Middle Eastern Penny Stocks To Watch In December 2025

Most Gulf markets have recently experienced an upswing, buoyed by rising oil prices and optimism surrounding potential U.S. Federal Reserve rate cuts. In this context, penny stocks—often representing smaller or emerging companies—remain a relevant investment area for those seeking growth opportunities. Despite their historical connotations, these stocks can offer a blend of affordability and potential when backed by strong financial health, making them worth considering for investors interested in tapping into promising market segments.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.25 | SAR1.3B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.416 | ₪173.21M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.03 | AED2.1B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.24 | AED670.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.88 | SAR974M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.22 | AED386.93M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.70 | AED15.86B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.852 | AED518.23M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.532 | ₪198.76M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 82 stocks from our Middle Eastern Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sharjah Cement and Industrial Development (PJSC) operates in the production and distribution of cement and related products, with a market capitalization of AED518.23 million.

Operations: The company generates revenue of AED735.05 million from its manufacturing segment.

Market Cap: AED518.23M

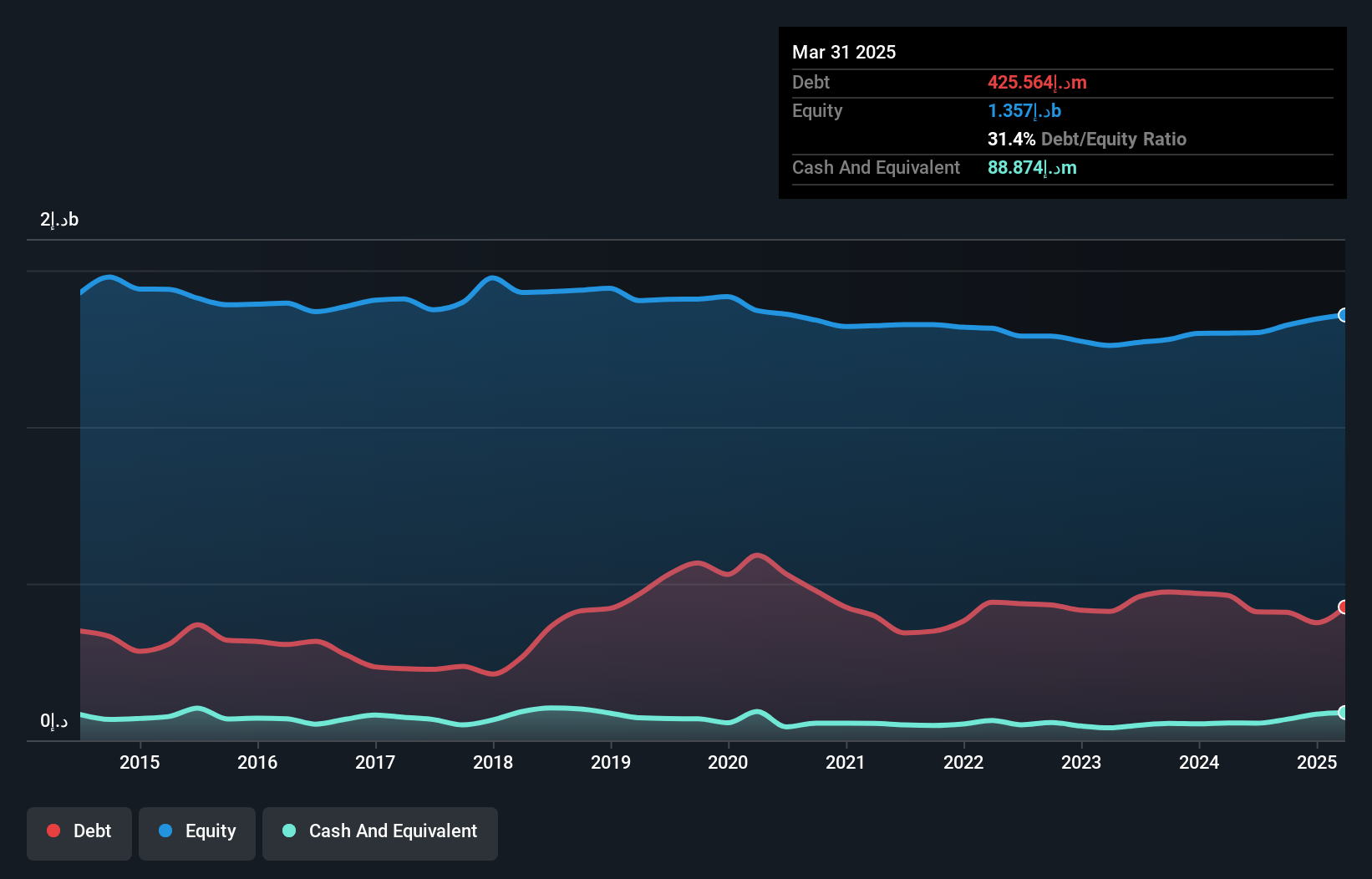

Sharjah Cement and Industrial Development (PJSC) has demonstrated robust financial health, with short-term assets of AED700.8 million exceeding both its long-term liabilities of AED122.3 million and short-term liabilities of AED540.1 million. The company's debt management is prudent, with a debt-to-equity ratio reduced to 30.9% and interest payments well covered by EBIT at 17.3x coverage. Recent earnings growth is impressive at 88.6%, surpassing industry benchmarks, though the dividend yield of 5.87% isn't fully supported by free cash flows, indicating potential sustainability concerns despite high-quality past earnings and stable weekly volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Sharjah Cement and Industrial Development (PJSC).

- Explore historical data to track Sharjah Cement and Industrial Development (PJSC)'s performance over time in our past results report.

National Investor Pr. J.S.C (ADX:TNI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The National Investor Pr. J.S.C., with a market cap of AED122.20 million, operates in the United Arab Emirates offering services in private equity, real estate investment and consultancy, economic feasibility studies, commercial agencies, and hospitality through its subsidiaries.

Operations: The company's revenue segment is primarily derived from Principal Investments, totaling AED31.79 million.

Market Cap: AED122.2M

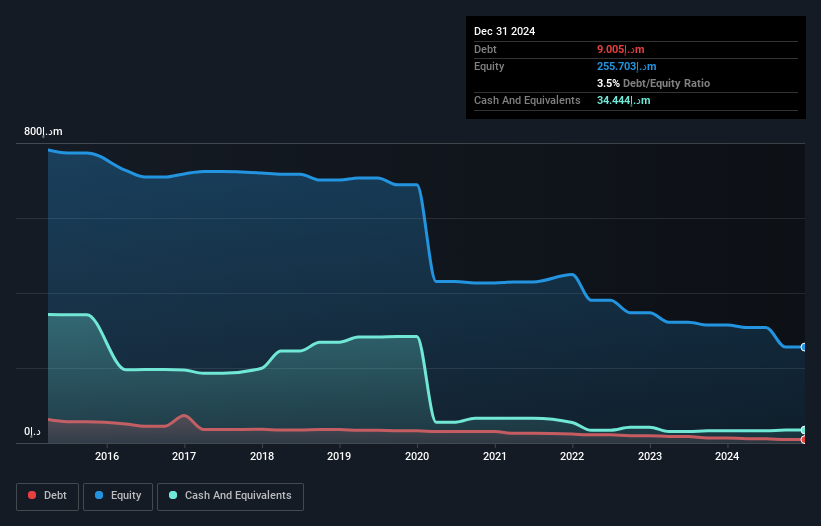

National Investor Pr. J.S.C., with a market cap of AED122.20 million, operates in the UAE's investment sector and remains unprofitable, yet it has a positive cash flow that ensures a cash runway exceeding three years. The company has effectively reduced its debt-to-equity ratio from 7.1% to 1.1% over five years and maintains more cash than total debt, indicating prudent financial management despite high share price volatility recently observed in the market. Its board is experienced with an average tenure of 6.7 years, and while earnings have grown minimally by 1.3% annually over five years, profitability remains elusive for now.

- Jump into the full analysis health report here for a deeper understanding of National Investor Pr. J.S.C.

- Review our historical performance report to gain insights into National Investor Pr. J.S.C's track record.

Canzon Israel (TASE:CNZN-M)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Canzon Israel Ltd invests in and manages construction projects for residential and commercial purposes in Portugal, with a market cap of ₪3.40 million.

Operations: The company generates its revenue from field services, amounting to ₪0.09 million.

Market Cap: ₪3.4M

Canzon Israel Ltd, with a market cap of ₪3.40 million, is pre-revenue, generating less than US$1 million annually. The company has not diluted shareholders recently and maintains a satisfactory net debt to equity ratio of 8.6%. Despite being unprofitable, it has reduced losses by 39.3% annually over the past five years and raised additional capital through private placements totaling ILS 270,000 in November 2025. However, its short-term assets of ₪226K do not cover liabilities of ₪1.6M, indicating liquidity challenges despite an experienced board averaging 5.3 years in tenure.

- Click here to discover the nuances of Canzon Israel with our detailed analytical financial health report.

- Learn about Canzon Israel's historical performance here.

Seize The Opportunity

- Navigate through the entire inventory of 82 Middle Eastern Penny Stocks here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal