IPO News | Longxun Co., Ltd. (688486.SH) listed the Hong Kong Stock Exchange as a high-speed mixed-signal chip design company

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange disclosure on December 22, Longxun Semiconductor (Hefei) Co., Ltd. (688486.SH for short)) submitted a listing application to the main board of the Hong Kong Stock Exchange, with CITIC Construction Investment International as the sole sponsor.

Company profile

According to the prospectus, Longxun Co., Ltd. is a leading high-speed mixed-signal chip design company dedicated to building an efficient and reliable “data highway” for smart terminals, devices and AI applications. The company's products enable seamless transmission and processing of data and efficient interaction between computing, storage and display units. Major applications include smart vision terminals, smart vehicles, AR/VR devices, and AI and high-efficiency computing (“HPC”). According to Frost & Sullivan, in terms of 2024 revenue, the company is the number one Fabless design company in mainland China and the top five in the world in the video bridging chip market.

High-definition audio and video data contains rich contextual information, which is essential for computational systems to dynamically perceive and interpret the real world. For end-side applications, audio and video processing can not only be used as a sensing mechanism, but also enables intelligent recognition and immediate interaction. These functions can be further integrated with other input modes (such as touch) to form a closed loop system of sensing—analysis—interaction. Therefore, high-definition audio and video data has become an important bridge between the physical world and the digital world. The seamless, high-speed, and stable transmission of such data in robots and drones, AR/VR devices, autonomous driving systems, and high-performance computing systems depends on three basic technology pillars: (i) high-bandwidth SerDes technology; (ii) high-speed protocol processing and data encryption technology; and (iii) high-definition video processing and display driver technology. The company has carried out continuous innovation and R&D on these core technologies for nearly 20 years.

Based on its technical advantages in high-bandwidth SerDes, Longxun Co., Ltd. expanded into a wider range of interconnect chips. In particular, the company focuses on the development of key interconnect components such as PCIe/CXL/UsbreTimer and Switch. To meet the growing demand for HPC and AI, the company's solutions address multi-modal data transmission bottlenecks in increasingly complex computing environments, including vertically scalable architectures (within GPU clusters), horizontally scalable architectures (data centers), and cross-system architectures (between data centers). The company's solutions are designed to meet the stringent ultra-low latency, ultra-high bandwidth, and high-reliability interconnect requirements for next-generation AI infrastructure and HPC systems.

Financial data

Revenue:

On the financial side, in 2022, 2023, 2024, 2024, and 2025 for the nine months ending September 30, Longxun Co., Ltd. achieved revenue of approximately RMB 241 million, RMB 323 million, RMB 466 million, RMB 334, and RMB 389 million respectively.

Profit:

For the nine months ended September 30 in 2022, 2023, 2024, 2024 and 2025, Longxun Co., Ltd. achieved profits of 69.206 million yuan, about 103 million yuan, about 144 million yuan, 93.988 million yuan, and about 125 million yuan, respectively.

Industry Overview

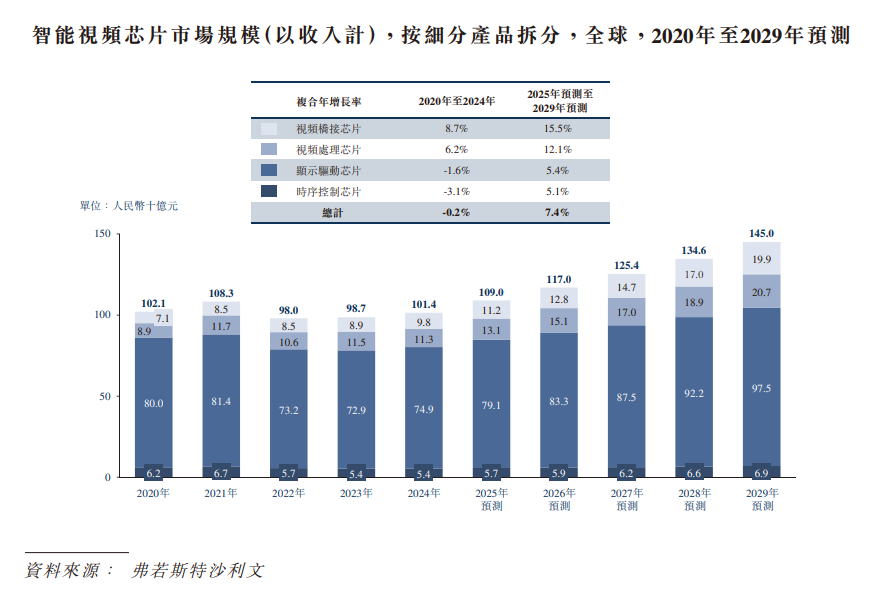

Smart video chips continue to promote the upgrading of display performance and interactive experience, and have become an important engine for terminal device innovation and performance improvement. The global market size declined slightly from RMB 102.1 billion to RMB 101.4 billion between 2020 and 2024, mainly due to cyclical fluctuations in the downstream application industry. From 2022 to 2023, shipments in downstream fields such as smart vision terminals declined significantly, leading to a simultaneous decline in overall smart video chip market demand. In 2024, overall demand for smart video chips will gradually pick up as the economy recovers and the downstream cycle gradually eases. In the future, AR/VR, smart vehicle and smart terminal equipment upgrades will drive rapid growth in the smart video chip market, which is expected to grow at a CAGR of 7.4% from RMB 109 billion in 2025 to RMB 145 billion in 2029.

Looking at product segments, video bridging chips and video processing chips are expected to be the two core segments with the fastest growth rate and the broadest development prospects. Over the past five years, even after experiencing the cyclical decline in the downstream industry, due to the increase in penetration rate and value in terminal equipment, the overall market size of video bridge chips and video processing chips has maintained relatively considerable market growth, with compound annual growth rates of 8.7% and 6.2% between 2020 and 2024, respectively. In the future, as demand for multi-protocol compatible, high-speed and stable signal bridging and high-quality visual experiences from downstream terminals such as smart vision terminals, AR/VR devices, and smart vehicles will continue to grow, the market size of video bridging chips and video processing chips will increase rapidly. It is expected to grow from RMB 11.2 billion and RMB 13.1 billion in 2025 to RMB 19.9 billion and RMB 20.7 billion in 2029, respectively. The compound annual growth rates are 15.5% and 12.1%, respectively.

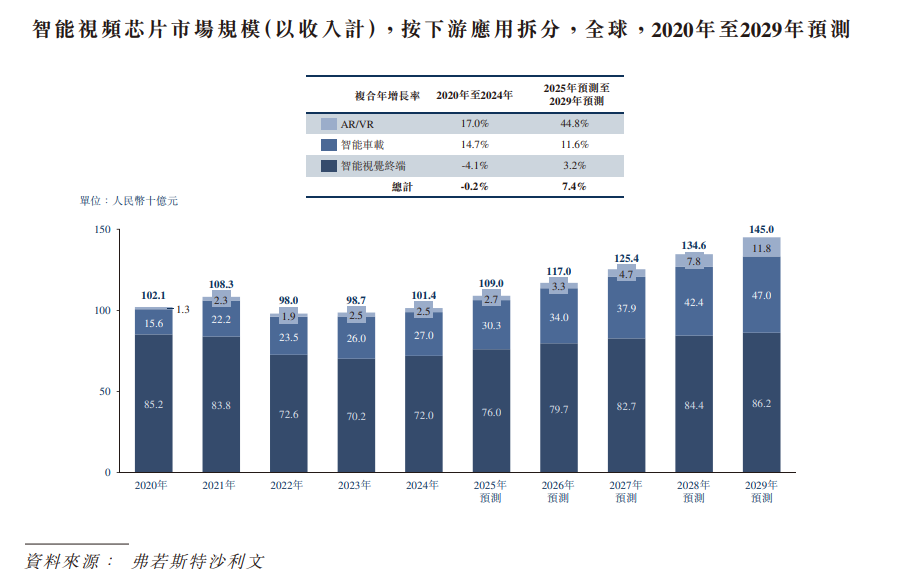

From the perspective of downstream application fields, AR/VR and intelligent vehicle fields are the two core segments with the fastest growth rate and the broadest development prospects in the future. The penetration of AR/VR devices in consumer and commercial scenarios is expected to continue to deepen, and shipments will enter a period of rapid growth, thus driving demand for smart video chips. The market size in this field is expected to grow from RMB 2.7 billion in 2025 to RMB 11.8 billion in 2029, with a compound annual growth rate of 44.8%. The share of this field in the overall smart video chip market will also increase from 1.3% in 2020 to 8.1% in 2029. In the field of smart vehicles, with the popularity of multi-screen interactive cockpits and the continuous upgrading of autonomous driving technology, the capacity and functional complexity of smart video chips for bicycles will also increase significantly. It is expected to drive the market size of this field from RMB 30.3 billion in 2025 to RMB 47 billion in 2029. The share of this field in the overall smart video chip market will also gradually rise from 15.3% in 2020 to 32.4% in 2029. In the field of smart vision terminals, the market size will also grow steadily to RMB 86.2 billion in 2029, driven by factors such as technology upgrades and national compensation policies.

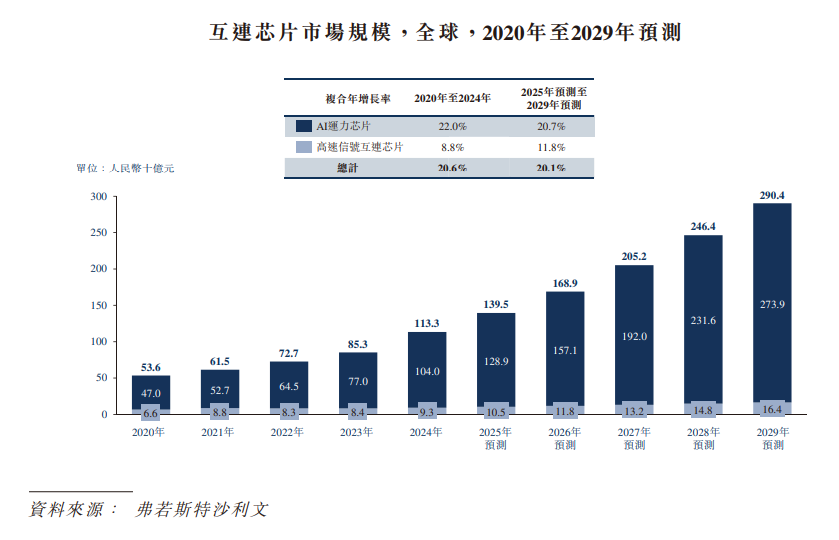

The global interconnect chip market maintained a steady growth trend from 2020 to 2024, and the market size increased from RMB 53.6 billion to RMB 113.3 billion. Looking ahead, as demand for data processing and visual displays continues to grow in the AI era, its market size will grow from RMB 139.5 billion in 2025 to RMB 290.4 billion in 2029, with a compound annual growth rate of 20.1% during this period.

Looking at market segments, AI mobility chips, as key devices for carrying data transmission, are widely used in various downstream products such as AI servers, other high-performance computing devices, smart vehicles, and smart terminals. From 2020 to 2024, the AI capacity chip market grew from RMB 47 billion to RMB 104 billion. Looking forward to the future, clustering of computing power, the upgrading of smart vehicle electronic architectures, and the popularity of high-speed interfaces in smart terminals will drive demand for general data interconnection to continue to rise, and the AI capacity chip market is expected to reach RMB 273.9 billion in 2029. High-speed signal interconnect chips are the key infrastructure responsible for video and audio signal transmission. As terminal visual presentation evolves in the direction of higher resolution, lower latency, and multi-mode integration, the high-speed signal interconnect chip market will grow simultaneously. From 2025 to 2029, the high-speed signal interconnect market will grow from RMB 10.5 billion to RMB 16.4 billion.

Board Information

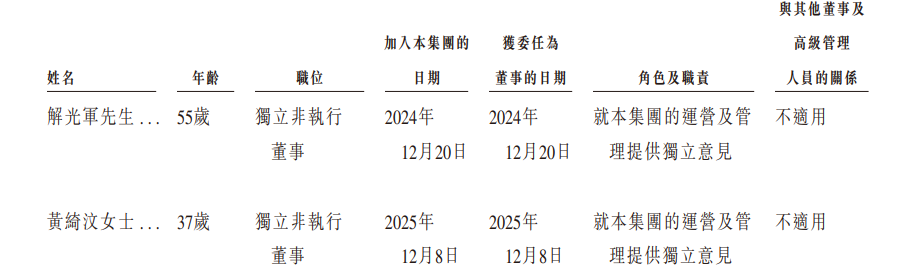

The Board consists of six directors, including 2 executive directors, 1 non-executive director and 3 independent non-executive directors.

Shareholding structure

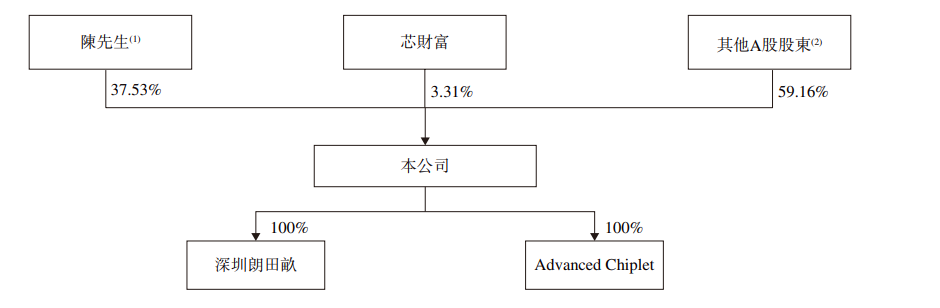

Longxun shares have a high concentration of shares. Among them, Mr. Chen holds 37.53% of the shares, Core Wealth holds 3.31% of the shares, and other A-share shareholders hold 59.16% of the shares.

Intermediary team

Sole sponsor: CITIC Construction Investment (International) Finance Co., Ltd.

Company Legal Adviser: Related to Hong Kong and US Law: Pu Heng Law Firm (Hong Kong) Limited Liability Partnership; Related to Chinese Law: Shanghai AllBright Law Firm

Sole sponsor's legal adviser: Law relating to Hong Kong and the United States: Guo Weiyan Law Firm; relating to Chinese law: Deheng Law Offices

Auditors and reporting accountants: Ernst & Young

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal