Evaluating Diodes (DIOD): Is Automotive Transistor Expansion Reflected in Today’s Valuation?

Diodes (DIOD) just widened its footprint in automotive semis, rolling out new DXTN/P 78Q and 80Q bipolar transistors aimed at power switching, better efficiency, and tighter thermal control in harsh environments.

See our latest analysis for Diodes.

The launch of these automotive grade transistors lands at an interesting moment, with Diodes showing a 13.03 percent 1 month share price return but still carrying a 1 year total shareholder return of negative 18.75 percent. This suggests early momentum following a tougher stretch.

If this kind of targeted auto exposure appeals to you, it could be a good time to explore other chip names riding similar themes through high growth tech and AI stocks.

With the shares still down sharply over one and three years but trading at a double digit discount to analyst targets, is Diodes an underappreciated turnaround story, or are markets already baking in the next leg of growth?

Most Popular Narrative Narrative: 13.8% Undervalued

With the narrative fair value of $58.67 sitting above Diodes last close at $50.57, the story leans toward upside if growth plays out.

Strategic focus on new product introductions especially in high margin analog, mixed signal, and power management segments positions Diodes to benefit from product mix improvement, which should translate into structurally higher gross and operating margins over time.

Want to see the playbook behind that margin reset and higher earnings power, including the growth path and the future profit multiple doing the heavy lifting? Read on.

Result: Fair Value of $58.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stretched inventories and heavy exposure to cyclical Asian consumer demand could quickly cap margin upside if pricing weakens or orders slow.

Find out about the key risks to this Diodes narrative.

Another View on Value

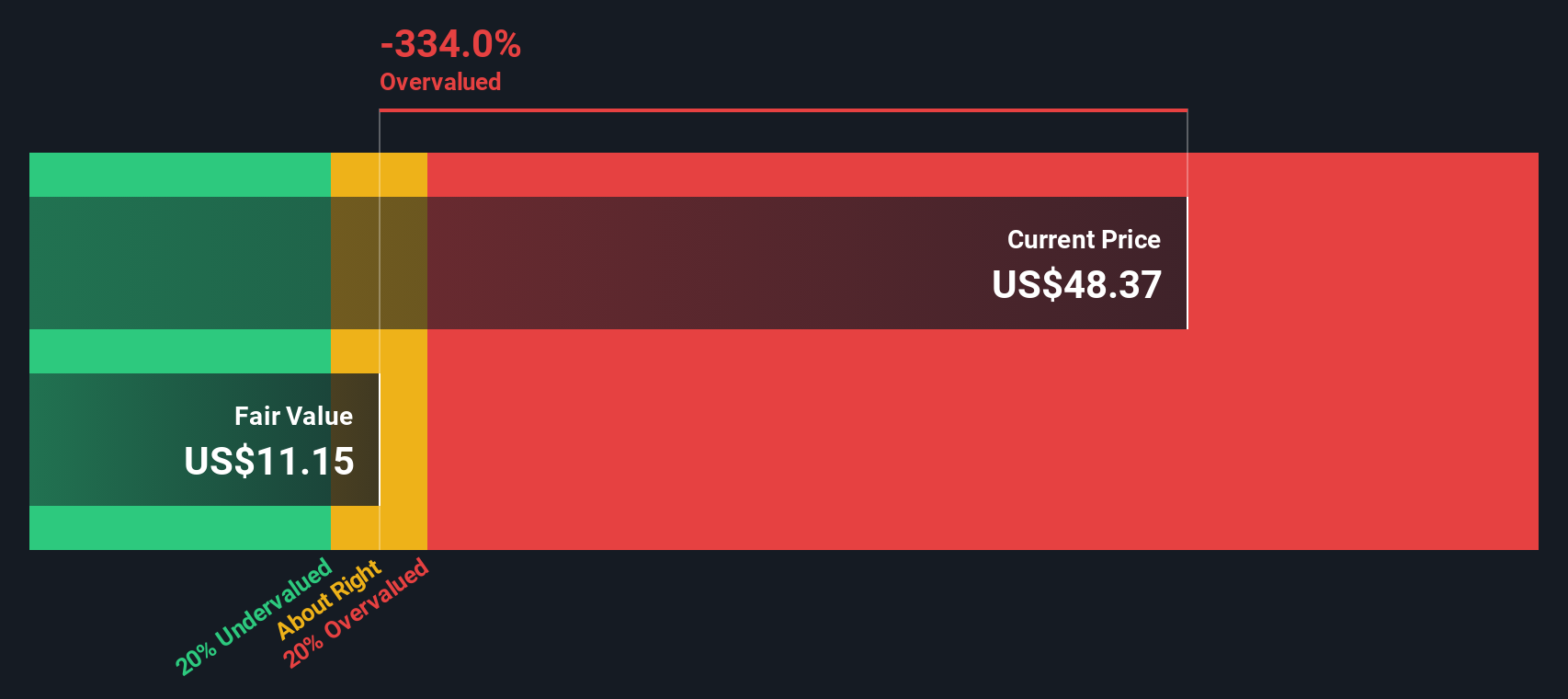

Our DCF model takes a stricter cash flow lens and lands well below today’s $50.57 share price, flagging Diodes as overvalued on this framework even though the narrative points to upside. Is the market paying up for long term growth too early, or is the model too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Diodes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Diodes Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom narrative in just minutes, Do it your way.

A great starting point for your Diodes research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before markets move on without you, use the Simply Wall St screener to spot fresh opportunities that match your strategy and sharpen your edge.

- Capitalize on mispriced quality by targeting companies trading below their cash flow potential through these 898 undervalued stocks based on cash flows before the rest of the market catches on.

- Ride structural growth in automation and smart software by zeroing in on tomorrow's innovators with these 24 AI penny stocks powering real world AI adoption.

- Strengthen your income stream by focusing on steady payers with attractive yields using these 10 dividend stocks with yields > 3% to avoid stretching for risky returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal