Arista’s Secure AI Data Center Push With Fortinet Could Be A Game Changer For Arista Networks (ANET)

- In December 2025, Fortinet announced it had deployed a jointly developed Secure AI Data Center solution with Arista Networks at Monolithic Power Systems, while Arista also revealed new AI-driven campus networking features and ruggedized switches for industrial environments.

- Together, these moves highlight how Arista is extending its Ethernet and software platforms beyond core data centers into AI-centric security, campus, and industrial edge use cases.

- We’ll now examine how Arista’s role in Fortinet’s multivendor Secure AI Data Center architecture may influence the company’s broader investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Arista Networks Investment Narrative Recap

To own Arista Networks, you need to believe that Ethernet-centric, software-driven networking will remain central to AI data centers, campuses, and industrial edge environments. The Fortinet Secure AI Data Center deployment illustrates Arista’s role in multivendor, AI-focused architectures, but it does not materially change the near term earnings catalyst or the key risk of concentrated exposure to a handful of hyperscale and AI customers.

The most relevant announcement here is Arista’s expanded Cognitive Campus and AVA capabilities, including VESPA for large scale mobility and ruggedized switches for harsh environments. Together with the Fortinet collaboration, this reinforces Arista’s push to diversify beyond core cloud data centers into enterprise, campus, and industrial use cases, which could gradually reduce reliance on a small group of large cloud customers if execution stays on track.

Yet, while Arista’s AI and campus opportunities look appealing, investors should still be aware that concentrated hyperscaler demand could quickly shift...

Read the full narrative on Arista Networks (it's free!)

Arista Networks' narrative projects $13.6 billion revenue and $5.4 billion earnings by 2028. This requires 19.5% yearly revenue growth and an earnings increase of about $2.1 billion from $3.3 billion today.

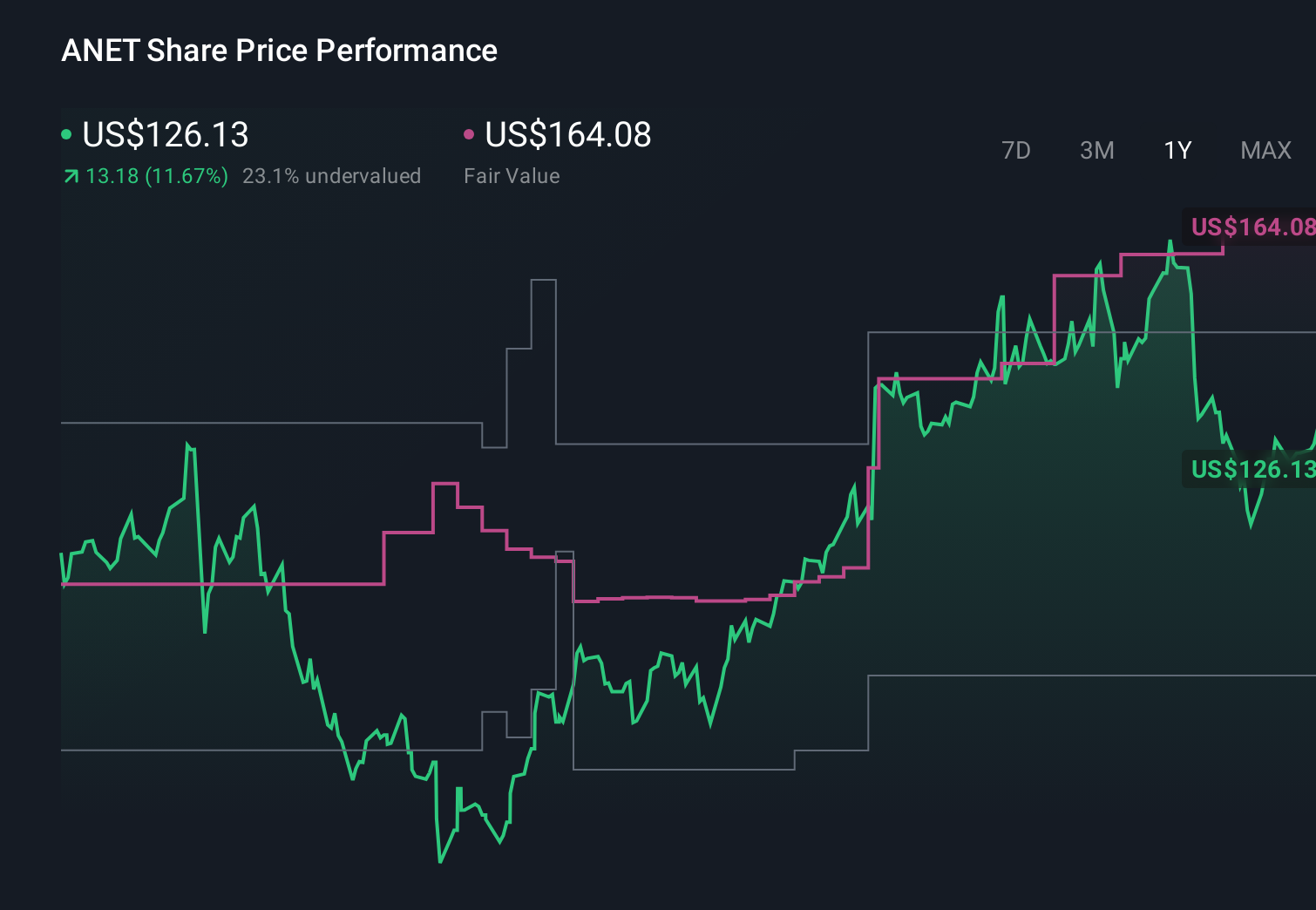

Uncover how Arista Networks' forecasts yield a $164.08 fair value, a 26% upside to its current price.

Exploring Other Perspectives

The most optimistic analysts were already modeling about US$15.4 billion in 2028 revenue and US$5.9 billion in earnings, so if you only focus on AI growth and software mix, you may miss how sharply views differ on whether customer concentration risk could still cap the upside.

Explore 20 other fair value estimates on Arista Networks - why the stock might be worth as much as 26% more than the current price!

Build Your Own Arista Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arista Networks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arista Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arista Networks' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal