Hope Bancorp (HOPE): Revisiting Valuation After Revenue Beats Expectations and Grows 21% Year on Year

Hope Bancorp (HOPE) just turned in a quarter that caught investors’ attention, with revenue jumping 21% year on year and topping expectations, even as earnings per share simply matched the Street.

See our latest analysis for Hope Bancorp.

At around $11.39, the stock has staged a solid rebound with a 10.05 percent 1 month share price return and a 31.02 percent 5 year total shareholder return. This suggests momentum is tentatively rebuilding after a softer year to date.

If this quarter has you rethinking your banking exposure, it might be a good moment to explore fast growing stocks with high insider ownership as a way to spot the next wave of committed owner operators.

With revenue and profit now accelerating, and the shares still trading at a discount to both intrinsic value estimates and analyst targets, the key question is whether Hope Bancorp is a bargain or if markets are already pricing in future growth.

Most Popular Narrative Narrative: 7% Undervalued

With Hope Bancorp last closing at $11.39 versus a narrative fair value of $12.25, the story leans toward upside if its aggressive growth path plays out.

The completion of the Territorial Bancorp acquisition expands Hope Bancorp's addressable customer base in Hawaii, enhancing its ability to serve growing Asian-American communities and boosting both deposit and loan growth, supporting future revenue expansion. Accelerating organic loan production, especially with recently hired, experienced commercial bankers, is expected to drive high single-digit loan growth and increased origination fees, which should positively impact both revenue and non-interest income in the coming quarters.

Curious how deposits, loan growth, and fatter margins supposedly stack together into this value gap, all discounted at a modest rate, not a tech style hurdle?

Result: Fair Value of $12.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering commercial real estate concentration and ongoing integration costs could easily derail the optimistic growth path that underpins this undervaluation story.

Find out about the key risks to this Hope Bancorp narrative.

Another View on Valuation

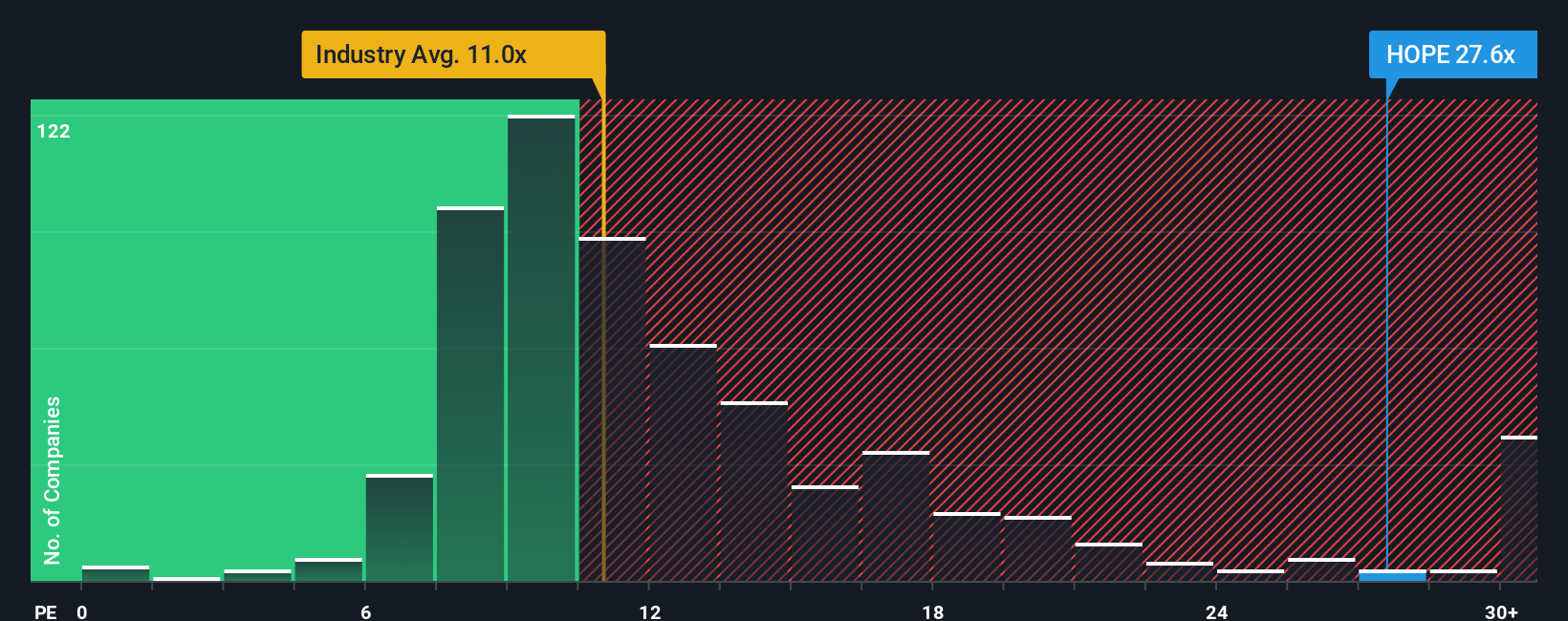

On simple earnings terms, the picture is less generous. Hope Bancorp trades on a 30.2 times price to earnings ratio versus 11.9 times for the US banks industry, while its fair ratio is closer to 24.8 times. That premium leaves less room for error if growth stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hope Bancorp Narrative

If you see the picture differently, or would rather stress test the numbers yourself, you can shape a complete narrative in minutes using Do it your way.

A great starting point for your Hope Bancorp research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh ideas that match your strategy before the market moves without you.

- Capitalize on mispriced potential by scanning these 898 undervalued stocks based on cash flows that pair strong fundamentals with attractive valuations before sentiment fully catches up.

- Ride powerful innovation trends by targeting these 24 AI penny stocks positioned at the forefront of real world artificial intelligence adoption and earnings growth.

- Strengthen your income stream by focusing on these 10 dividend stocks with yields > 3% that can support reliable cash returns alongside capital appreciation potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal