TXNM Energy (TXNM): Assessing Valuation After a 26% One-Year Climb in a Regulated Growth Story

TXNM Energy (TXNM) has quietly delivered a solid run, gaining about 26% over the past year as investors warm to its regulated footprint in New Mexico and Texas and its improving earnings profile.

See our latest analysis for TXNM Energy.

The steady 20.66% year to date share price return, capped by a recent close at $58.93, alongside a 25.96% one year total shareholder return, suggests momentum is quietly building as investors reassess its regulated growth story and earnings resilience.

If TXNM's run has you thinking about what else could re rate, now is a good moment to scout fast growing stocks with high insider ownership for other potential standout names.

With earnings expanding faster than revenue, but the share price now sitting just below analyst targets, the question is whether TXNM is still trading below its true potential or if the market has already priced in its regulated growth.

Most Popular Narrative: 2.8% Undervalued

With TXNM Energy last closing at $58.93 against a narrative fair value near $60.63, the story leans slightly in favor of further upside.

Robust capital investment opportunities in transmission and resource development, highlighted by an unmodeled need for at least 500 megawatts of new capacity by 2030 and up to 2,900 megawatts by 2032, provide a pipeline for long term asset base and revenue growth. Strategic focus on renewable energy and grid modernization, with stakeholder backed investments in solar, storage, and resiliency, positions TXNM Energy to benefit from decarbonization policies while reducing fuel cost volatility and supporting margin expansion.

Curious how steady top line growth, rising margins, and a future earnings multiple come together to justify that price target? The underlying projections may surprise you.

Result: Fair Value of $60.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated grid investment needs and potential regulatory setbacks on cost recovery could squeeze free cash flow and undermine the current upside narrative.

Find out about the key risks to this TXNM Energy narrative.

Another View: Multiples Flash a Warmer Warning

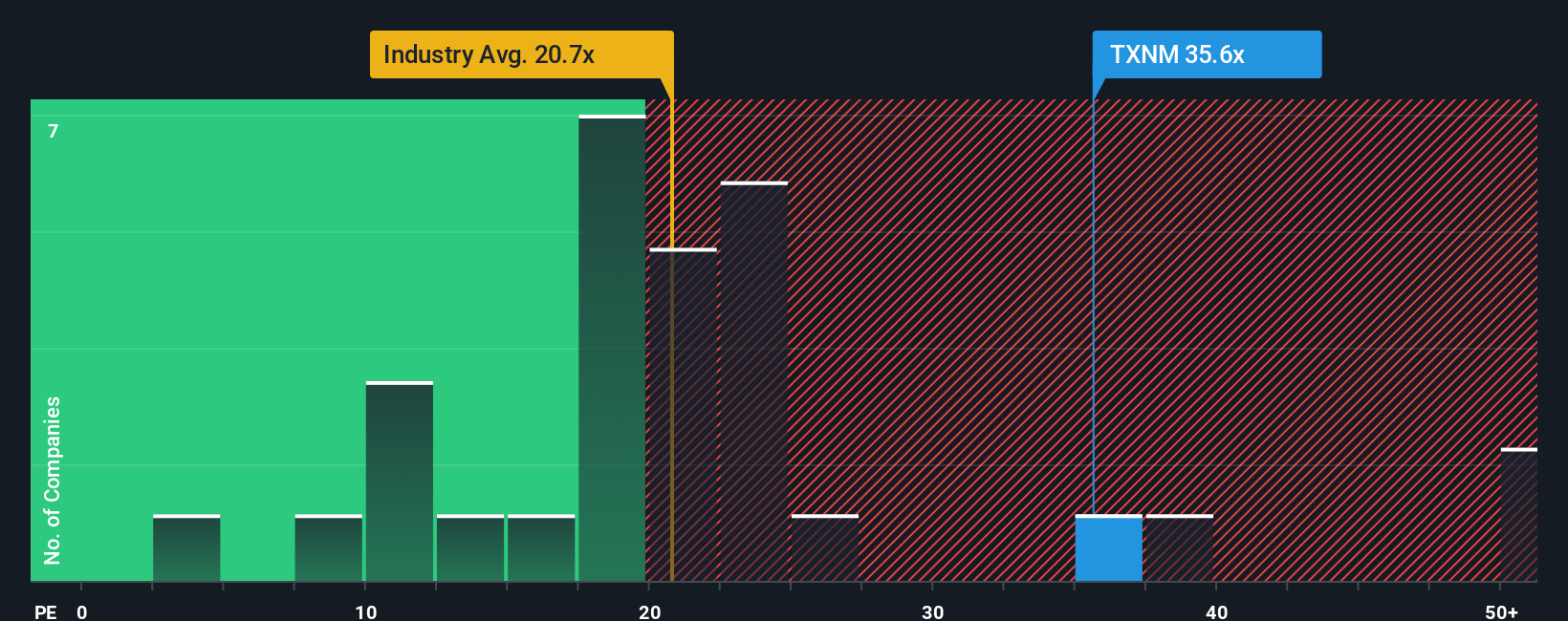

While the narrative fair value suggests TXNM Energy is modestly undervalued, its 36.3x price to earnings ratio looks stretched relative to a 28.7x fair ratio and roughly 19x for both the industry and peers. This signals downside risk if sentiment cools or the deal thesis wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TXNM Energy Narrative

If this perspective does not quite match your own view, or you prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way.

A great starting point for your TXNM Energy research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before the market moves on without you, lock in your next opportunities with targeted screens built to surface quality, momentum, and income potential in minutes.

- Capitalize on mispriced potential by scanning these 898 undervalued stocks based on cash flows that pair solid fundamentals with attractive entry points others are still overlooking.

- Ride the next wave of innovation by zeroing in on these 24 AI penny stocks positioned at the front line of real world AI adoption.

- Strengthen your income game by reviewing these 10 dividend stocks with yields > 3% that can help support a steadier, more resilient total return profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal