Top Asian Dividend Stocks For December 2025

As the Bank of Japan raises its benchmark interest rate to the highest level in 30 years, and China's economic indicators highlight sluggish growth, investors are closely monitoring Asian markets for opportunities amidst these shifting dynamics. In such an environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to navigate uncertain market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.76% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.21% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.92% | ★★★★★★ |

| NCD (TSE:4783) | 3.94% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.96% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.14% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.66% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.88% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.30% | ★★★★★★ |

Click here to see the full list of 1026 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

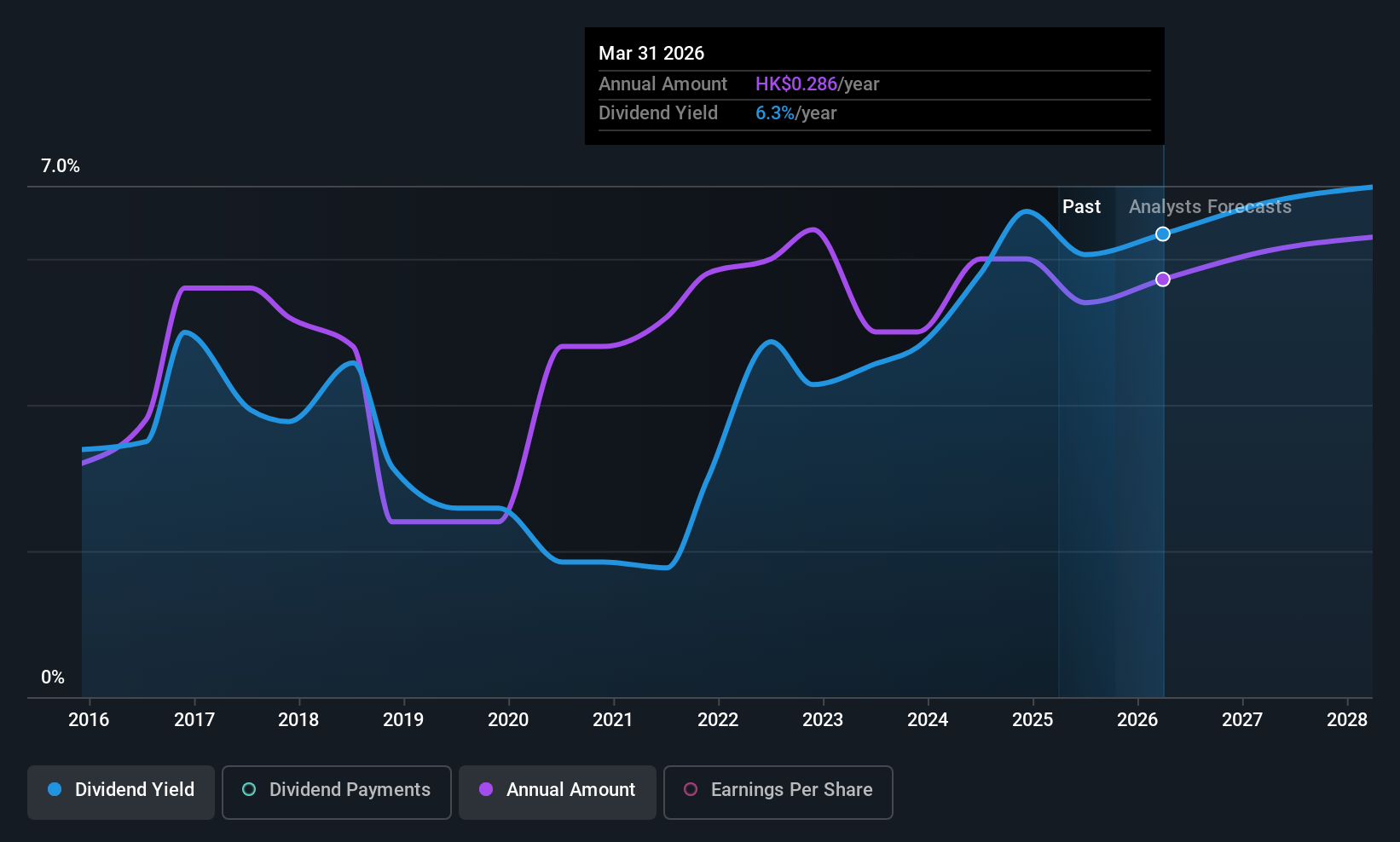

Man Wah Holdings (SEHK:1999)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Man Wah Holdings Limited is an investment holding company that manufactures and distributes sofas and ancillary products in the People's Republic of China, Europe, Vietnam, Mexico, and internationally with a market cap of HK$18.77 billion.

Operations: Man Wah Holdings Limited generates revenue primarily from the Sofa and Ancillary Products segment, which accounts for HK$11.48 billion, followed by Bedding and Ancillary Products at HK$2.32 billion and Home Group Business contributing HK$785.74 million.

Dividend Yield: 5.6%

Man Wah Holdings trades at 33.3% below its estimated fair value, offering potential value for investors. Its dividend payments are covered by earnings and cash flows, with a payout ratio of 50.6% and a cash payout ratio of 43.1%, respectively, indicating sustainability despite a volatile track record over the past decade. Recent earnings showed stable net income at HK$1.15 billion for the half year ended September 2025, with an interim dividend maintained at HK$0.15 per share.

- Delve into the full analysis dividend report here for a deeper understanding of Man Wah Holdings.

- The valuation report we've compiled suggests that Man Wah Holdings' current price could be quite moderate.

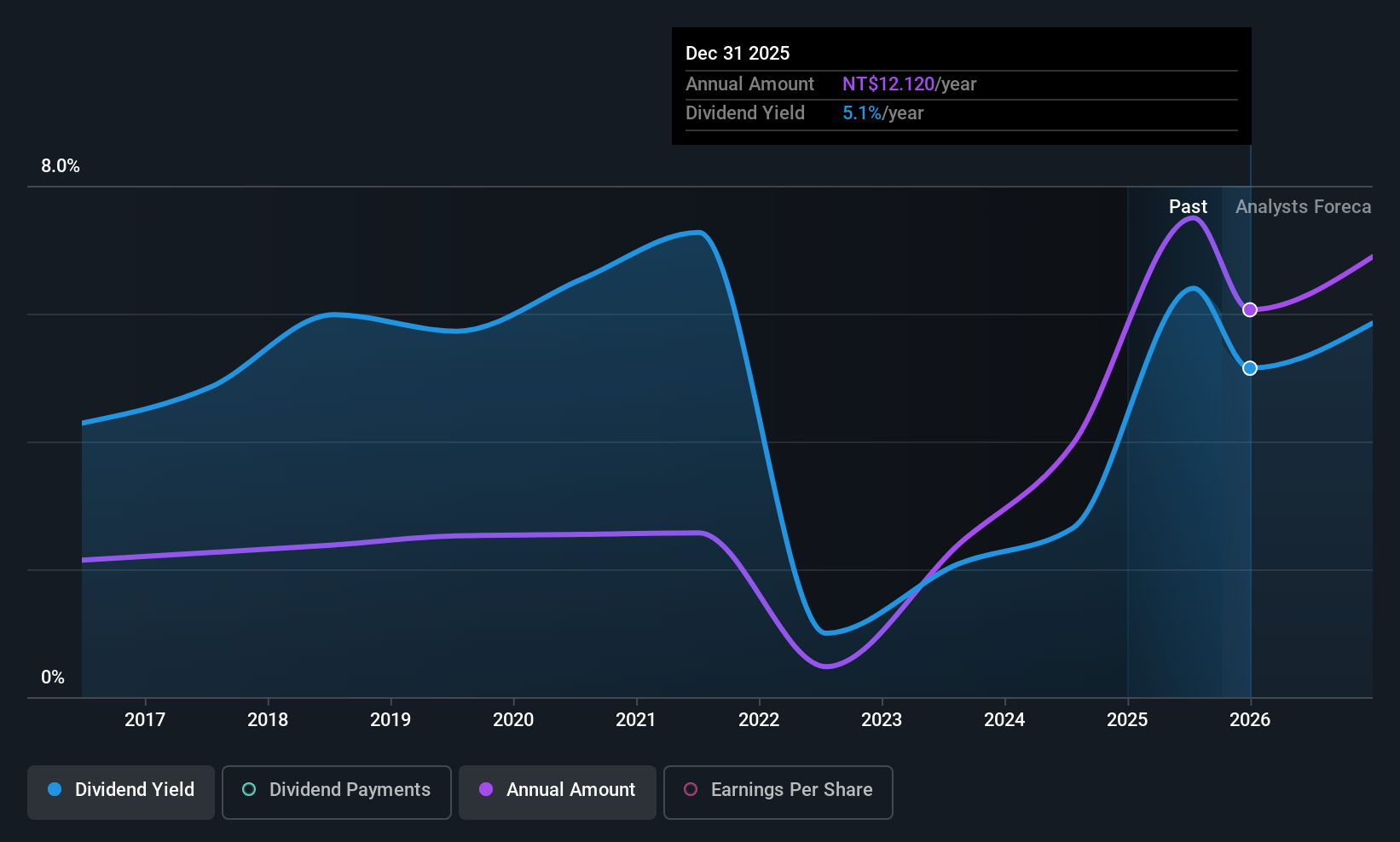

Eclat Forever Machinery (TPEX:3485)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Eclat Forever Machinery Co., Ltd. focuses on the research, development, and production of equipment for touch panels, liquid crystal displays, plasma display panels, and printed circuit boards in Taiwan and globally, with a market cap of NT$3.30 billion.

Operations: Eclat Forever Machinery Co., Ltd. generates revenue primarily from its Semiconductor Equipment and Services segment, amounting to NT$566.82 million.

Dividend Yield: 5.7%

Eclat Forever Machinery offers a compelling dividend profile with a stable yield of 5.69%, ranking in the top 25% among Taiwan's dividend payers. Its dividends have shown consistent growth and stability over the past decade, supported by earnings and cash flows, with payout ratios of 78.3% and 82.1%, respectively. Despite a decline in sales to TWD 125.35 million for Q3 2025, net income nearly doubled year-over-year to TWD 64.72 million, reflecting strong profitability that supports its dividend sustainability.

- Take a closer look at Eclat Forever Machinery's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Eclat Forever Machinery is priced higher than what may be justified by its financials.

Cyber Power Systems (TWSE:3617)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cyber Power Systems, Inc. designs, manufactures, and sells power protection products and computer peripheral accessories worldwide with a market cap of NT$19.73 billion.

Operations: Cyber Power Systems, Inc. generates revenue primarily from its Electric Equipment segment, which accounts for NT$12.33 billion.

Dividend Yield: 7.2%

Cyber Power Systems offers a competitive dividend yield of 7.16%, placing it in the top 25% of Taiwan's market. However, its dividend history has been volatile over the past decade with significant annual drops. Despite this instability, dividends are currently covered by earnings and cash flows, both with payout ratios around 80%. Recent Q3 results show net income increased to TWD 660.75 million despite a slight decline in revenue, indicating potential for continued dividend support.

- Unlock comprehensive insights into our analysis of Cyber Power Systems stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Cyber Power Systems shares in the market.

Where To Now?

- Click here to access our complete index of 1026 Top Asian Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal