Innovation New Material Technology Leads 3 Promising Global Penny Stocks

As global markets navigate mixed signals from economic data and shifting monetary policies, investors are keenly observing opportunities that align with the current landscape. Penny stocks, though an older term, still capture the essence of investing in smaller or newer companies that offer potential growth at lower price points. When these stocks are backed by strong financials and sound fundamentals, they present a compelling case for investors seeking to uncover hidden value and capitalize on promising innovations in various sectors.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.48 | HK$921.6M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.185 | £480.11M | ✅ 5 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$2.87 | A$456.46M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.57 | HK$2.13B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €222.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.46 | SGD13.62B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6975 | $405.48M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.215 | MYR331.28M | ✅ 4 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £183.46M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,629 stocks from our Global Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Innovation New Material Technology (SHSE:600361)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Innovation New Material Technology Co., Ltd. operates in the advanced materials sector and has a market cap of CN¥16.11 billion.

Operations: The company generates revenue of CN¥80.12 billion from its Commodity Retail Business segment.

Market Cap: CN¥16.11B

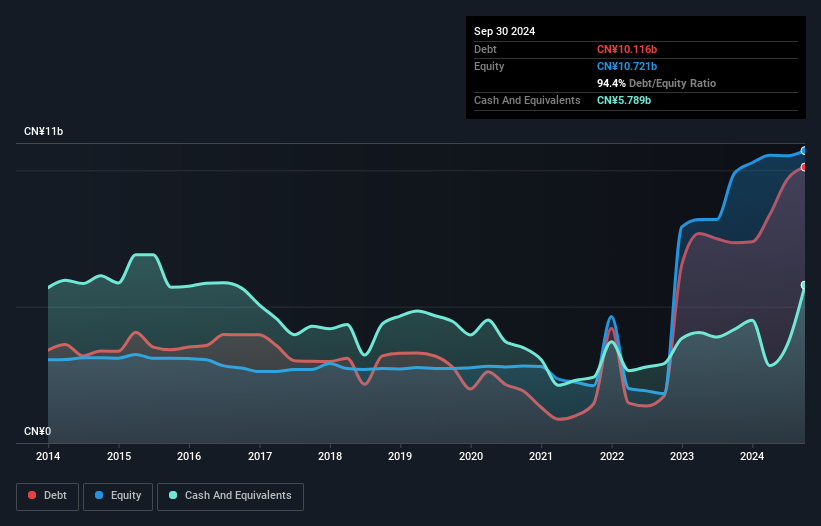

Innovation New Material Technology, operating in the advanced materials sector, has experienced some financial challenges recently. The company reported a slight decline in revenue and net income for the first nine months of 2025 compared to the previous year. Despite this, its earnings are forecast to grow significantly at 24.28% per year. The management team and board are considered experienced with an average tenure of three years. While its interest payments are well covered by EBIT, debt coverage by cash flow remains inadequate. Notably, the company completed a small share buyback earlier this year, reflecting shareholder-focused initiatives.

- Click to explore a detailed breakdown of our findings in Innovation New Material Technology's financial health report.

- Examine Innovation New Material Technology's earnings growth report to understand how analysts expect it to perform.

Hunan Er-Kang Pharmaceutical (SZSE:300267)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hunan Er-Kang Pharmaceutical Co., Ltd is involved in the research, development, production, and sale of pharmaceutical excipients, APIs, and finished drugs both in China and internationally with a market cap of CN¥7.26 billion.

Operations: Hunan Er-Kang Pharmaceutical Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥7.26B

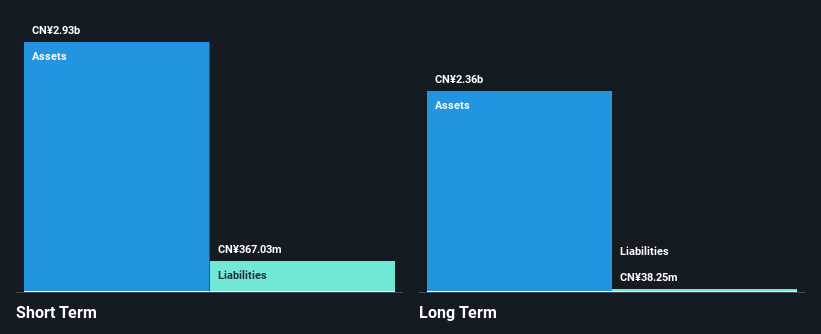

Hunan Er-Kang Pharmaceutical has demonstrated financial resilience with sales reaching CN¥1.01 billion for the first nine months of 2025, up from CN¥854.29 million a year earlier, and net income turning positive at CN¥39.58 million from a previous loss. Despite being unprofitable overall, its short-term assets significantly exceed both short-term and long-term liabilities, indicating strong liquidity. The company’s cash reserves surpass total debt, enhancing financial stability despite an increased debt-to-equity ratio over five years. Recent board changes and amendments to governance structures could indicate strategic shifts aimed at improving operational efficiency and shareholder value in the future.

- Unlock comprehensive insights into our analysis of Hunan Er-Kang Pharmaceutical stock in this financial health report.

- Evaluate Hunan Er-Kang Pharmaceutical's historical performance by accessing our past performance report.

Ourpalm (SZSE:300315)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ourpalm Co., Ltd. is engaged in the development, distribution, and operation of online games both in China and internationally, with a market cap of CN¥13.13 billion.

Operations: The company's revenue from the Information Service Industry amounts to CN¥702.37 million.

Market Cap: CN¥13.13B

Ourpalm Co., Ltd. has shown financial stability with short-term assets of CN¥3 billion surpassing its liabilities, while remaining debt-free enhances its balance sheet strength. Despite being unprofitable, the company has reduced losses over five years and is forecasted to grow earnings by 52.88% annually. Recent shareholder approval for revisions to the restricted stock incentive plan suggests a focus on aligning management incentives with performance goals. However, revenue declined to CN¥534.25 million for the first nine months of 2025 compared to CN¥650.61 million a year prior, pointing to challenges in maintaining sales momentum amidst strategic changes in governance and board composition.

- Click here and access our complete financial health analysis report to understand the dynamics of Ourpalm.

- Review our growth performance report to gain insights into Ourpalm's future.

Where To Now?

- Click this link to deep-dive into the 3,629 companies within our Global Penny Stocks screener.

- Interested In Other Possibilities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal