Torrance GEM IPOs have been accepted, and many products have entered customer supply systems such as North China Chuang and China Micro

The Zhitong Finance App learned that on December 23, Torrance Precision Manufacturing (Jiangsu) Co., Ltd. (Torrance) Shenzhen Stock Exchange GEM IPO was accepted. As its sponsor, China International Finance Co., Ltd. plans to raise 1,1561.6 billion yuan.

According to the prospectus, the company is a leading comprehensive service provider for R&D, production and sales of precision metal parts in China. It is committed to providing high-performance key process components, process components, structural components, gas pipelines and system assembly products for semiconductor equipment. At the same time, the company's process capabilities cover the field of laser equipment, and can provide laser cavities and cooling process component products required for high-power lasers.

In terms of product types, the company has established a unique competitive advantage with a variety of semiconductor equipment metal component products. In the production of semiconductor key process components that require extremely high technical and process levels, the company not only mass-produces key process components such as cavities, liners, heaters, and uniform plates, but also successfully produces key process components with complex “multi-layer structures, large cross-sections, complex waterways and gas circuits” such as cold plates, multi-tubular heating reflection covers, gas distribution plates, and electrostatic chuck substrates. At the same time, the company's product application field has expanded horizontally to the field of high-power laser equipment, providing core components such as laser cavities, and demonstrating strong ability to reuse technology across fields.

In terms of technical process capabilities, the company's overall process level ranks first among domestic manufacturers. The core technology fully covers the three major fields of high-precision machinery manufacturing, welding and surface treatment, and has further developed complex precision component process integration and inspection capabilities. In terms of welding, relying on long-term collaborative development and technology iteration with leading customers, the company is in a leading position in diverse welding processes represented by vacuum brazing. It is particularly good at multi-layer superposition, multi-channel structures and composite brazing of alloys of different materials, which can meet the strict requirements for accuracy, cleanliness and reliability of complex precision components. In terms of surface treatment and machining, the company uses advanced surface treatment processes such as anodizing and semiconductor-grade clean cleaning, combined with precision machining technology for complex structural parts and high-precision machining technology such as fine hole precision manufacturing, to jointly ensure that key components reach industry-leading levels in terms of corrosion resistance, dimensional accuracy, surface cleanliness and sealing. Based on the system integration of the above core technologies, the company has achieved integrated delivery from process design and manufacturing to multi-dimensional inspection and verification. This complex precision component process integration and inspection capability has been highly recognized by leading domestic semiconductor equipment manufacturers, fully supporting the demand for high-performance complex precision components in semiconductor equipment.

On the customer side, the company deeply serves local semiconductor equipment manufacturers. A variety of products have entered the semiconductor equipment supply system for customers such as Beifang Huachuang and Zhongwei, and are used in core equipment such as etching equipment, film deposition equipment, polishing equipment, and annealing equipment, covering fields such as logic chip process equipment, memory chip process equipment and advanced packaging. In addition, the company also successfully introduced the supply chain of Lumentum, an internationally renowned laser equipment company, demonstrating the international competitiveness of the company's technology.

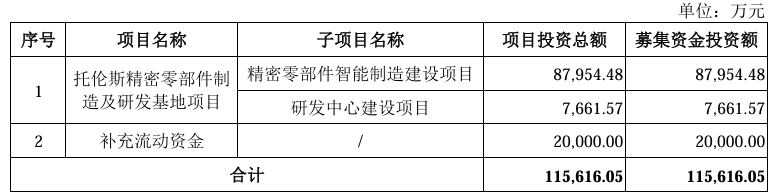

The company plans to publicly issue no more than 46,368,423 shares this time, which is not less than 25% of the company's total share capital after issuance. The actual amount of capital raised this time will depend on the issuance price. The total amount of capital raised after deducting the issuance fee will all be used for the following projects:

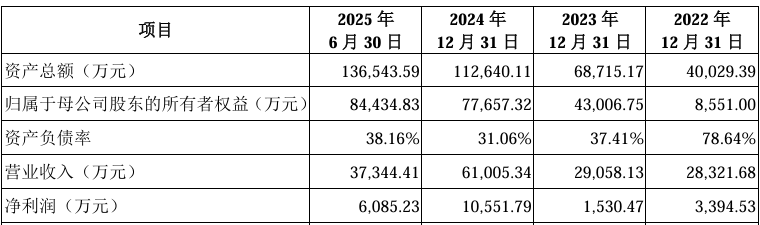

On the financial side, in 2022, 2023, 2024, and January-June 2025, the company achieved operating income of about 283 million yuan, 291 million yuan, 610 million yuan, and 373 million yuan respectively; in the same period, net profit was approximately 339.453 million yuan, 15.3047 million yuan, 106 million yuan, and 608.523 million yuan, respectively.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal