European Stocks Trading At An Estimated Discount For Value Seekers

As European markets show signs of steady economic growth and benefit from looser monetary policy, the pan-European STOXX Europe 600 Index has ended 1.60% higher, with major stock indexes across Italy, France, Germany, and the UK also posting gains. In this environment of cautious optimism and stable interest rates from the European Central Bank, investors may find opportunities in stocks trading at an estimated discount by focusing on those with strong fundamentals and potential for value appreciation amidst evolving market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vinext (BIT:VNXT) | €3.28 | €6.56 | 50% |

| Redelfi (BIT:RDF) | €11.68 | €23.30 | 49.9% |

| PVA TePla (XTRA:TPE) | €22.08 | €43.64 | 49.4% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.266 | €8.50 | 49.8% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.15 | NOK65.88 | 49.7% |

| Hemnet Group (OM:HEM) | SEK168.70 | SEK337.03 | 49.9% |

| EcoUp Oyj (HLSE:ECOUP) | €1.32 | €2.61 | 49.4% |

| Dynavox Group (OM:DYVOX) | SEK102.20 | SEK202.79 | 49.6% |

| Artifex Mundi (WSE:ART) | PLN12.36 | PLN24.34 | 49.2% |

| Aker BioMarine (OB:AKBM) | NOK89.40 | NOK176.71 | 49.4% |

Let's uncover some gems from our specialized screener.

LINK Mobility Group Holding (OB:LINK)

Overview: LINK Mobility Group Holding ASA, along with its subsidiaries, offers mobile and communication-platform-as-a-service solutions with a market cap of NOK9.60 billion.

Operations: The company generates revenue through its operations in Central Europe (NOK1.67 billion), Western Europe (NOK2.37 billion), Northern Europe (NOK1.58 billion), and Global Messaging (NOK1.33 billion).

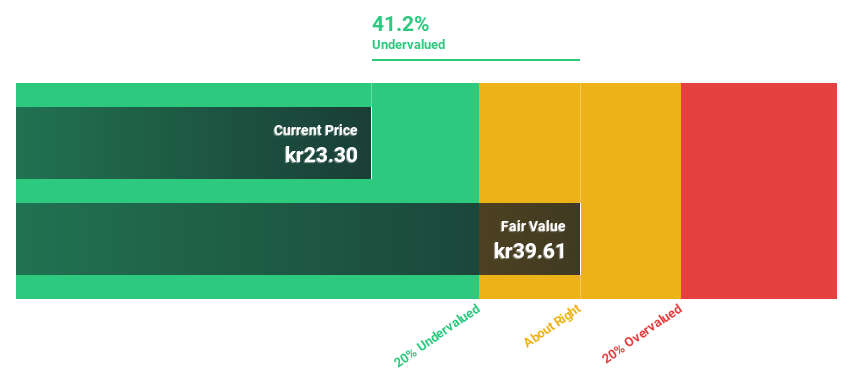

Estimated Discount To Fair Value: 49.7%

LINK Mobility Group Holding is trading at a significant discount, 49.7% below its estimated fair value of NOK 65.88, making it potentially attractive based on cash flows. Despite a decline in net profit margins from 2.5% to 1.5%, the company's earnings are forecasted to grow significantly above market averages over the next three years, although revenue growth is expected to be slower than desired benchmarks but still outpacing the Norwegian market rate.

- Insights from our recent growth report point to a promising forecast for LINK Mobility Group Holding's business outlook.

- Navigate through the intricacies of LINK Mobility Group Holding with our comprehensive financial health report here.

Arlandastad Group (OM:AGROUP)

Overview: Arlandastad Group AB (publ) is a real estate development company operating in Sweden, with a market cap of SEK2.36 billion.

Operations: The company's revenue segments include SEK170.65 million from operating activities, SEK9.32 million from property improvement, and SEK212.07 million from management of properties.

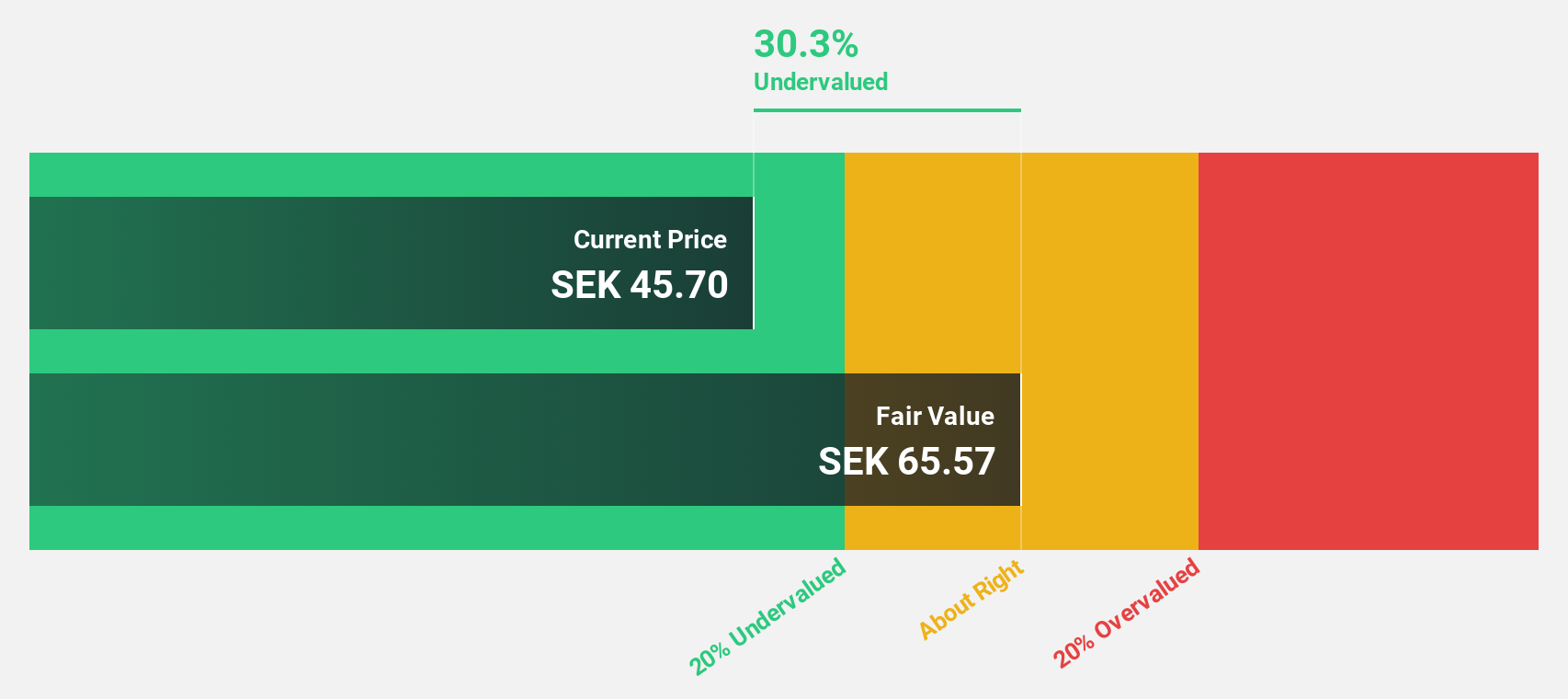

Estimated Discount To Fair Value: 39.6%

Arlandastad Group is trading at SEK 37.3, significantly below its estimated fair value of SEK 61.79, suggesting potential undervaluation based on cash flows. The company recently became profitable, with earnings expected to grow substantially above the Swedish market average over the next three years. Despite large one-off items affecting results and a low forecasted return on equity of 3.5%, its revenue growth is projected to outpace the broader market rate.

- The growth report we've compiled suggests that Arlandastad Group's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Arlandastad Group stock in this financial health report.

NEUCA (WSE:NEU)

Overview: NEUCA S.A. is involved in the wholesale distribution of pharmaceuticals in Poland and has a market cap of PLN3.70 billion.

Operations: The company's revenue segments include Pharmaceutical Wholesale (Including Marketing Services) at PLN12.26 billion, Medical Operator at PLN506.65 million, Clinical Studies at PLN461.25 million, Insurance Business at PLN208.44 million, and Pharmaceutical Manufacturing at PLN416.37 million.

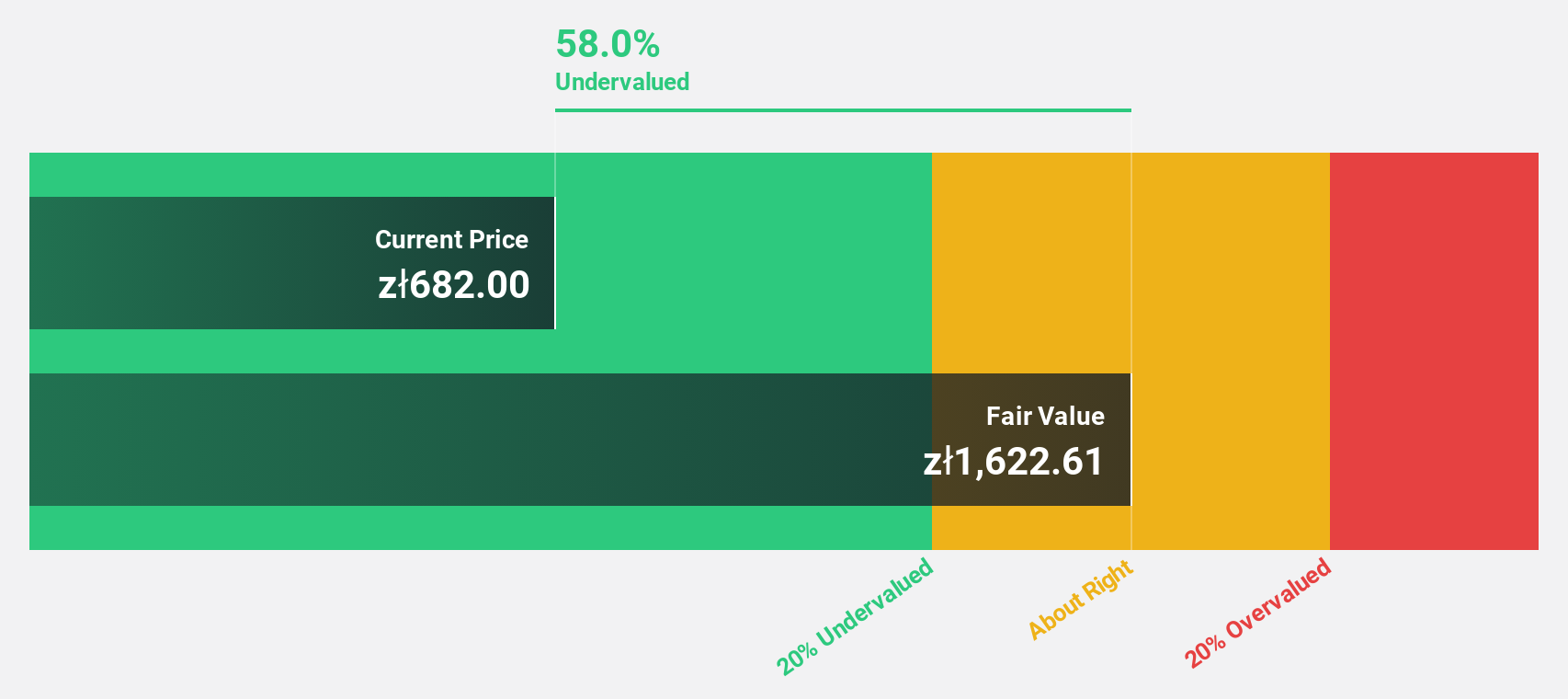

Estimated Discount To Fair Value: 46.1%

NEUCA is trading at PLN 835, significantly below its estimated fair value of PLN 1,549.55, highlighting potential undervaluation based on cash flows. Recent earnings reports show strong sales growth and improved net income for the third quarter. Although NEUCA carries a high level of debt and has a forecasted return on equity of 15.2%, its earnings are expected to grow significantly above the Polish market average over the next three years.

- The analysis detailed in our NEUCA growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of NEUCA.

Where To Now?

- Reveal the 190 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal