Is KBR’s (KBR) New Defense and Green-Fuel Wins Clarifying Its Core Investment Story?

- KBR recently announced several contract wins, including a seat on the U.S. Naval Supply Systems Command’s WEXMAC 2.1 TITUS IDIQ program, green ammonia and biomethanol technology deals in Europe and Saudi Arabia, and new recognition for its cloud migration capabilities with Amazon Web Services.

- These awards highlight KBR’s dual focus on mission-critical U.S. defense readiness and energy transition technologies, expanding its role in both government logistics support and low-carbon solutions.

- Next, we’ll examine how KBR’s participation in the large NAVSUP TITUS contract could influence its investment narrative and growth profile.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

KBR Investment Narrative Recap

To own KBR, you need to believe in its ability to convert a sizeable government and energy-transition contract pipeline into steadier earnings, despite recent guidance cuts and contract volatility. The new NAVSUP WEXMAC 2.1 TITUS award reinforces KBR’s relevance in U.S. defense logistics, but its impact on near term results will depend on actual task orders won, while delays or cancellations in large fixed price contracts remain the biggest swing factor for the business.

Among the recent announcements, the NAVSUP TITUS IDIQ seat is most relevant, because it speaks directly to KBR’s core government-services catalyst: securing long-duration frameworks that can refill the backlog after prior project disruptions. Although the contract’s US$20,000,000,000 ceiling is shared and not guaranteed, participation gives KBR a platform to compete for incremental work that could partly offset revenue pressure if other defense or energy projects underperform.

Yet even with this new defense framework, investors should be aware that prolonged contract delays and protest cycles could still...

Read the full narrative on KBR (it's free!)

KBR’s narrative projects $9.4 billion revenue and $664.3 million earnings by 2028. This requires 5.4% yearly revenue growth and an earnings increase of about $264 million from $400.0 million today.

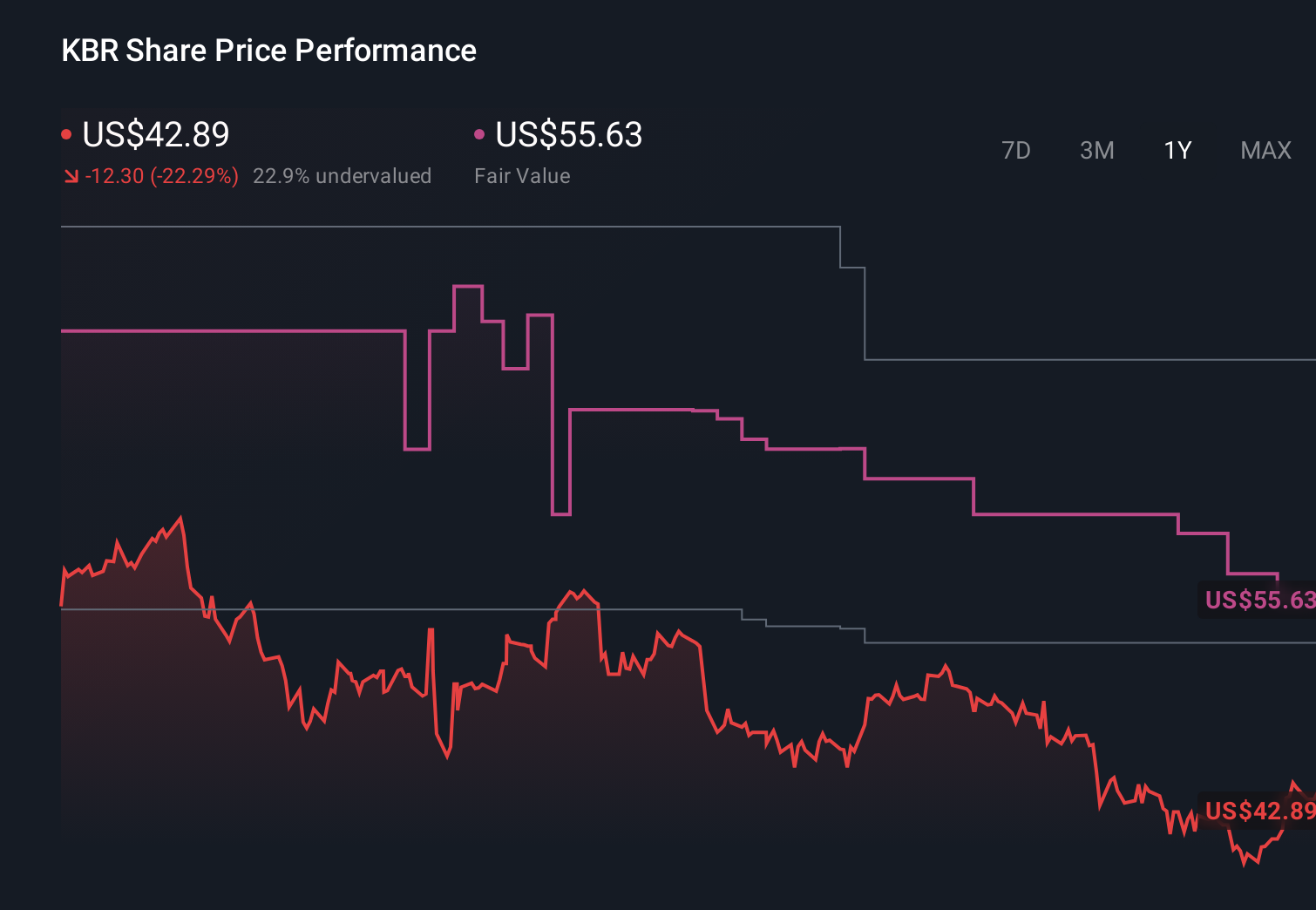

Uncover how KBR's forecasts yield a $55.62 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community range from US$40 to over US$5,400 per share, showing how far apart individual views can be. Against that backdrop, the new NAVSUP TITUS framework and ongoing contract uncertainty could both influence how reliably KBR converts its government pipeline into future earnings, so it is worth weighing several of these perspectives before forming your own view.

Explore 8 other fair value estimates on KBR - why the stock might be a potential multi-bagger!

Build Your Own KBR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KBR research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free KBR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KBR's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal