Market Might Still Lack Some Conviction On Roadzen, Inc. (NASDAQ:RDZN) Even After 28% Share Price Boost

Roadzen, Inc. (NASDAQ:RDZN) shares have continued their recent momentum with a 28% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

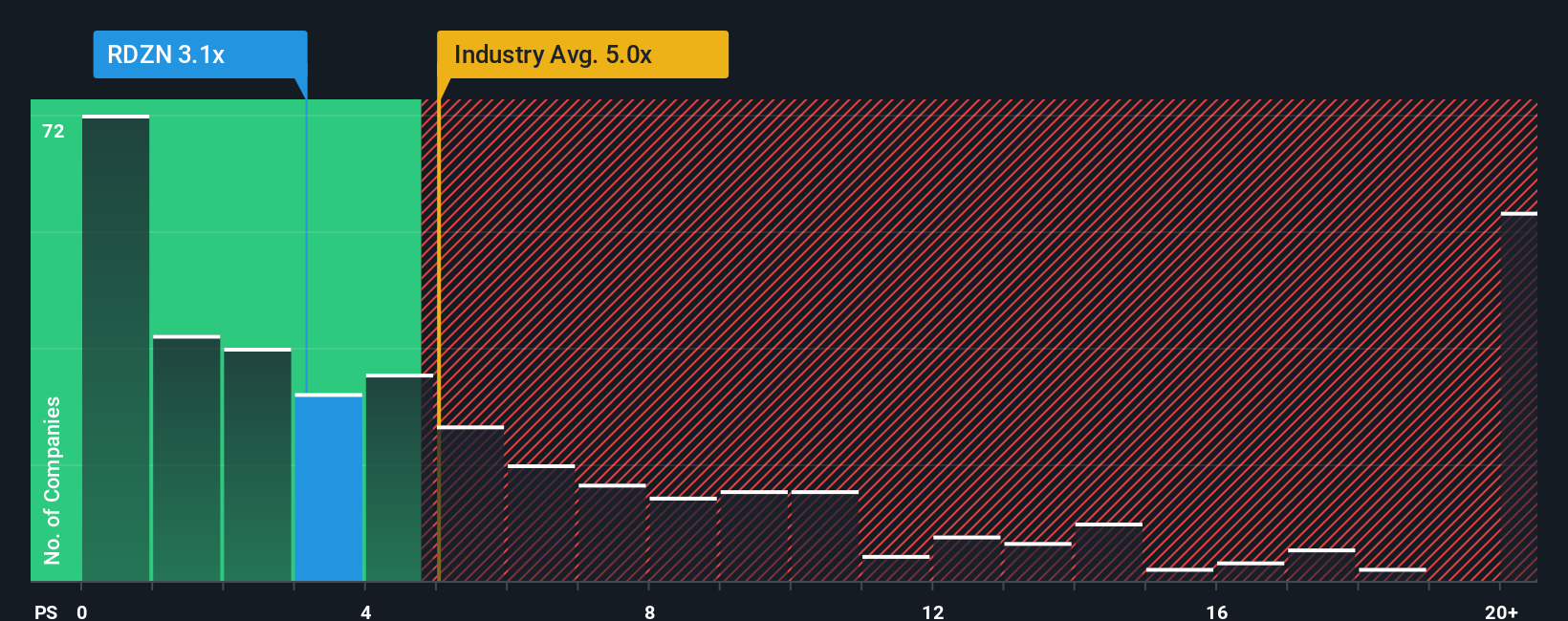

In spite of the firm bounce in price, Roadzen's price-to-sales (or "P/S") ratio of 3.1x might still make it look like a buy right now compared to the Software industry in the United States, where around half of the companies have P/S ratios above 5x and even P/S above 11x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Roadzen

What Does Roadzen's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Roadzen has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Roadzen will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Roadzen?

The only time you'd be truly comfortable seeing a P/S as low as Roadzen's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.4%. Pleasingly, revenue has also lifted 282% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 68% over the next year. With the industry only predicted to deliver 22%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Roadzen is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Roadzen's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Roadzen currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 3 warning signs for Roadzen (1 doesn't sit too well with us!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal