Asian Penny Stocks To Consider In December 2025

As the Asian markets navigate a landscape marked by significant economic shifts, such as Japan's interest rate hike to its highest level in 30 years and China's mixed economic indicators, investors are keenly observing potential opportunities. Penny stocks, though often considered a term from past market eras, continue to represent viable investment options due to their affordability and growth potential. These smaller or newer companies can offer substantial upside when backed by strong financials, making them an intriguing area of focus for those seeking diverse investment avenues.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.49 | HK$921.6M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.57 | HK$2.13B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB5.00 | THB3B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.104 | SGD54.45M | ✅ 2 ⚠️ 4 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.94 | THB882M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.46 | SGD13.62B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.78 | HK$2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.67 | HK$20.66B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.59 | HK$53.29B | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 977 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

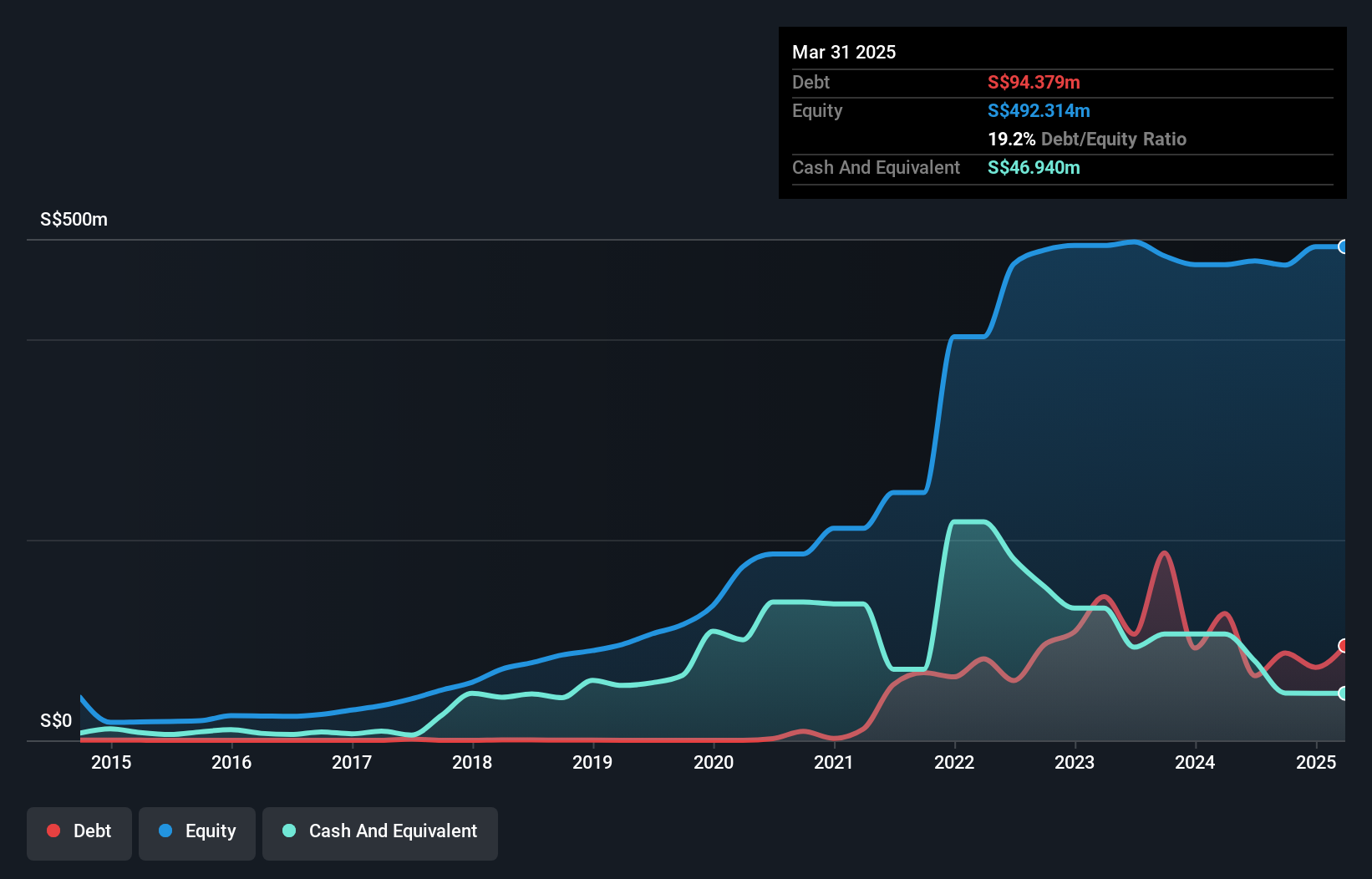

AEM Holdings (SGX:AWX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AEM Holdings Ltd., with a market cap of SGD538.21 million, provides semiconductor and electronics test solutions globally through its subsidiaries.

Operations: Revenue Segments: No Revenue Segments Reported AEM Holdings Ltd., with a market cap of SGD538.21 million, provides semiconductor and electronics test solutions globally through its subsidiaries.

Market Cap: SGD538.21M

AEM Holdings Ltd. has demonstrated financial improvement with sales reaching SGD287.54 million for the nine months ending September 2025, compared to SGD247.8 million the previous year, and a net income of SGD4.02 million, marking a shift from a prior net loss. Despite facing patent infringement allegations from Advantest Test Solutions Inc., AEM maintains its stance against these claims and continues to defend its position legally. The company has stable weekly volatility and its short-term assets comfortably cover both short- and long-term liabilities, though its Return on Equity remains low at 3.2%.

- Click here and access our complete financial health analysis report to understand the dynamics of AEM Holdings.

- Learn about AEM Holdings' future growth trajectory here.

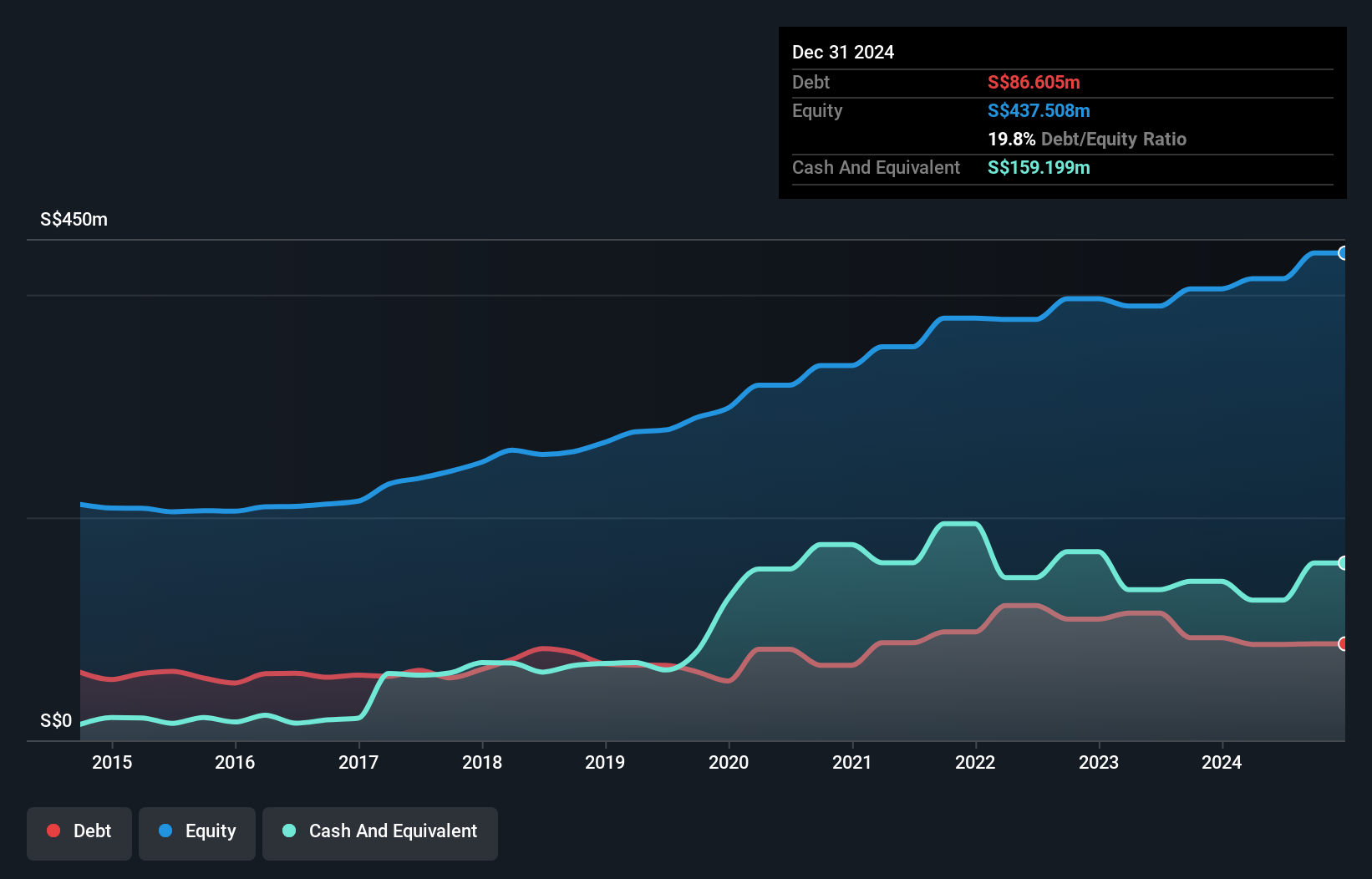

Frencken Group (SGX:E28)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Frencken Group Limited is an investment holding company that offers original design, original equipment, and diversified integrated manufacturing solutions globally, with a market cap of SGD597.93 million.

Operations: The company's revenue is primarily generated from its Mechatronics segment, which accounts for SGD768.23 million, followed by the Integrated Manufacturing Services (IMS) segment at SGD81.94 million, and Investment Holding & Management Services contributing SGD12.58 million.

Market Cap: SGD597.93M

Frencken Group Limited exhibits financial stability with its short-term assets of SGD525.2 million adequately covering both short- and long-term liabilities, while maintaining more cash than total debt. Despite a low Return on Equity at 8.7%, the company has not experienced significant shareholder dilution over the past year and shows stable weekly volatility. Although earnings growth is modest at 1% over the past year, it surpasses its five-year average decline of -6.9%. Earnings are forecasted to grow annually by 7.34%, with analysts suggesting potential stock price appreciation by 27.3%. However, recent guidance indicates slightly lower revenue for the second half of 2025 compared to the first half amidst challenging macroeconomic conditions.

- Click here to discover the nuances of Frencken Group with our detailed analytical financial health report.

- Explore Frencken Group's analyst forecasts in our growth report.

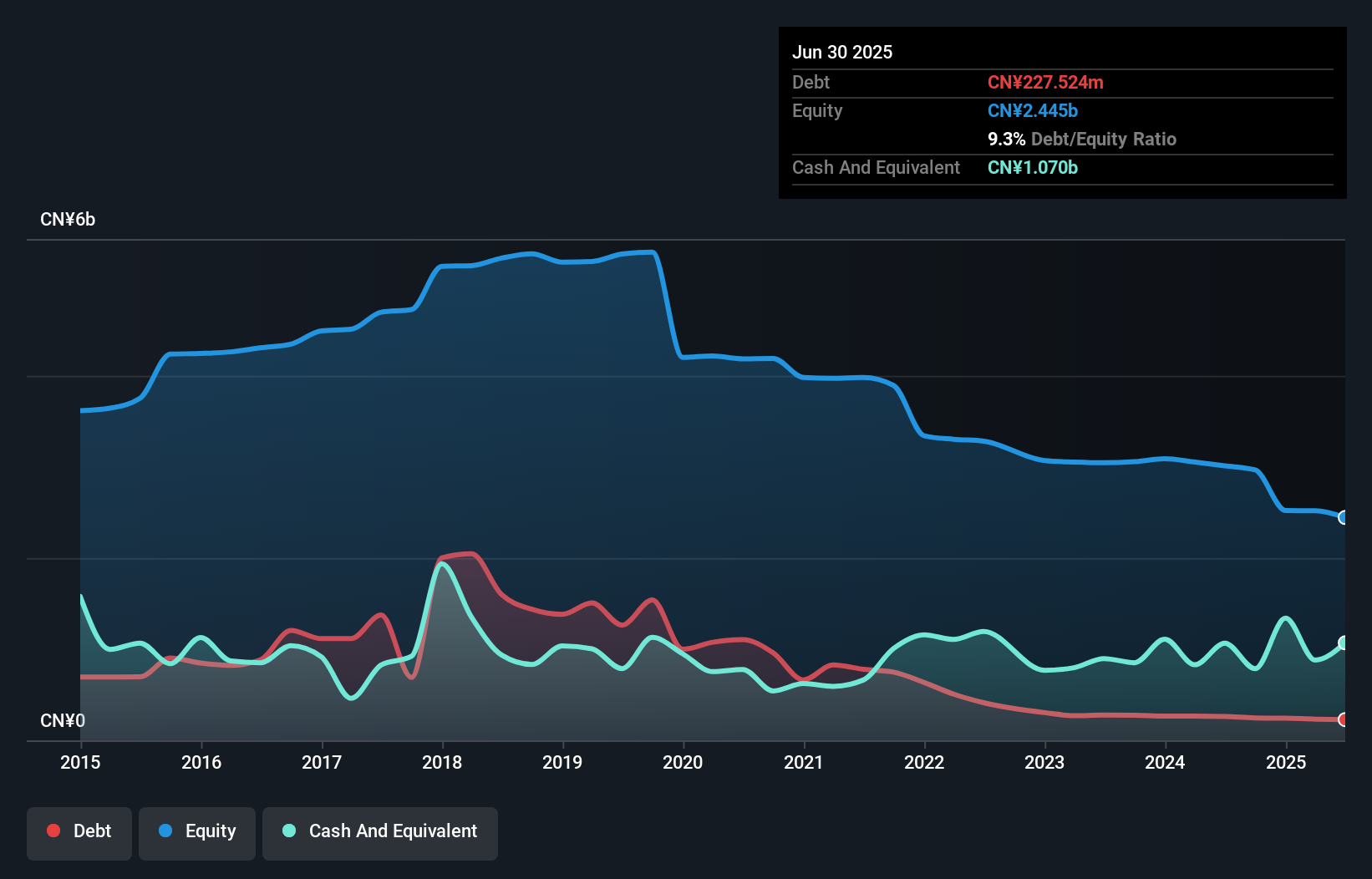

Pubang Landscape Architecture (SZSE:002663)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pubang Landscape Architecture Co., Ltd operates in China, focusing on garden engineering construction and landscape design, with a market cap of CN¥3.52 billion.

Operations: Revenue Segments: No specific revenue segments are reported for Pubang Landscape Architecture Co., Ltd.

Market Cap: CN¥3.52B

Pubang Landscape Architecture Co., Ltd demonstrates financial resilience with short-term assets of CN¥3 billion exceeding both its short- and long-term liabilities. Despite being unprofitable, the company has reduced losses by 15.7% annually over the past five years and maintains a cash runway for over three years, even if free cash flow decreases at historical rates. The debt-to-equity ratio has improved significantly to 9.6%, and the firm holds more cash than total debt. Although it faces a net loss of CN¥39.04 million for the nine months ended September 2025, shareholder dilution remains minimal with stable weekly volatility at 6%.

- Navigate through the intricacies of Pubang Landscape Architecture with our comprehensive balance sheet health report here.

- Assess Pubang Landscape Architecture's previous results with our detailed historical performance reports.

Next Steps

- Get an in-depth perspective on all 977 Asian Penny Stocks by using our screener here.

- Interested In Other Possibilities? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal