The risk of intervention is rising! Japan's finance minister issued the strongest warning: the sharp fall in yen is inconsistent with fundamentals and bold action will be taken if necessary

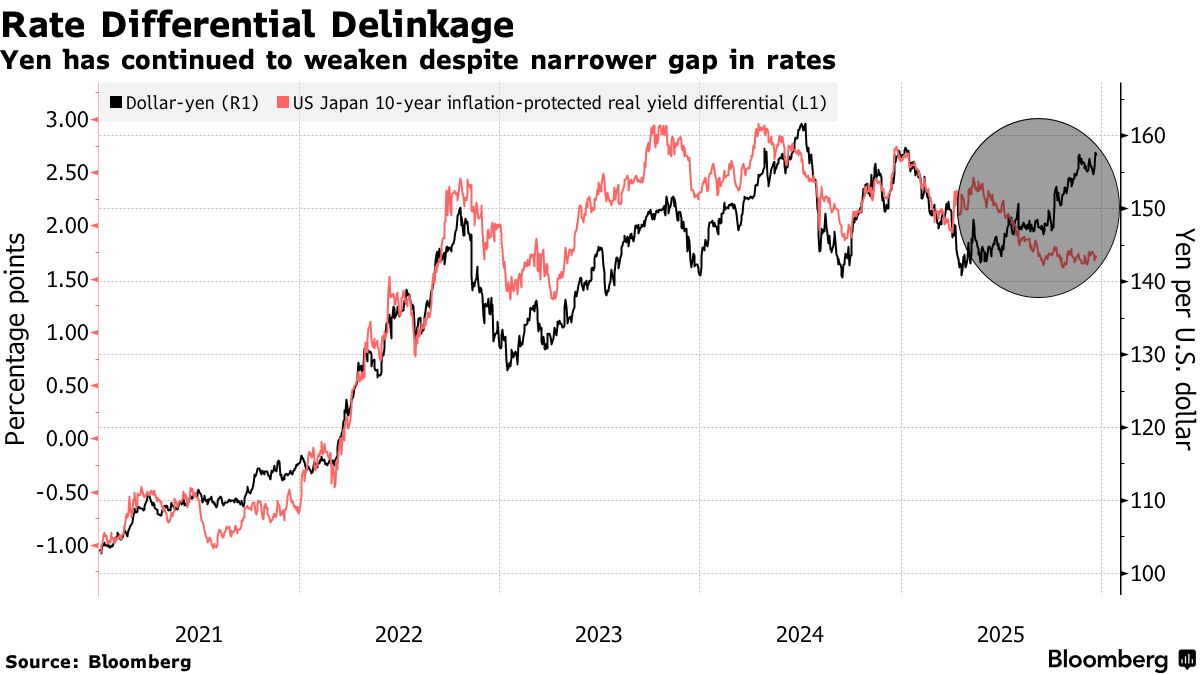

The Zhitong Finance App learned that while the yen continues to weaken even after the Bank of Japan raised interest rates, Japan's Finance Minister Satsuki Katayama (Satsuki Katayama) issued the strongest warning to speculators so far, saying that if currency trends do not match fundamentals, the Japanese authorities “have absolute freedom” to take bold action.

The Bank of Japan raised interest rates by 25 basis points as scheduled last Friday, raising the benchmark interest rate to 0.75%, the highest level in 30 years. However, the yen depreciated sharply last Friday as traders were disappointed that the Bank of Japan failed to give clear guidance on the timing of future monetary tightening.

Katayama Satsuki said, “This trend is clearly not in line with fundamentals; it is speculative.” “In response to this trend, we have made it clear that we will take bold action, as stated in the joint statement of the Japanese and US finance ministers.” The yen rose slightly after Katayama Satsuki made this statement. As of press release, the USD/JPY exchange rate was reported at 156.05.

According to reports, Japan's former Finance Minister Katsushin Kato and US Treasury Secretary Bezent signed a joint exchange rate statement in September, clarifying that the two countries adhere to the basic position that the market determines the exchange rate, while also confirming that there is still room for intervention in specific situations such as excessive exchange rate fluctuations. Today, Katayama Satsuki mentioned this joint exchange rate statement with the US, indicating that if Japan needs to take action, it has obtained the acquiescence of the US, and there is no need for further negotiations.

Japan's Ministry of Finance spent about 100 billion US dollars to support yen last year, and the time to intervene was probably around 160 yen per dollar. Katayama Satsuki did not comment on the current level of the yen exchange rate, and stated that there is no specific benchmark for what constitutes excessive or disorderly fluctuations.

Referring to changes in the Ministry of Finance's intervention strategy, she said, “Every situation is different, so it is wrong to expect the same model every time.” The former top foreign exchange official, Masato Kanda, said last year that the yen fluctuates between 1 US dollar and 10 yen within a month may be seen as too fast. When asked if the Japanese authorities might interfere in the foreign exchange market as the holiday season approaches, Katayama Satsuki said, “We are always fully prepared.”

On December 16, the Diet of Japan approved the supplementary budget for fiscal year 2025 (April 2025 to March 2026). The fiscal expenditure reached 18.3 trillion yen, claiming to be the largest after the pandemic. This budget is in the name of dealing with rising prices and promoting economic growth. Of this, 11.7 trillion yen will be raised through the issuance of new treasury bonds.

Meanwhile, the Japanese government plans to finalize the draft 2026 budget this Friday. According to the draft, the country's total budget for fiscal year 2026 will exceed 122 trillion yen for the first time, a record high. The increase in spending is mainly driven by two major factors: the cost of social welfare continues to rise, and the other is that the government plans to introduce a new round of financial support measures to mitigate the impact of rising living costs on households and businesses.

The Japanese government will also announce plans to issue Japanese treasury bonds at that time. Market participants are increasingly concerned that the Japanese authorities may increase the issuance of ten-year Japanese treasury bonds to help fill the fiscal gap. Meanwhile, as interest rates rise, the cost of financing Japan's huge public debt has increased markedly, causing outsiders to worry about the financial sustainability of the Japanese government.

Japan's Ministry of Finance predicts that the yield on Japan's 10-year treasury bonds will rise to 2.5% by 2028, and interest on debt will increase from 7.9 trillion yen last year to 16.1 trillion yen in 2028. According to International Monetary Fund (IMF) data, Japan's total government debt is expected to reach 229.6% of its gross domestic product (GDP) in 2025, leading the list among developed countries.

Due to concerns about Japan's public finance situation, Japan's 10-year treasury yield rose 7.5 basis points to 2.095% on Monday, the highest level since February 1999; the yield on Japanese two-year treasury bonds, which are sensitive to monetary policy expectations, rose 3 basis points to 1.12%, the highest level since 1997.

In response, Katayama Satsuki said that any deterioration in the government's financial situation is only temporary. She said it is expected that government spending in the next year or two will help stimulate the economy, investment will surge, and taxes will increase. She also said, “I often talk to other senior G7 officials, but no one has any doubts about Japan's financial situation.”

Katayama Satsuki pointed out, “Now that we have inflation, we are finally returning to a society where interest rates exist.” She noted that this shift is positive for growth. She also stated that the increase in debt service costs has so far been gradual, and stated that she intends to explain the reality of the situation in a transparent manner.

Katayama Satsuki also said, “By moving to an active fiscal policy, we knew before we started that some financial data would deteriorate in the first fiscal year, but this is not a problem.” “We spent 10, 20, or even 30 years, and economic growth barely accelerated no matter what we did. So there's no point in continuing to do the same thing as before.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal