PACCAR (PCAR) Valuation Check After a Steady 14% Three-Month Share Price Climb

PACCAR (PCAR) shares have quietly climbed about 14% over the past 3 months, easily outpacing the broader market. That steady move has investors rethinking what they are willing to pay for this trucking heavyweight.

See our latest analysis for PACCAR.

That move comes on top of a solid year, with an 8 percent year to date share price return and a powerful 5 year total shareholder return of about 136 percent. This signals that momentum is still firmly on PACCAR’s side as investors price in steady earnings growth and lower perceived risk.

If PACCAR’s steady climb has you wondering what else might be gaining traction in transport, it could be a good moment to explore auto manufacturers for more ideas.

With PACCAR now trading essentially in line with analyst targets but still showing robust earnings and intrinsic value support, is this a rare chance to buy durable trucking growth at a discount, or has the market already priced in the next leg higher?

Most Popular Narrative: 4% Overvalued

Compared with PACCAR’s last close of $111.57, the most followed narrative points to a fair value a little lower, hinting at modest optimism already in the price.

Ongoing investments in next-gen clean diesel, alternative powertrains, and connected vehicle services position PACCAR to capture future growth as fleets transition towards more efficient and zero-emission vehicles, supporting long-term top line and margin expansion. Rising adoption of digital fleet management and over-the-air telematics, combined with PACCAR's strengthening financial services and used truck business, is expected to increase customer lifetime value and support higher margin, recurring revenue, positively impacting future profitability.

Curious how steady revenue assumptions, expanding margins, and a richer future earnings multiple all combine into that fair value call? The full narrative breaks down the math.

Result: Fair Value of $107.28 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated interest rates and uncertain tariffs could pressure truck demand and margins, quickly challenging today’s growth assumptions and that modestly overvalued fair value assessment.

Find out about the key risks to this PACCAR narrative.

Another Lens on Value: Earnings Multiple Says Undervalued

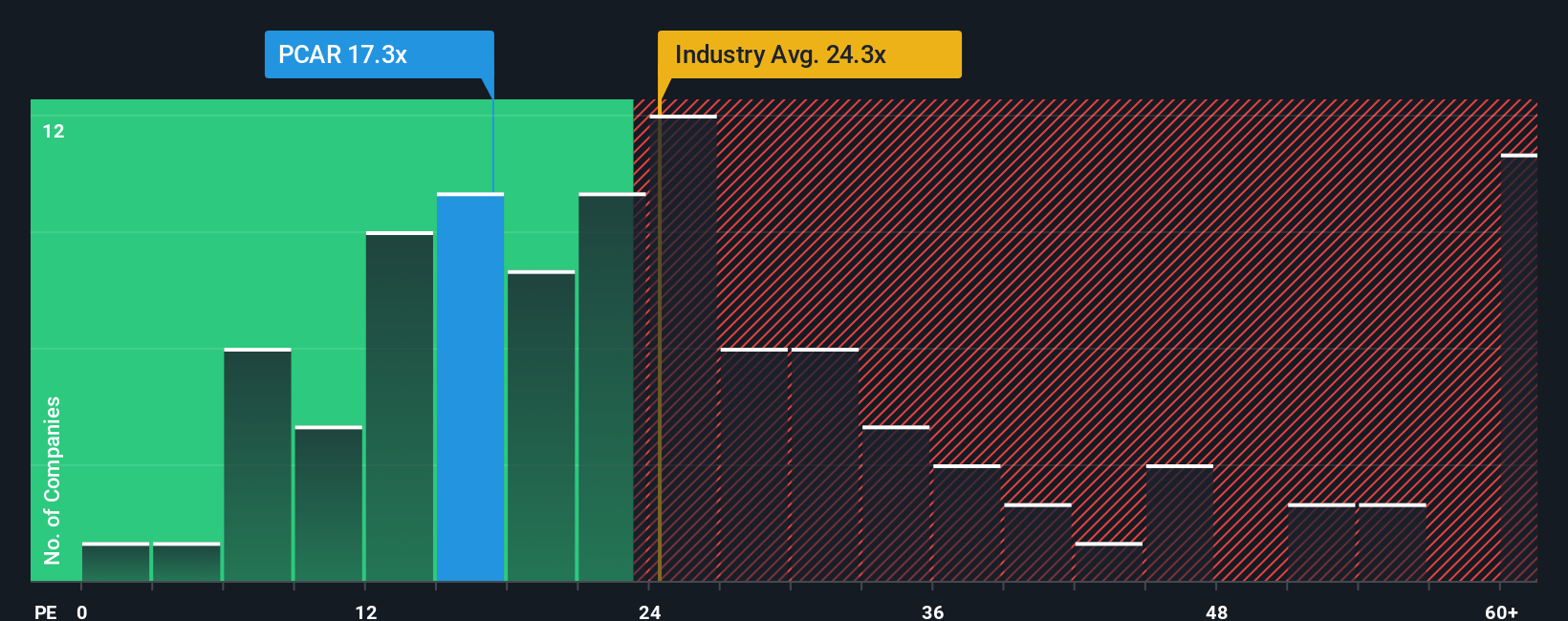

While the most popular narrative sees PACCAR about 4 percent overvalued, our earnings based view tells a different story. At 21.8 times earnings versus an industry average of 25.3 times and a fair ratio of 33.1 times, the stock screens as attractively priced rather than stretched. Is the market underestimating PACCAR’s staying power, or is it rightly cautious about the next cycle?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PACCAR Narrative

If you see the PACCAR story differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your PACCAR research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, refine your watchlist by using the Simply Wall St Screener to uncover fresh opportunities that could complement your current picks.

- Explore potential bargains trading below their projected cash flows with these 903 undervalued stocks based on cash flows and monitor them for possible reratings if market views change.

- Follow structural themes in machine learning and automation by reviewing innovators featured in these 24 AI penny stocks.

- Look for a steadier income stream while rates and markets shift by focusing on consistently paying companies in these 12 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal