How GM’s Pivot Back to Gas Cash Flow and Buybacks Has Changed Its Investment Story (GM)

- In recent months, General Motors has scaled back parts of its electric vehicle push, ending BrightDrop electric van production, trimming EV capacity, and retooling plants toward gas-powered models, while investing billions of US dollars in U.S. facilities to manage tariff exposure and bolster cash flow from its traditional lineup.

- Alongside this reset, GM is leaning on share buybacks that have reduced its share count by very large percentages since 2015, expanding higher-margin software and autonomy offerings, and investing hundreds of millions of US dollars in workforce training to support a longer-term shift toward advanced vehicle technologies.

- Now, we’ll explore how GM’s renewed emphasis on internal-combustion cash flow, including shifting the Orion plant away from EVs, affects its investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

General Motors Investment Narrative Recap

To own GM today, you need to believe that cash flow from trucks and SUVs can fund a gradual, financially disciplined shift into EVs, software and autonomy. The latest reset toward internal combustion output and U.S. production does not materially change that near term, but it does put more weight on execution in gas-powered margins as a key catalyst, while keeping trade and tariff policy as the biggest external risk to the story right now.

Among recent announcements, GM’s aggressive share repurchase program stands out alongside this operational shift, with the company shrinking its share count by over 40% since 2015 and continuing to buy back stock in 2025. For investors, those buybacks, paired with a higher-margin mix driven by full-size pickups, SUVs and growing software contributions, are central to how the reset in EV spending could still translate into earnings per share growth if execution holds.

Yet, despite this renewed emphasis on internal combustion cash generation, investors should be aware of the ongoing tariff and trade uncertainty that could...

Read the full narrative on General Motors (it's free!)

General Motors' narrative projects $185.3 billion revenue and $8.0 billion earnings by 2028. This assumes a 0.4% yearly revenue decline and an earnings increase of about $1.5 billion from $6.5 billion today.

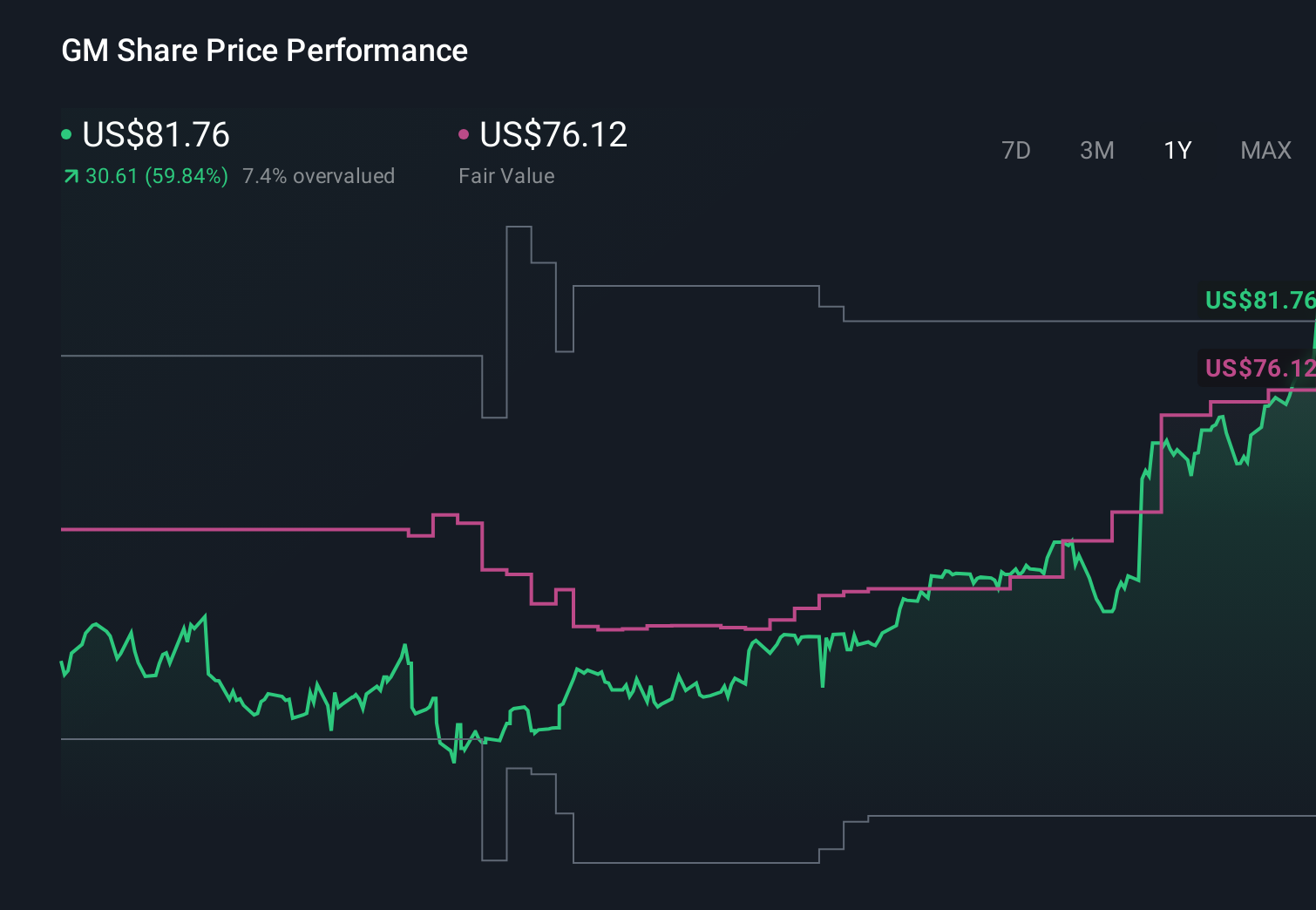

Uncover how General Motors' forecasts yield a $76.12 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly US$41.8 to US$97.4, showing how widely opinions can differ on GM’s worth. As you weigh those views against GM’s focus on internal combustion cash flow and tariff mitigation efforts, it is worth considering how trade policy and production shifts might influence the company’s ability to sustain margins and reinvest for its EV and autonomy ambitions.

Explore 8 other fair value estimates on General Motors - why the stock might be worth 50% less than the current price!

Build Your Own General Motors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your General Motors research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free General Motors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate General Motors' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal