finance trends through these 79 cryptocurrency and blockchain stocks that focus on blockchain innovation as a platform for scalable, long term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal