Goldman Sachs Nuggets “Alpha” in the Japanese market: spending 800 billion yen over the next ten years, focusing on mergers and acquisitions of medium-sized enterprises

The Zhitong Finance App learned that Goldman Sachs (GS.US) plans to expand its acquisition and investment scale in Japan's booming merger and acquisition market by about 800 billion yen (about 5.1 billion US dollars) within the next ten years, focusing on medium-sized enterprises. Yu Itoki, managing director of Goldman Sachs Japan's growth equity and private equity team, said Goldman Sachs is looking for corporate clients in areas such as management acquisitions, subsidiary sales, and corporate succession planning. He believes that global institutional investors are in strong demand in the Japanese market, while more and more companies are also keen to carry out projects such as management acquisitions and sales of non-core assets.

In an interview, Itoki said, “We are investing two to three times faster now than before.” He pointed out that supply and demand relationships between investors and companies seeking financing have converged.

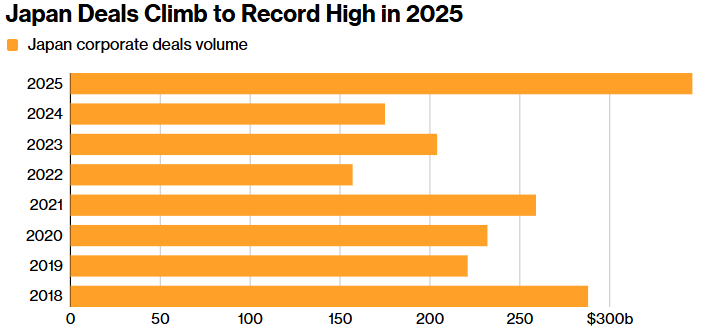

As corporate governance reforms aimed at improving shareholder returns drive more transactions, the volume of transactions involving Japanese companies is expected to soar to a record high of about 350 billion US dollars by 2025. Although huge multi-billion dollar deals are popping up, Itoki said these are not Goldman Sachs's main goals, as competition is extremely intense, making them less attractive.

He said that Goldman Sachs's target customers are medium-sized enterprises with a valuation of between 30 billion and 300 billion yen, and these companies often lack the capital and human resources needed to expand overseas markets or carry out mergers and acquisitions. Itoki said, “In many cases, these companies are of high quality business and have a large market share in Japan, but they lack the resources needed to grow further.”

Goldman Sachs has already begun making such investments. In 2022, Goldman Sachs partnered with Eneos Holdings Inc. to acquire road construction company Nippo Corp. at a price of about 200 billion yen. In 2024, the US investment bank collaborated with the founding family and other investors to acquire Japan Housing Co., Ltd. by management at a price of approximately 94 billion yen. The US investment bank focuses on four industries, including tech companies it invests in, such as taxi dispatch app operator Go Inc., and smart lock company Bitkey Inc.

Healthcare is another area of focus. Kakehashi Inc. spans the medical and tech sectors, providing software data through cloud services, and the company raised approximately 140 billion yen from Goldman Sachs and existing shareholders earlier this year.

According to Itoki, the third area of focus is industry, which covers a wide range of industries, including Nippon and Nihon Housing. Internet service provider Raksul Inc. is one of them, and the company just announced that it will conduct a management acquisition for 120 billion yen.

Itoki said industrial companies “may not be experiencing rapid growth,” but they have “high-quality technology and services, and there is still a lot of room for value improvement by improving operational efficiency and streamlining balance sheets.”

Goldman Sachs had not previously been involved in the fourth largest industry — the consumer goods industry until November of last year when it announced the acquisition of Japan's Burger King; Goldman Sachs bought this fast food company from Hong Kong investment company Affinity Equity Partners for about 70 billion yen.

Itoki said that since the outbreak of COVID-19, fast food restaurants like Burger King have grown rapidly, and among them, burger restaurants have performed particularly well. Due to language barriers and differences in business practices and regulatory environments, overseas private equity funds take time and money to set up teams and invest directly in Japan.

“Many investors believe it is reasonable to entrust the capital as a limited partner to a company with a team and track record in Japan,” Itoki said. With regard to the funds entrusted to Goldman Sachs, he added, “I hope to invest responsibly to help Japanese companies grow and grow.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal