Honest Company (HNST): Reassessing Valuation After a Difficult Year for the Share Price

Honest Company (HNST) has quietly become a tougher stock to own, with shares down about 60% this year despite a recent month rebound. That disconnect is exactly what makes the setup interesting.

See our latest analysis for Honest Company.

The latest pullback, including a 1 day share price return of minus 2.9 percent to 2.71 dollars, comes after a modest 1 month share price rebound. However, year to date performance remains deeply negative, so momentum is still fragile rather than firmly turning.

If Honest Company has you rethinking where growth and conviction really sit, this could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

With shares still down sharply this year despite improving profits and a sizable gap to analyst targets, the big question now is simple: Is Honest Company a contrarian value play, or is the market already discounting its next leg of growth?

Most Popular Narrative Narrative: 29.3% Undervalued

With Honest Company closing at 2.71 dollars versus a narrative fair value of roughly 3.83 dollars, the storyline leans toward meaningful upside if the assumptions stick.

Disciplined focus on operational improvements, margin enhancement, and tariff mitigation (evidenced by record gross margin, positive net income, and improved cost structure) is expected to further improve net margins and earnings resilience over the long term, especially as marketing and supply chain investments drive increased efficiency.

Curious how modest top line expectations can still support a punchy earnings outlook and a premium future multiple usually reserved for market darlings? The most followed narrative quietly stacks together margin gains, capital discipline, and a specific profit runway that could justify today’s discount, but only if a few key levers move in tandem. Want to see which assumptions really carry the weight in that fair value math?

Result: Fair Value of $3.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this optimistic setup still hinges on execution, with tariff exposure and slowing core category growth both capable of quickly undermining the margin story.

Find out about the key risks to this Honest Company narrative.

Another Lens on Valuation

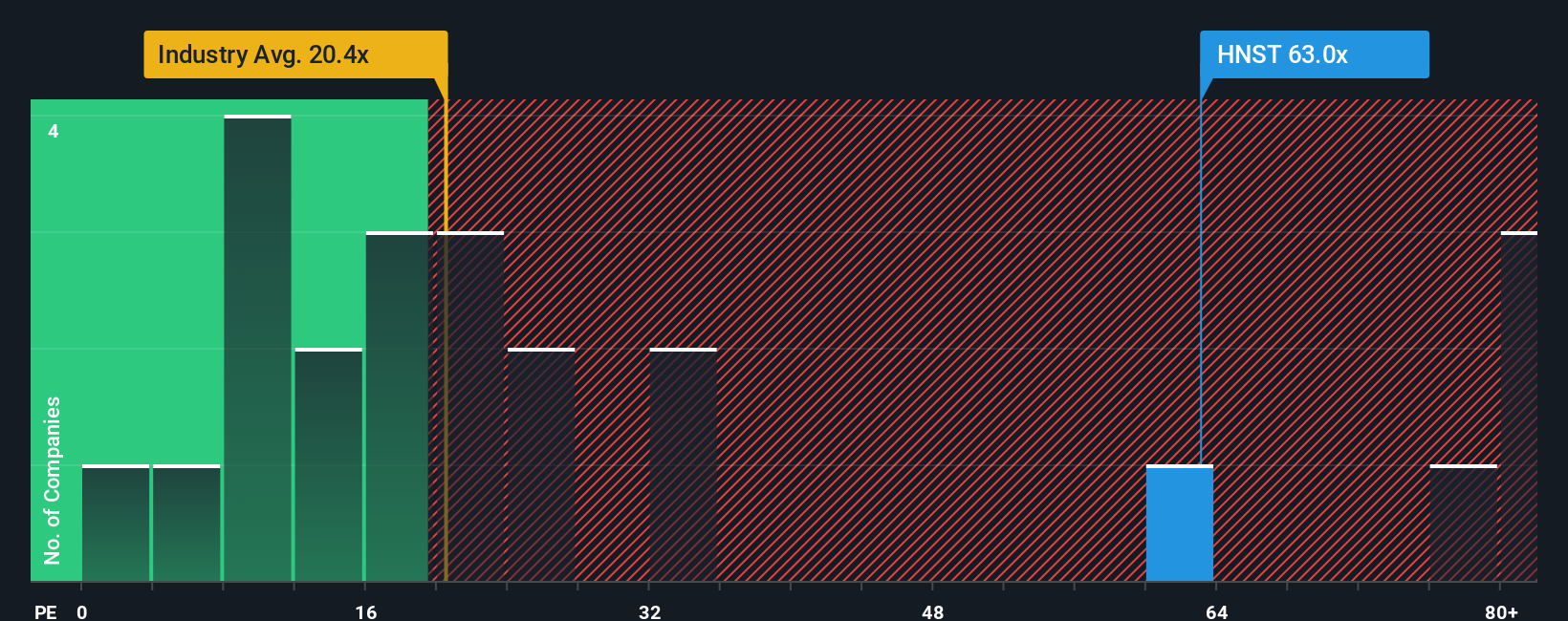

Look past the narrative fair value and analyst targets, and Honest Company starts to look stretched on earnings. At a price to earnings ratio of 42.8 times versus a fair ratio of 14.6 times and an industry average around 21.9 times, the market is already paying up for execution that is still unproven. If growth underwhelms, how much room is left before that gap closes the other way?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Honest Company Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Honest Company research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one stock when the market offers so many angles. Use the Simply Wall St Screener to uncover focused ideas that match your strategy.

- Target steady income streams by reviewing these 10 dividend stocks with yields > 3% that combine attractive yields with the potential for long term total returns.

- Capitalize on early stage innovation by scanning these 3629 penny stocks with strong financials that pair smaller market caps with solid financial underpinnings.

- Position your portfolio for the next computing leap by assessing these 28 quantum computing stocks that could benefit from breakthroughs in processing power and security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal