High Growth Tech Stocks to Watch in December 2025

As European markets show signs of steady economic growth with the STOXX Europe 600 Index rising by 1.60%, looser monetary policies and stable interest rates across major economies like the UK and Eurozone have set a conducive backdrop for tech stocks to potentially thrive. In such an environment, identifying high-growth tech stocks involves looking for companies that can leverage these favorable conditions to innovate and expand, particularly those well-positioned in emerging sectors like artificial intelligence or digital transformation.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Bonesupport Holding | 27.76% | 49.60% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Pharma Mar | 19.32% | 41.01% | ★★★★★☆ |

| Kitron | 21.22% | 32.49% | ★★★★★★ |

| Aelis Farma | 108.74% | 130.33% | ★★★★★☆ |

| Gapwaves | 32.48% | 72.52% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Waystream Holding | 17.38% | 66.50% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Datalogic (BIT:DAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Datalogic S.p.A. is a company that manufactures and sells automatic data capture and process automation products across various regions including Italy, the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market capitalization of €242.45 million.

Operations: Datalogic generates revenue primarily from two segments: Data Capture (€328.76 million) and Industrial Automation (€158.10 million).

Datalogic S.p.A. confronts a challenging landscape with its earnings growth of 68.3% per year outpacing the Italian market's 9.9%, yet struggles with a significant one-off loss of €6.2M that skewed last year's financial results. Despite this, the company maintains a positive free cash flow and is projected to see revenue growth at 5.6% annually, slightly above the Italian market average of 5.4%. The recent earnings report highlighted a dip in net income from €12.57 million to €1.18 million over nine months, reflecting lower profit margins year-over-year from 2.4% to just 0.6%. As Datalogic navigates these mixed financial waters, its ability to innovate and adapt will be crucial for future stability and growth within Europe's high-tech sector.

Bonesupport Holding (OM:BONEX)

Simply Wall St Growth Rating: ★★★★★★

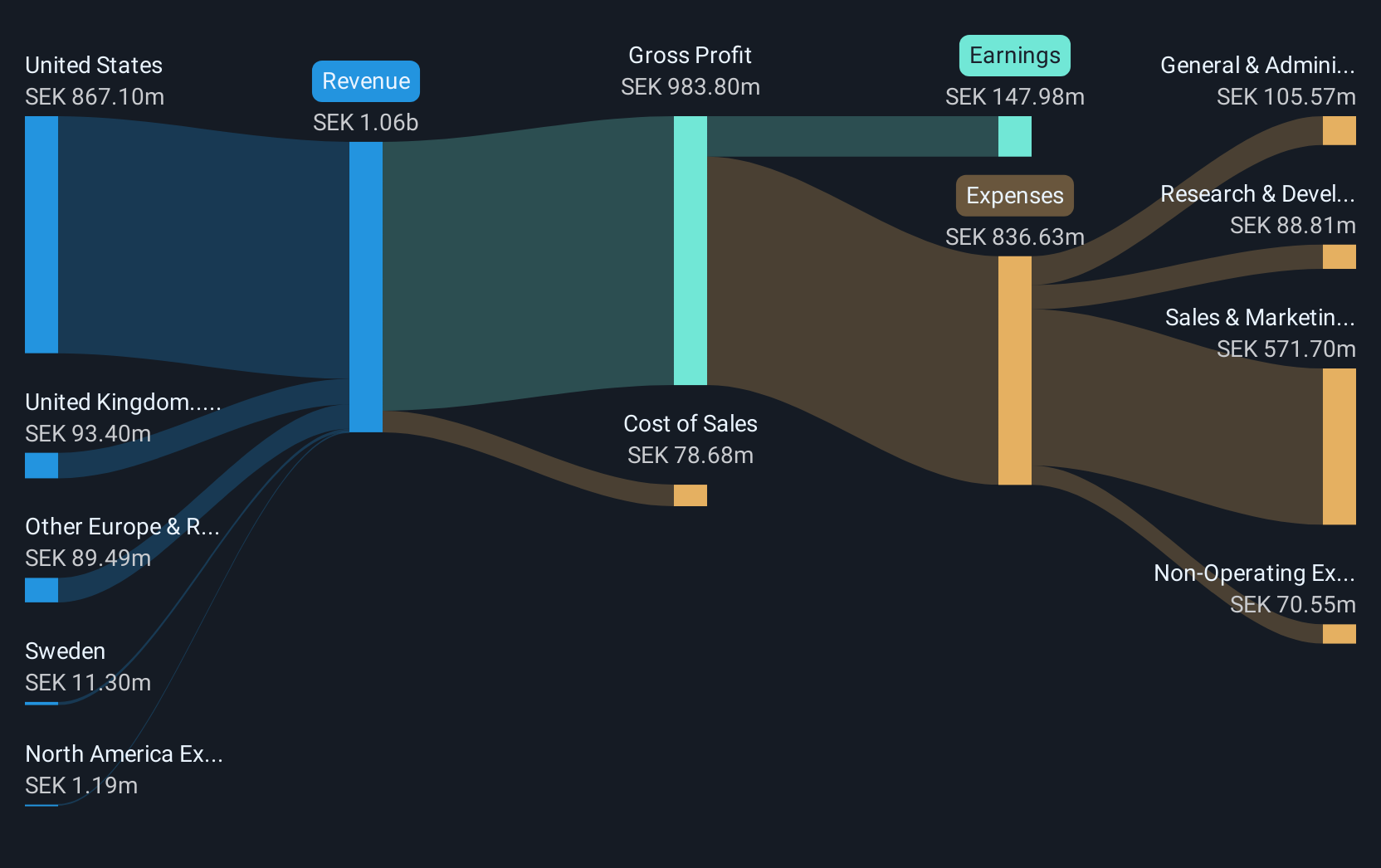

Overview: Bonesupport Holding AB (publ) is an orthobiologics company that develops and sells injectable bio-ceramic bone graft substitutes across Europe, North America, and internationally, with a market cap of SEK12.14 billion.

Operations: Bonesupport generates revenue primarily from its pharmaceuticals segment, totaling SEK1.12 billion.

Bonesupport Holding, a notable entity in the European tech landscape, demonstrates robust growth with its revenue surging by 27.8% annually, outpacing the Swedish market's average of 3.9%. This growth is underpinned by significant R&D investments that enhance its product offerings in medical technology, specifically in bone healing solutions. The recent strategic shift to a De Novo regulatory process for its CERAMENT® V product in the U.S. could potentially open new market segments, reflecting an adaptive and forward-looking approach. With earnings projected to climb by 49.6% annually—far exceeding Sweden's average of 13.5%—and a strong return on equity forecast at 38.9%, Bonesupport is poised to strengthen its position within high-tech medical solutions.

- Delve into the full analysis health report here for a deeper understanding of Bonesupport Holding.

Evaluate Bonesupport Holding's historical performance by accessing our past performance report.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

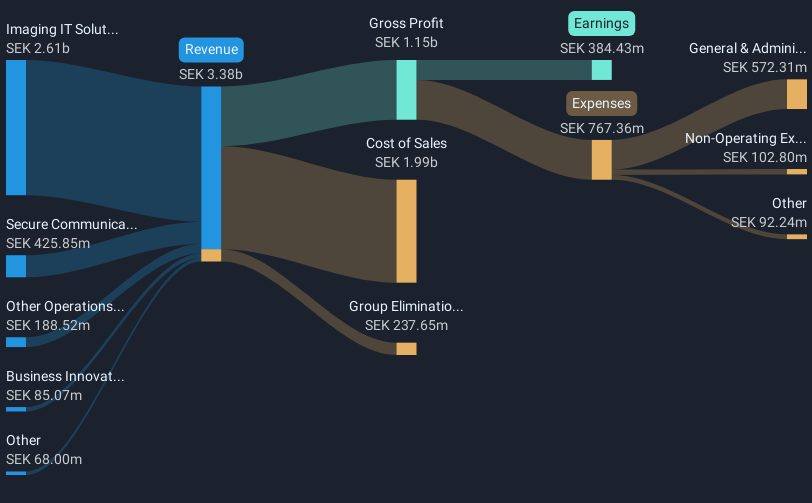

Overview: Sectra AB (publ) is a company that offers solutions in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of SEK48.74 billion.

Operations: Sectra generates revenue primarily from its Imaging IT Solutions segment, which accounts for SEK2.95 billion, and Secure Communications, contributing SEK392.76 million. The company operates in the medical IT and cybersecurity sectors across multiple European countries.

Amidst a dynamic European tech landscape, Sectra stands out with its recent strategic advancements and robust financial performance. In the latest quarter, the company's revenue climbed to SEK 903.48 million, marking a significant increase from SEK 779.4 million in the previous year; this surge is supported by an impressive net income jump to SEK 148.4 million from SEK 87.76 million. These figures underscore Sectra's effective expansion strategies and operational efficiency in medical imaging IT and cybersecurity sectors—sectors poised for further growth given increasing demands for digital healthcare solutions globally. Additionally, Sectra's recent deal to provide NHS trusts with an enterprise imaging solution via Sectra One Cloud not only enhances its market footprint but also bolsters its recurring revenue model through cloud-based services, ensuring long-term customer engagement and heightened cybersecurity measures across multiple facilities.

- Get an in-depth perspective on Sectra's performance by reading our health report here.

Assess Sectra's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Explore the 50 names from our European High Growth Tech and AI Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal