Trupanion (TRUP) Valuation After New Pawp Partnership, CEO Share Sale, and Strong Earnings Update

Trupanion (TRUP) is back in the spotlight after a busy stretch, from a new distribution partnership with Pawp Insurance Solutions to CEO Margaret Tooth’s recent stock sale and option exercise following better than expected earnings.

See our latest analysis for Trupanion.

Those moves land against a mixed backdrop, with Trupanion’s share price now at $38.05, a solid 1 month share price return but a weaker 1 year total shareholder return suggesting momentum is rebuilding from a still bruised base.

If Trupanion’s story has you rethinking what growth can look like in niche markets, it could be worth exploring healthcare stocks for more ideas beyond pet insurance.

With shares still down sharply over one and five years but trading at a steep discount to analyst targets despite accelerating earnings, is Trupanion quietly undervalued, or is the market already baking in all the future growth?

Most Popular Narrative: 32.7% Undervalued

Compared with Trupanion’s last close at $38.05, the most widely followed narrative sees meaningful upside, anchoring its view on steady growth and premium earnings multiples.

Adoption of advanced technologies such as data analytics and direct payment software for claims has begun to yield efficiencies, resulting in improved claims processing cost, higher retention rates, and expanding operating margins, which could continue to positively impact net margins going forward. Improved underwriting discipline, focus on higher lifetime value pets, and optimization of acquisition channels are driving higher quality book growth and supporting strong free cash flow, setting up for scalable and more profitable expansion in coming years.

Want to see why modest revenue growth assumptions, slim margins, and a towering future earnings multiple still add up to upside potential in this narrative? Read on.

Result: Fair Value of $56.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on price increases and intensifying competition could strain subscriber growth, pressure margins, and undermine the optimistic long term earnings narrative.

Find out about the key risks to this Trupanion narrative.

Another Lens on Valuation

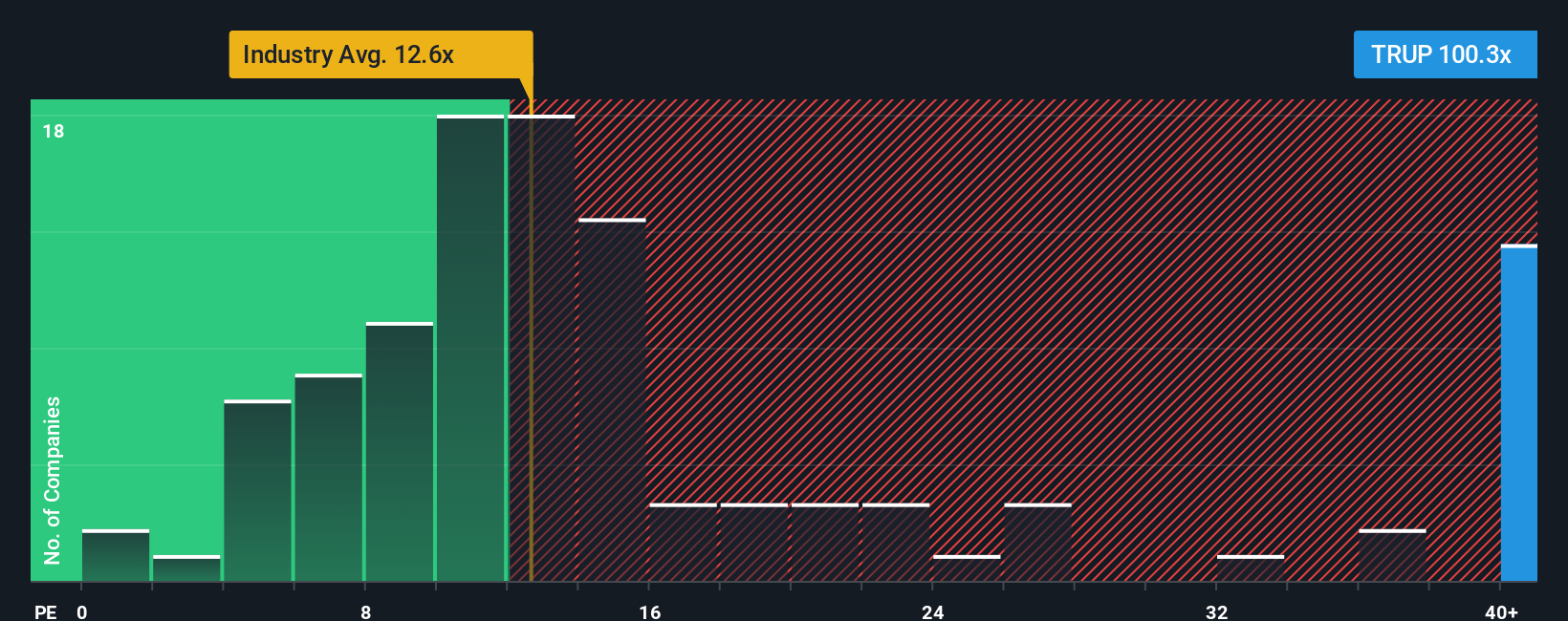

That upbeat fair value contrasts sharply with how the market is pricing Trupanion on earnings today. At roughly 106 times earnings versus about 13 times for US insurers and a fair ratio of 22.7, the stock screens as richly valued, raising the risk that even small execution missteps could trigger a sharp reset.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trupanion Narrative

If you see the numbers differently or just prefer to dig into the details yourself, you can build a personalized narrative in minutes: Do it your way.

A great starting point for your Trupanion research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall St to work for you and uncover fresh opportunities that could reshape your portfolio faster than the market expects.

- Capture potential mispricing by targeting companies trading below their projected cash flows through these 900 undervalued stocks based on cash flows, and position yourself before sentiment catches up.

- Explore the next wave of innovation by researching emerging automation and machine-learning leaders using these 24 AI penny stocks that may influence entire industries.

- Seek steadier income streams by focusing on mature businesses with established payouts via these 10 dividend stocks with yields > 3%, so your capital is deployed consistently over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal