Benign Growth For Amixa Holding Nyilvánosan Muködo Részvénytársaság (BUSE:AMIXA) Underpins Stock's 26% Plummet

Unfortunately for some shareholders, the Amixa Holding Nyilvánosan Muködo Részvénytársaság (BUSE:AMIXA) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

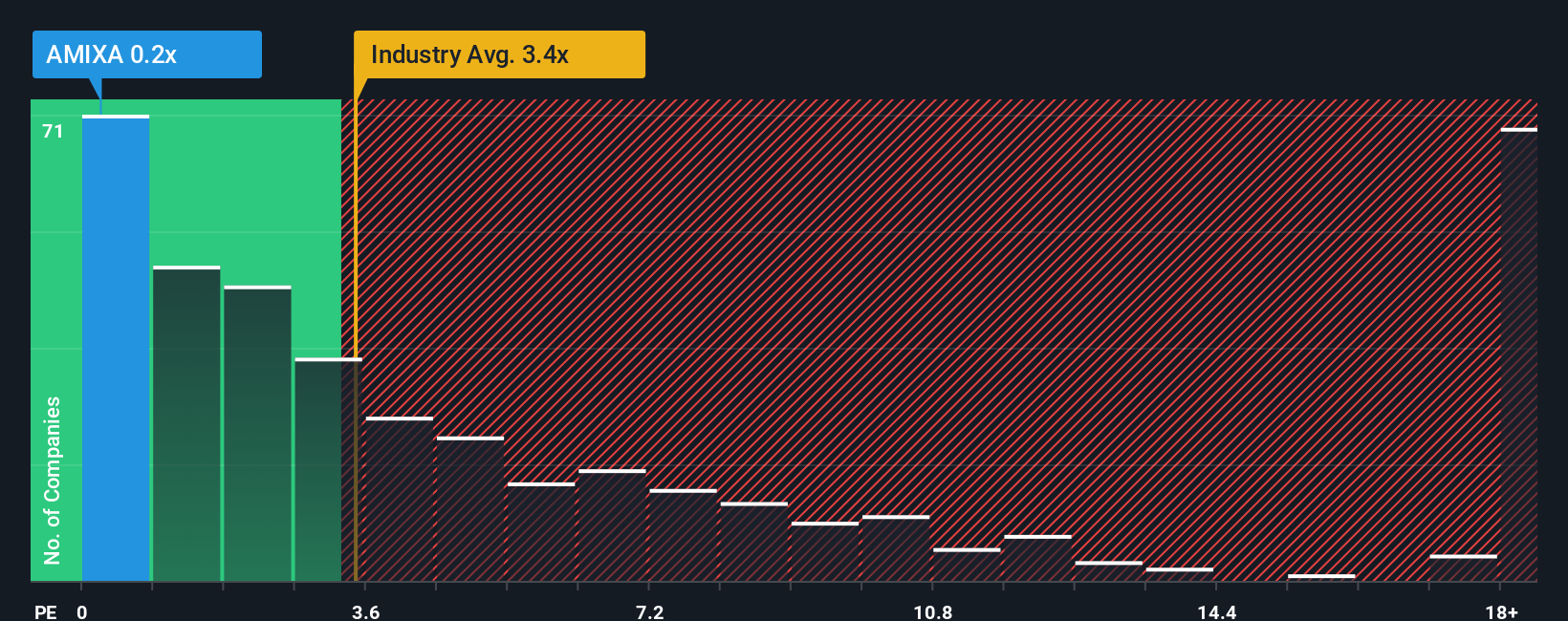

In spite of the heavy fall in price, Amixa Holding Nyilvánosan Muködo Részvénytársaság may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Capital Markets industry in Hungary have P/S ratios greater than 3.4x and even P/S higher than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Amixa Holding Nyilvánosan Muködo Részvénytársaság

How Has Amixa Holding Nyilvánosan Muködo Részvénytársaság Performed Recently?

For instance, Amixa Holding Nyilvánosan Muködo Részvénytársaság's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Amixa Holding Nyilvánosan Muködo Részvénytársaság will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Amixa Holding Nyilvánosan Muködo Részvénytársaság's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Amixa Holding Nyilvánosan Muködo Részvénytársaság?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Amixa Holding Nyilvánosan Muködo Részvénytársaság's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 3.1% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Amixa Holding Nyilvánosan Muködo Részvénytársaság's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does Amixa Holding Nyilvánosan Muködo Részvénytársaság's P/S Mean For Investors?

Having almost fallen off a cliff, Amixa Holding Nyilvánosan Muködo Részvénytársaság's share price has pulled its P/S way down as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Amixa Holding Nyilvánosan Muködo Részvénytársaság revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Amixa Holding Nyilvánosan Muködo Részvénytársaság that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal