BHP (ASX:BHP): Assessing Valuation After a 12% One-Month Share Price Rebound

Recent performance puts BHP Group (ASX:BHP) back on investors’ radar

BHP Group (ASX:BHP) has quietly pushed higher over the past month, with the share price gaining about 12% as investors lean back into large cap miners for income and long term growth.

See our latest analysis for BHP Group.

That recent 11.6% one month share price return has nudged BHP back toward the upper end of its yearly range, and when you set that alongside a 17.8% one year total shareholder return, it suggests momentum is quietly rebuilding as investors warm to its earnings resilience and dividend profile.

If BHP’s run has you thinking about where else value and momentum might be hiding, it is worth exploring fast growing stocks with high insider ownership as a source of fresh stock ideas.

With analyst targets sitting only slightly above today’s price and intrinsic value estimates hinting at a modest discount, the key question now is whether BHP still offers a genuine buying opportunity or if the market has already priced in its future growth.

Most Popular Narrative Narrative: 0% Overvalued

With BHP last closing at A$45.07 against a narrative fair value of about A$44.94, the valuation gap is razor thin but built on detailed long term assumptions.

The fair value estimate has edged down slightly from 45.21 to 44.94, implying a modest reduction in intrinsic valuation per share.

The revenue growth assumption has increased significantly from about 2.8 percent to roughly 21.7 percent, indicating a much stronger long-term top-line outlook.

Curious how modest share price upside is being justified by sharply higher growth assumptions and a richer future earnings multiple, even in a cyclical miner? Dig into the full narrative and see which long term forecasts really carry the valuation.

Result: Fair Value of $44.94 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution setbacks at projects like Jansen and any sustained slowdown in Chinese steel demand could quickly undermine the current earnings and valuation narrative.

Find out about the key risks to this BHP Group narrative.

Another Take On Valuation

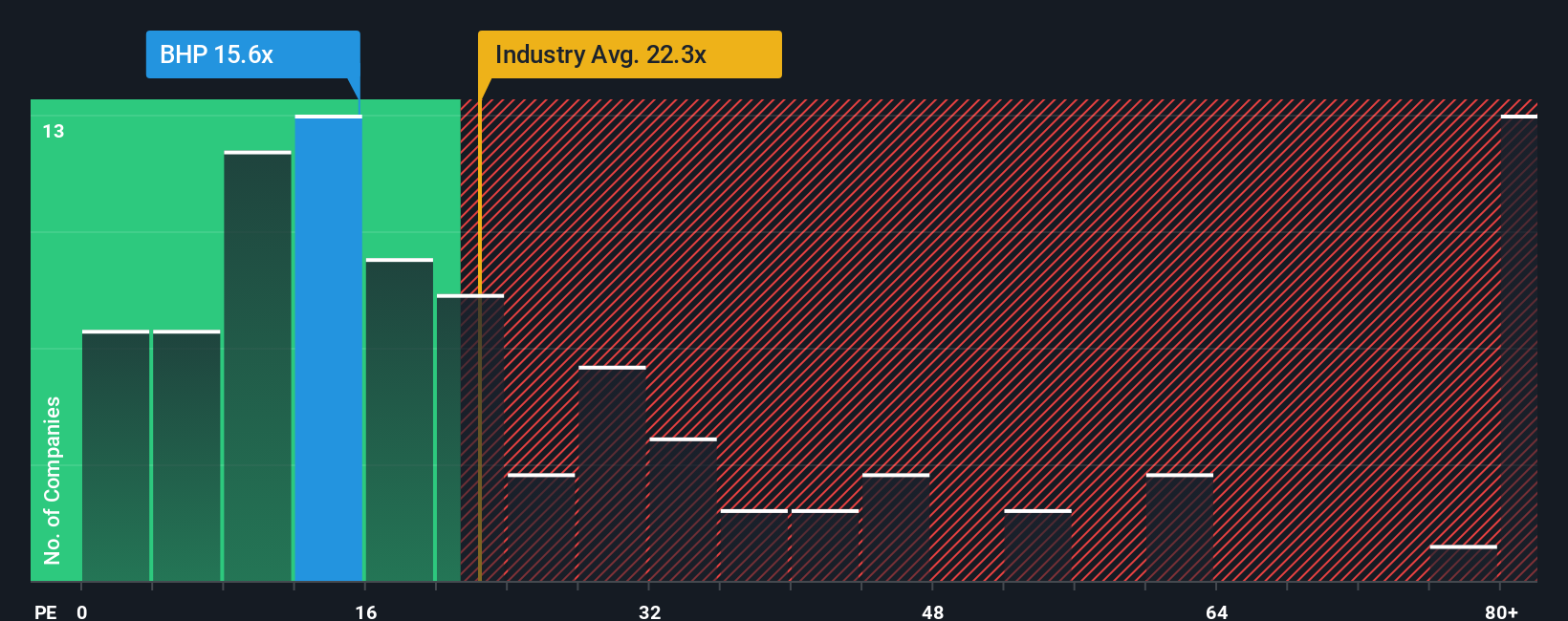

While the narrative fair value suggests BHP is roughly fully priced, its current price to earnings ratio of 16.9 times still sits well below both peers at 20.4 times and our fair ratio of 28.2 times, which hints at potential upside if sentiment and valuation multiples improve.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BHP Group Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a personalised narrative in just minutes: Do it your way.

A great starting point for your BHP Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at BHP. Use the Simply Wall St Screener to spot fresh opportunities where growth, income, and innovation could reshape your portfolio’s next move.

- Tap into potential multi-baggers by targeting under-the-radar companies through these 3629 penny stocks with strong financials that already show strong financial foundations.

- Ride powerful secular trends by focusing on businesses at the forefront of automation and machine learning using these 24 AI penny stocks.

- Strengthen your long term returns with cash flow backed bargains you uncover through these 898 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal