AppLovin (APP) Valuation Check After AI Ad Platform Momentum, S&P 500 Entry, and Strategic Refocus

The recent run in AppLovin (APP) is being powered by a clean story, faster growth from its AI ad platform and e commerce tools, and the decision to exit first party gaming.

See our latest analysis for AppLovin.

That backdrop helps explain why the share price has climbed to about $733.6, with a powerful year to date share price return of roughly 115 percent and a three year total shareholder return above 7,300 percent, suggesting momentum is still very much building.

If AppLovin’s surge has you thinking about what else could rerate on strong AI execution, this might be the moment to explore high growth tech and AI stocks as your next hunting ground.

But with APP now trading just shy of fresh analyst targets after a 7,000 plus percent three year run, are investors still getting in ahead of the story, or is the market already discounting the next leg of growth?

Most Popular Narrative Narrative: 0.5% Undervalued

With the narrative fair value sitting a touch above the last close, the story leans toward modest upside built on powerful operating assumptions.

Continuous advancements and adoption of the AXON machine learning platform are improving ad targeting, campaign ROI, and automation, enhancing advertiser outcomes and enabling higher net margins through increased operating efficiency.

Curious how sustained double digit growth, expanding margins, and a richer earnings multiple all fit together? Want to see the numbers behind that confidence? Read on.

Result: Fair Value of $737.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained regulatory pressure on data privacy and renewed platform tracking restrictions could quickly compress margins and undermine the optimistic earnings trajectory embedded in today’s valuation.

Find out about the key risks to this AppLovin narrative.

Another Lens on Valuation

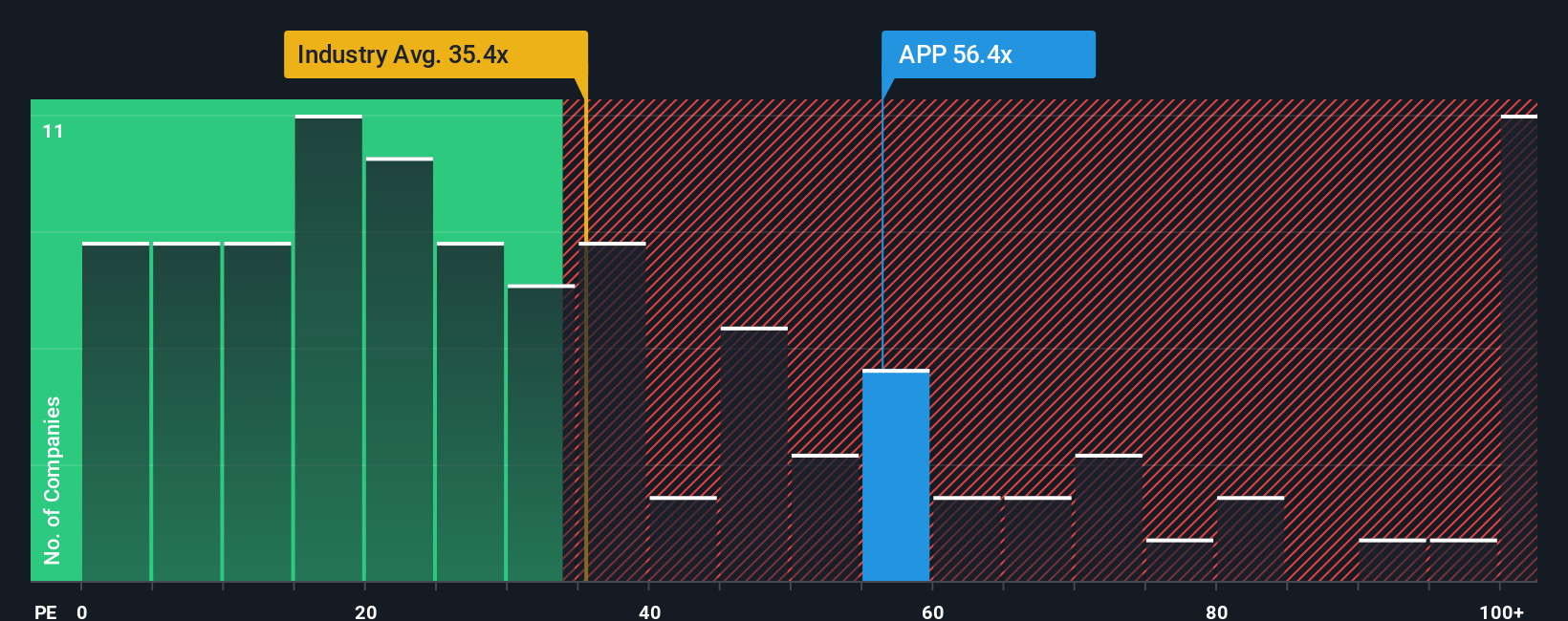

There is a catch. While the narrative model points to modest undervaluation, the earnings multiple tells a very different story, with APP trading on a rich 85 times earnings versus 32.3 times for the US software group and a 57 times fair ratio, implying little room for execution missteps. Is the market paying too far in advance for growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AppLovin Narrative

If this framework does not quite match your view, or you want to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your AppLovin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one great story. Use the Simply Wall St Screener to uncover fresh opportunities that match your strategy before the market fully catches on.

- Capture early stage growth potential by scanning for quality companies trading under the radar with these 3629 penny stocks with strong financials.

- Capitalize on the AI revolution by targeting businesses at the heart of machine learning and automation through these 24 AI penny stocks.

- Lock in potential bargains by focusing on stocks trading below estimated cash flow value using these 898 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal