CSPC Pharmaceutical Group (SEHK:1093) valuation after new CEO appointment and SYH2085 influenza trial approval

The latest move at CSPC Pharmaceutical Group (SEHK:1093) blends leadership change with pipeline progress, as the company installs a new CEO and secures trial approval for its SYH2085 influenza candidate.

See our latest analysis for CSPC Pharmaceutical Group.

The market seems to like this mix of fresh leadership and R&D momentum, with CSPC Pharmaceutical Group's 1 day share price return of 7.64 percent and 7 day share price return of 20.65 percent pushing the stock to HK$8.88. This backs up an already strong year to date share price return of 91.79 percent and a 1 year total shareholder return of 90.27 percent that suggests positive momentum rather than a one day pop.

If this combination of new drugs and management shifts has your attention, it could be a good moment to explore other healthcare names using healthcare stocks as a starting universe for ideas.

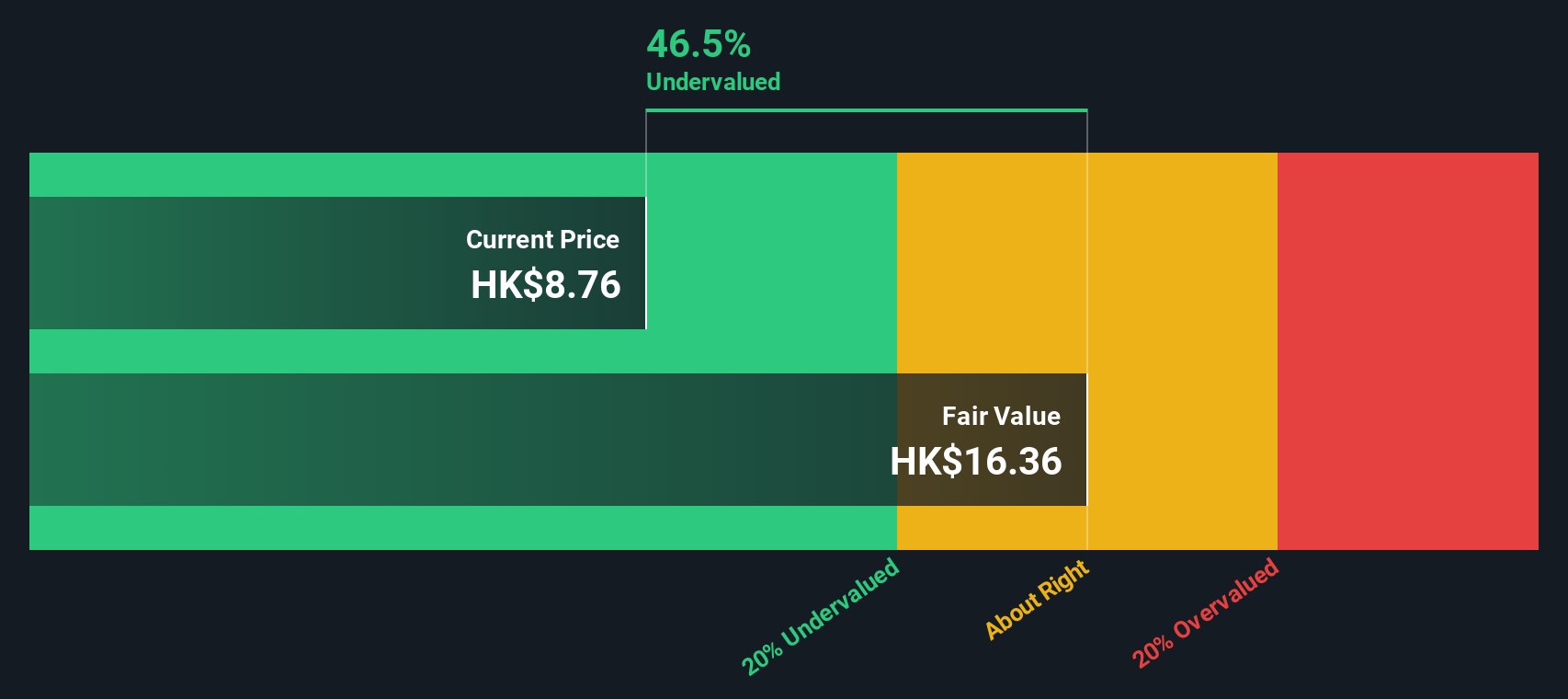

After such a sharp rerating, with shares still trading below the average analyst target and implying a hefty intrinsic discount, is CSPC Pharmaceutical Group quietly undervalued or is the market already baking in years of future growth?

Price-to-Earnings of 21x, is it justified?

On 21x price to earnings, compared with both peers and the wider Hong Kong pharmaceuticals space, the market is paying up for CSPC Pharmaceutical Group's earnings.

The price to earnings ratio compares the current share price to earnings per share. It is a simple shorthand for how much investors are willing to pay for every unit of current profit. For a diversified drug maker with established products and a steady pipeline, it is a key lens because earnings already reflect the mix of mature cash cows and growth investments.

Against the Hong Kong pharmaceuticals industry average of 13.4x, CSPC Pharmaceutical Group screens as materially more expensive. This implies investors are pricing in stronger profitability or a more resilient earnings profile than the sector overall. Yet when set against a peer average of 30.7x and an estimated fair price to earnings ratio of 24.3x, its current 21x looks more like a discount within its direct competitive set and is still below the level our fair ratio suggests the market could eventually converge toward.

Explore the SWS fair ratio for CSPC Pharmaceutical Group

Result: Price-to-Earnings of 21x (UNDERVALUED)

However, this upbeat story could falter if key pipeline trials disappoint or regulatory scrutiny intensifies, squeezing margins just as expectations peak.

Find out about the key risks to this CSPC Pharmaceutical Group narrative.

Another View, DCF Points to Deeper Value

While a 21x price to earnings ratio already hints at upside, our DCF model goes further. It estimates a fair value of HK$15.84 compared to the current HK$8.88. This suggests CSPC Pharmaceutical Group may be materially undervalued. Is the market underestimating its cash generation runway?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CSPC Pharmaceutical Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CSPC Pharmaceutical Group Narrative

If you see things differently or want to dig into the numbers yourself, you can build a tailored view in just minutes: Do it your way.

A great starting point for your CSPC Pharmaceutical Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investment move?

Before the market leaves you behind, put Simply Wall St to work and line up your next set of high conviction ideas with a few focused screens.

- Secure more resilient income streams by scanning these 10 dividend stocks with yields > 3% that can help anchor your portfolio through different market cycles.

- Target mispriced opportunities by reviewing these 898 undervalued stocks based on cash flows that may offer strong upside based on future cash flows.

- Get ahead of the next technology wave by evaluating these 24 AI penny stocks positioned at the forefront of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal