Ollie’s (OLLI) Valuation Check After Strong Q3 Results and Upgraded 2025 Earnings and Sales Guidance

Ollie's Bargain Outlet Holdings (OLLI) just paired a strong third quarter with a guidance bump, signaling that management sees its off price playbook working and expects that momentum to carry through 2025.

See our latest analysis for Ollie's Bargain Outlet Holdings.

That stronger third quarter and fresh guidance raise come after a choppier stretch, with a 30 day share price return of minus 11.16 percent but a powerful three year total shareholder return of 138.21 percent that suggests longer term momentum is still very much intact.

If Ollie's steady execution has you thinking about where else value and growth might be hiding, now is a good time to explore fast growing stocks with high insider ownership.

With the stock still about 28 percent below the average analyst target but already boasting a strong multi year run, are investors staring at an overlooked bargain, or a market that has fully priced in Ollie’s next leg of growth?

Most Popular Narrative Narrative: 23.2% Undervalued

With Ollie's Bargain Outlet Holdings last closing at $110.46 versus a most popular narrative fair value of $143.80, the story leans toward upside if forecasts land as expected.

The company is benefiting from a growing value conscious consumer base, amplified by economic uncertainty and inflation, which is driving more customers toward discount retailers like Ollie's. This is boosting both store traffic and revenue growth, as seen by accelerated customer acquisition and rising loyalty program membership. Expanding and modernizing distribution infrastructure and enhanced vendor relationships have increased operational efficiency and buying power, contributing to reduced supply chain costs and greater gross profit leverage.

Curious how steady double digit growth, rising margins, and a premium future earnings multiple can all coexist in one model and still point to upside? The full narrative unpacks how revenue, profitability, and a richer valuation profile interact to justify that higher fair value, and which assumptions matter most if the story starts to shift.

Result: Fair Value of $143.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could crack if closeout inventory dries up, or if rapid store expansion triggers cannibalization and weaker returns on new locations.

Find out about the key risks to this Ollie's Bargain Outlet Holdings narrative.

Another View On Valuation

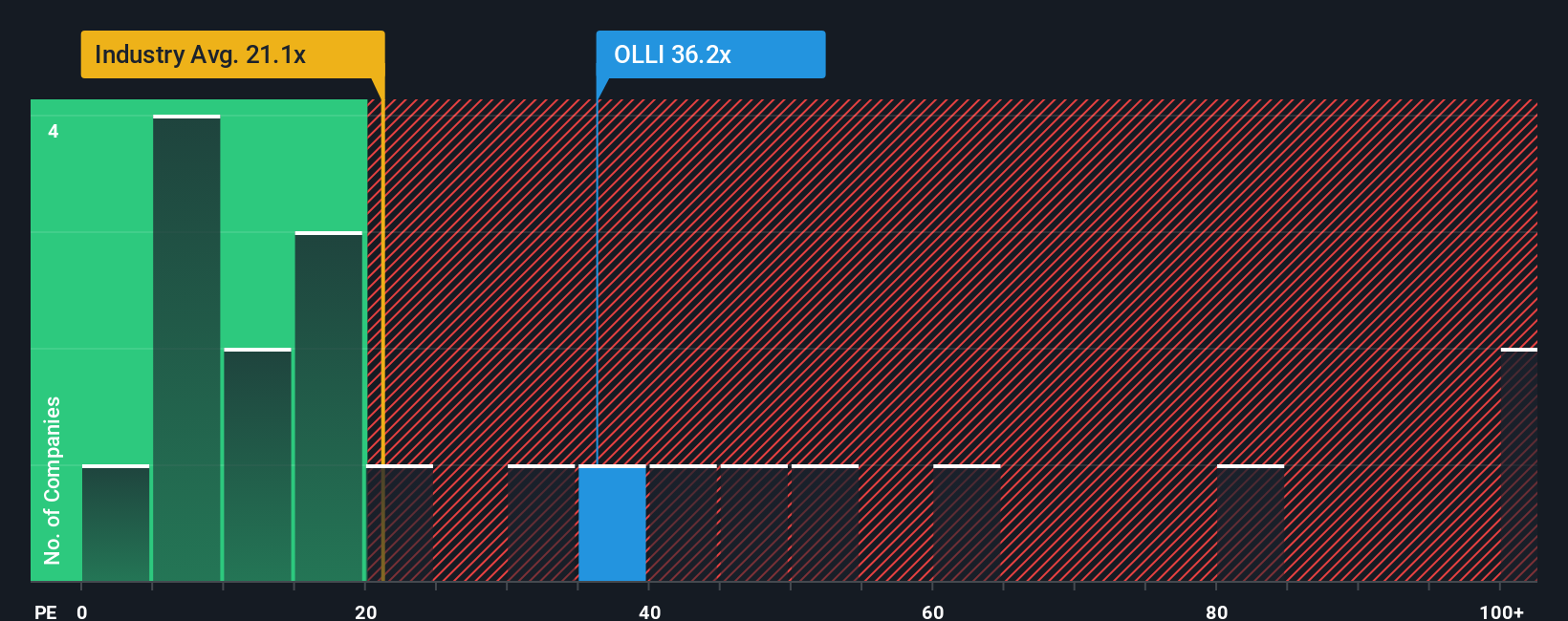

While the narrative model points to upside, a simple earnings based lens looks more demanding. At 30.3 times earnings versus 18.1 times for peers and a 19 times fair ratio, the stock trades on a rich premium, raising the question of how much future growth is already baked in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ollie's Bargain Outlet Holdings Narrative

If you want to stress test these assumptions yourself, or simply prefer your own research, you can build a personalized view in just minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ollie's Bargain Outlet Holdings.

Looking for more investment ideas?

Before you move on, give yourself the edge and line up your next opportunities with powerful screeners that surface stocks most investors are still overlooking.

- Capture potential bargains early by scanning these 898 undervalued stocks based on cash flows that trade below their estimated cash flow value before the broader market catches on.

- Capitalize on the AI revolution by targeting these 24 AI penny stocks positioned at the intersection of accelerating demand, scalable software, and data rich business models.

- Strengthen your income stream by pinpointing these 10 dividend stocks with yields > 3% that combine reliable payouts with solid underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal