Cognizant’s Expanded Microsoft AI Alliance and New AI Labs Might Change The Case For Investing In Cognizant Technology Solutions (CTSH)

- Cognizant recently announced a series of multi-year agreements, including an AI-focused partnership with Microsoft, new AI-driven BPaaS and IT modernization deals with Bupa Hong Kong, ERIKS, and BayWa, alongside the opening of an India AI Lab and Cognizant Moment Studio in Bengaluru to deepen applied AI research and innovation.

- Together, these moves highlight how Cognizant is integrating agentic AI and sector-specific platforms into core client workflows, aiming to reposition itself as an AI-first transformation partner across healthcare, financial services, manufacturing, and broader enterprise IT.

- Now we’ll examine how this expanded Microsoft AI alliance, and broader AI investments, influence Cognizant’s existing investment narrative and risk-reward profile.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Cognizant Technology Solutions Investment Narrative Recap

To own Cognizant, you need to believe it can convert its AI push into steadier, higher quality growth while defending margins in a competitive IT services market. The Microsoft alliance and new AI-heavy deals support the core near term catalyst of large, multi-year transformations, but they do not remove the key risks around pricing pressure, wage inflation and the potential for AI to compress demand for traditional outsourcing.

The expanded, multi-year Microsoft partnership is the most relevant piece here, because it ties Cognizant’s AI-first narrative directly to hyperscaler technology, its Neuro AI Suite and sector platforms like TriZetto and FlowSource. This can reinforce its position in large GenAI implementation cycles across healthcare and financial services, which many investors already see as central to the company’s risk reward profile as AI adoption accelerates and competition intensifies.

Yet behind the promise of AI powered growth, investors should be aware that rising platform based models and hyperscaler competition could still...

Read the full narrative on Cognizant Technology Solutions (it's free!)

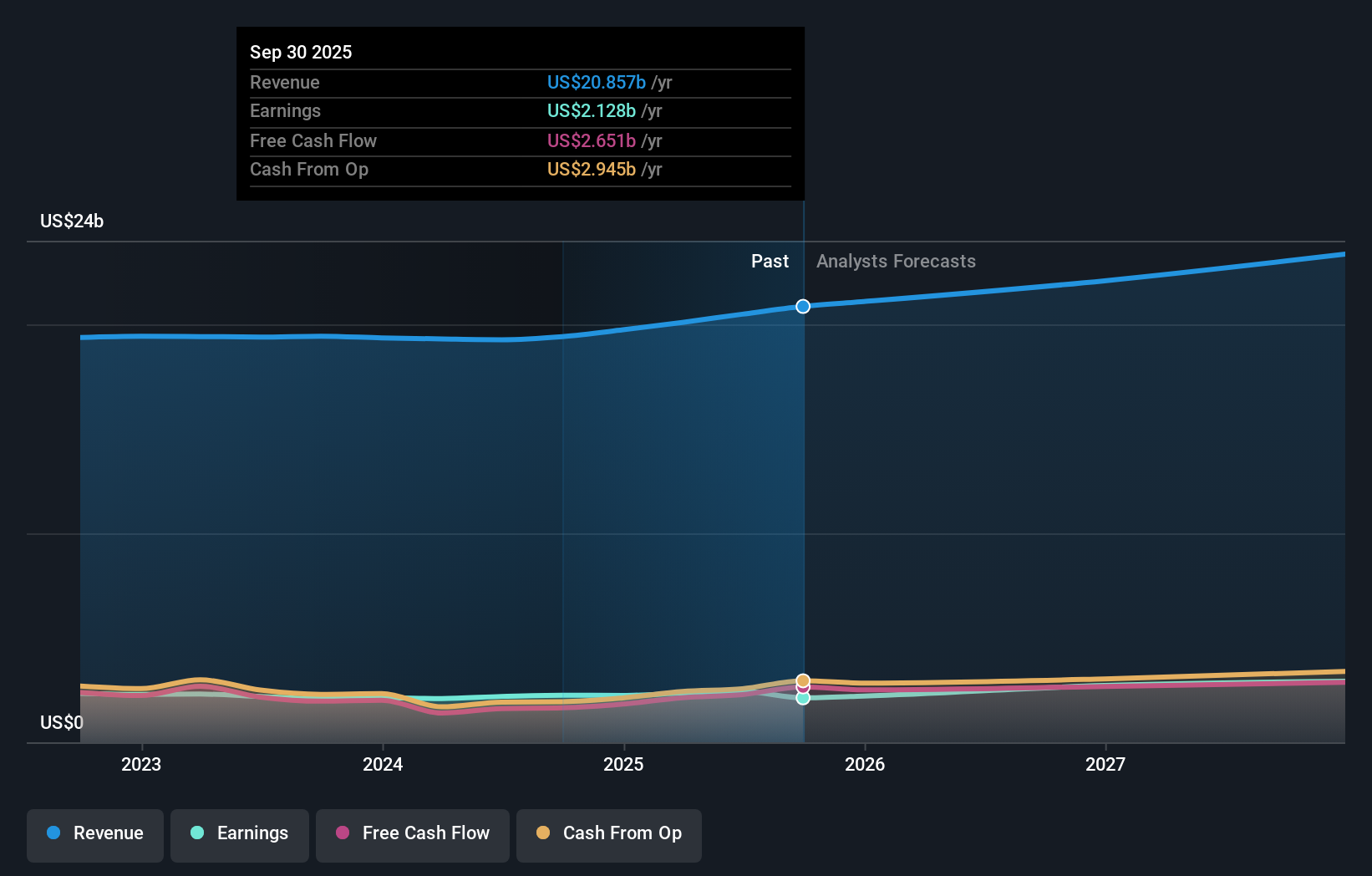

Cognizant Technology Solutions’ narrative projects $23.5 billion revenue and $2.9 billion earnings by 2028.

Uncover how Cognizant Technology Solutions' forecasts yield a $85.22 fair value, in line with its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community currently see fair value for Cognizant between US$66.06 and US$123.71, with some estimates well above the consensus target. Set against Cognizant’s push into large, AI heavy transformation deals, this spread of views underlines how differently investors weigh the upside from new GenAI projects against the risk that platform based, as a service models could eat into traditional outsourcing work.

Explore 8 other fair value estimates on Cognizant Technology Solutions - why the stock might be worth as much as 45% more than the current price!

Build Your Own Cognizant Technology Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cognizant Technology Solutions research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Cognizant Technology Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cognizant Technology Solutions' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal