Peabody Energy (BTU): Assessing Valuation After CEO James Grech’s Extended Tenure and Structured Succession Plan

Peabody Energy (BTU) just gave investors a long runway on leadership clarity by extending CEO James Grech’s tenure through May 2028, then shifting him into an advisory role until 2030.

See our latest analysis for Peabody Energy.

That commitment to leadership stability comes as investors have already been rewarding Peabody, with a year to date share price return of 47.17 percent and a one year total shareholder return of 53.74 percent, signaling building momentum rather than a late cycle spike.

If this kind of steady leadership and strong recent performance has you thinking more broadly about opportunities in traditional energy and beyond, it could be a good moment to explore fast growing stocks with high insider ownership.

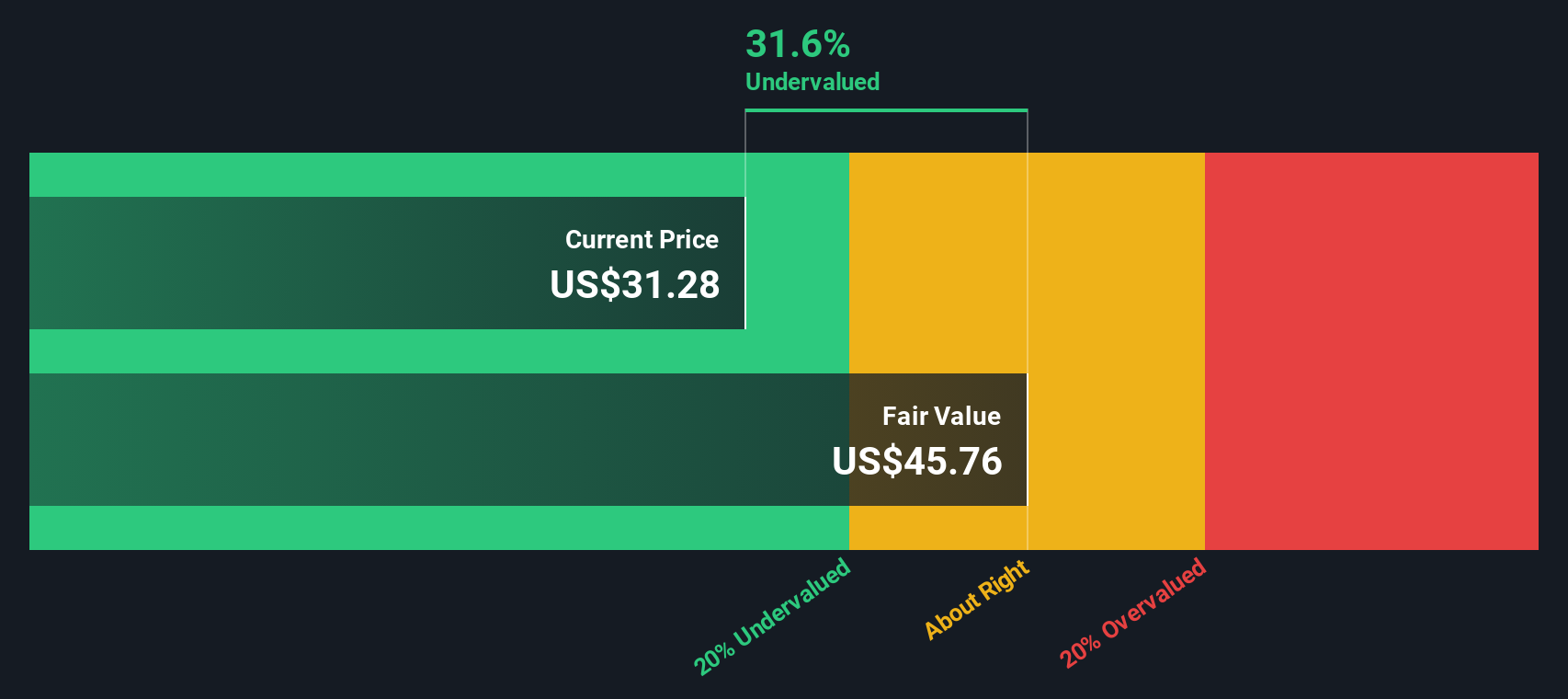

Yet with revenue and profits growing, an intrinsic valuation implying a steep discount, and shares still below analyst targets, is Peabody a quietly undervalued cash generator, or are markets already pricing in every ton of future upside?

Most Popular Narrative: 10.9% Undervalued

With Peabody’s last close at $30.70 against a narrative fair value of $34.47, the current share price sits noticeably below that long range target, framing the backdrop for one key growth driver.

Execution of accelerated ramp-up at the Centurion premium hard coking coal mine and continued portfolio optimization toward higher-margin metallurgical coal are poised to increase Peabody's exposure to infrastructure and steel production-driven demand, mainly in Asia-Pacific, underpinning future topline growth and higher operating margins.

Want to see how a faster ramp up, richer margin mix, and stronger overseas demand are baked into this valuation gap? The projections behind this fair value hinge on shifting profit drivers, rising earnings power, and a future multiple that looks very different to today. Curious which assumptions really move the needle here? Read on to unpack the full narrative.

Result: Fair Value of $34.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, in the longer term, decarbonization policies and potential carbon pricing could compress coal demand, undermining the growth, margins, and valuation underpinning this narrative.

Find out about the key risks to this Peabody Energy narrative.

Another View on Valuation

Our fair value estimate of $86.10 using the SWS DCF model paints a far more optimistic picture than the $34.47 narrative fair value and even the $34.80 analyst target. If cash flows really evolve that way, is the market ignoring a deep value story or correctly discounting long term coal risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Peabody Energy Narrative

If you see the story differently or want to stress test the assumptions yourself, you can easily build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Peabody Energy.

Looking for more investment ideas?

Before coal sentiment shifts again, strengthen your watchlist with fresh opportunities that match your strategy using targeted stock screeners built to surface what others overlook.

- Capture fast moving potential by scanning these 3629 penny stocks with strong financials that pair smaller market caps with balance sheets and fundamentals built to support real, sustainable growth.

- Position ahead of the next productivity wave by focusing on these 24 AI penny stocks that harness artificial intelligence to reshape industries and expand scalable revenue streams.

- Identify value where sentiment has not caught up by filtering for these 898 undervalued stocks based on cash flows that trade below intrinsic estimates based on available cash flow forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal