Undiscovered Gems in Global and 2 Promising Small Caps for Your Portfolio

In recent weeks, global markets have shown mixed performance with the Russell 2000 Index, a key benchmark for small-cap stocks, experiencing a slight decline amid broader economic uncertainties and fluctuating investor sentiment. As investors navigate these turbulent waters, identifying undiscovered gems—stocks that are undervalued or overlooked but have strong fundamentals—can be an effective strategy to enhance a diversified portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toho | 64.50% | 7.33% | 58.64% | ★★★★★★ |

| Te Chang Construction | 10.33% | 13.82% | 17.08% | ★★★★★★ |

| Mendelson Infrastructures & Industries | 17.65% | 4.48% | 4.46% | ★★★★★★ |

| FALCO HOLDINGS | 4.59% | -1.20% | -5.35% | ★★★★★★ |

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Payton Industries | NA | 3.44% | 14.24% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 11.18% | 1.78% | ★★★★★★ |

| Jiangsu Rainbow Heavy Industries | 25.93% | 19.62% | 2.58% | ★★★★★☆ |

| Xinjiang Torch Gas | 0.14% | 17.07% | 14.43% | ★★★★★☆ |

| Banyan Tree Holdings | 42.74% | 15.33% | 72.59% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou (SZSE:000523)

Simply Wall St Value Rating: ★★★★★★

Overview: Hongmian Zhihui Science and Technology Innovation Co., Ltd. Guangzhou operates in the production and sale of edible sugar, beverages, and other food products both domestically in China and internationally, with a market cap of CN¥6.78 billion.

Operations: The company generates revenue primarily from the production and sale of edible sugar and beverages. It operates both domestically in China and internationally, contributing to its financial performance. The market cap stands at CN¥6.78 billion, reflecting its valuation in the industry.

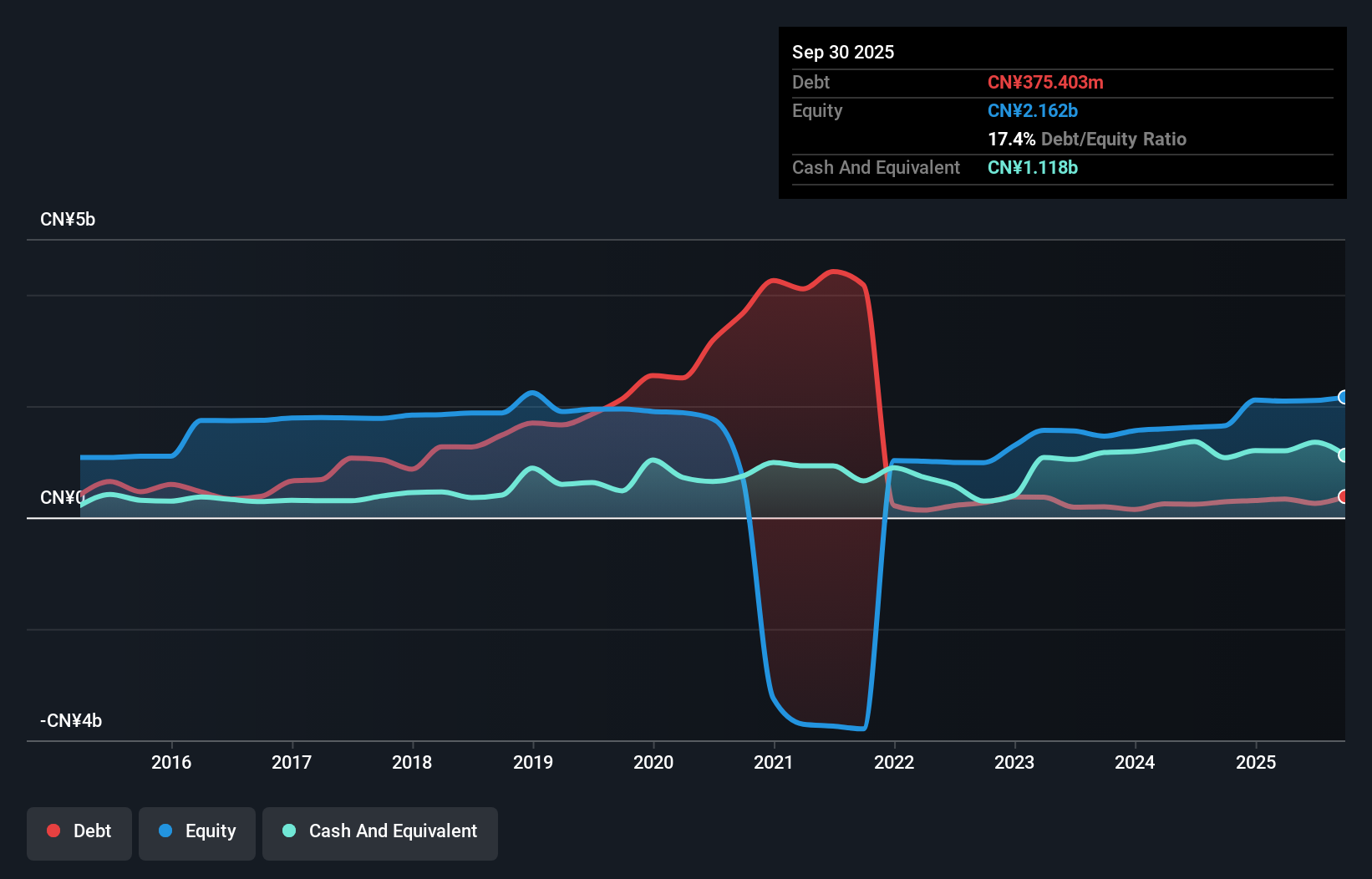

Hongmian Zhihui Science and Technology Innovation Ltd. Guangzhou has shown a significant improvement in its financial health, reducing its debt to equity ratio from 534.8% to 17.4% over five years while maintaining more cash than total debt, which suggests a robust balance sheet position. The company reported earnings growth of 330.8% in the past year, far outpacing the Household Products industry's growth of 21.4%. Despite a one-off gain of CN¥93 million affecting recent results, it trades at 60.6% below estimated fair value, indicating potential undervaluation for investors seeking opportunities in smaller firms with strong fundamentals.

Shenglan Technology (SZSE:300843)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenglan Technology Co., Ltd. engages in the research, development, manufacturing, and sale of electronic connectors, wire harness components, and precision components both domestically in China and internationally with a market cap of CN¥8.07 billion.

Operations: Shenglan Technology's revenue is primarily derived from the sale of electronic connectors, wire harness components, and precision components. The company has a market cap of CN¥8.07 billion.

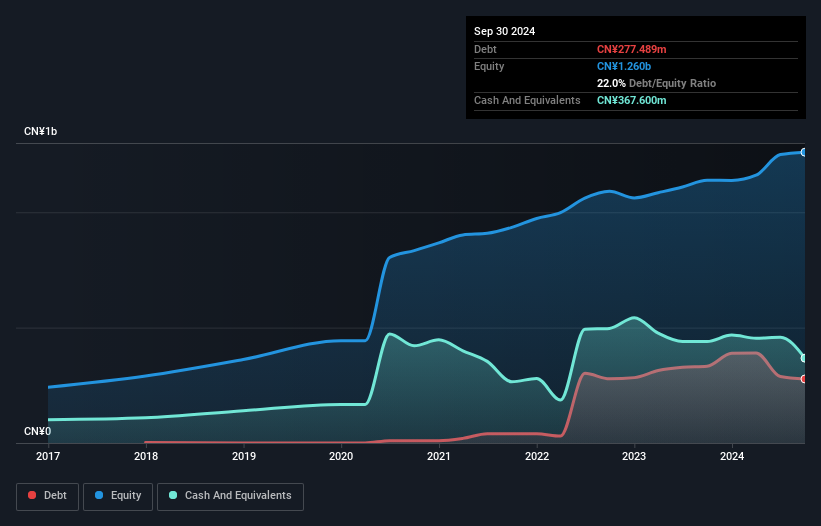

Shenglan Technology, a promising player in its sector, has showcased robust earnings growth of 27.5% over the past year, outpacing the broader electronics industry. The company's recent financials reveal sales hitting CNY 1.24 billion for nine months ending September 2025, up from CNY 923 million previously. Net income also rose to CNY 102.86 million from CNY 87.69 million last year, with basic earnings per share climbing to CNY 0.63 from CNY 0.58 in the same period last year. However, its debt-to-equity ratio has surged significantly over five years to reach a concerning level of 35.6%.

Inno Laser Technology (SZSE:301021)

Simply Wall St Value Rating: ★★★★★★

Overview: Inno Laser Technology Co., Ltd. is involved in the research, development, production, and sale of lasers and comprehensive solutions both domestically and internationally, with a market capitalization of CN¥6.30 billion.

Operations: Inno Laser Technology generates revenue primarily through the sale of lasers and related solutions. The company's financial performance is highlighted by a net profit margin of 12.5%, reflecting its ability to manage costs effectively relative to its revenue streams.

Inno Laser Technology, a nimble player in the machinery sector, has seen its earnings skyrocket by 1535.6% over the past year, far outpacing industry growth of 6.1%. Despite this impressive surge, earnings have dipped by an average of 41.6% annually over five years. The company's debt to equity ratio dramatically improved from 17.3% to just 1.1%, indicating stronger financial health and more cash than total debt on hand. Recent earnings for nine months ended September show sales climbing to CN¥341.98 million from last year's CN¥290.24 million, with net income jumping to CN¥22.09 million from CN¥0.86 million previously reported.

- Delve into the full analysis health report here for a deeper understanding of Inno Laser Technology.

Understand Inno Laser Technology's track record by examining our Past report.

Where To Now?

- Unlock more gems! Our Global Undiscovered Gems With Strong Fundamentals screener has unearthed 2997 more companies for you to explore.Click here to unveil our expertly curated list of 3000 Global Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal