Medtronic's diabetes business MiniMed (MMED.US) submitted an IPO application to raise up to US$100 million

The Zhitong Finance App learned that last Friday, MiniMed, a business spin-off entity under Medtronic (MDT.US) focusing on diabetes management equipment and technology, officially submitted relevant documents to the US Securities and Exchange Commission to raise no more than 100 million US dollars through an initial public offering (IPO). MiniMed plans to be listed on the NASDAQ stock exchange under the stock code “MMED.” In this transaction, Goldman Sachs, Bank of America Securities, Citibank, and Morgan Stanley will jointly serve as joint bookkeeping managers. However, at present, the specific pricing terms have not been disclosed to the outside world.

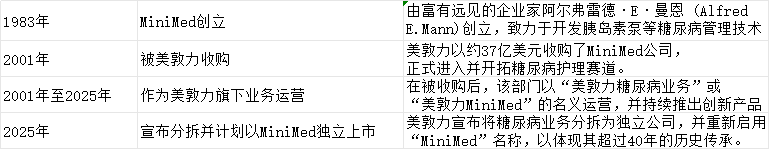

This move marks the official launch of the independent marketing process for this diabetes care business, which has a history of 40 years. The split began with a strategic adjustment announced by Medtronic in May 2025. It is planned to complete the full separation within the next 18 months, and ultimately create a pattern of “more focused Medtronic” and independently operated diabetes technology companies.

From announcing a plan to submitting an application, Medtronic's diabetes business's path to independence is progressing step by step. At the Morgan Stanley Global Healthcare Conference in early September, Medtronic management stated that the diabetes business's IPO is expected to take place in early 2026, and the spin-off will take place about six months after the IPO is completed.

However, according to the latest news on December 19, this process appears to have been faster than expected. Medtronic said the IPO is expected to commence after completing the SEC review process, depending on the market and other relevant conditions.

According to financial data, in the six months ending October 24, 2025, MiniMed reported net sales of US$1.48 billion and net loss of US$21 million; compared with net sales of US$1.3 billion and net loss of US$23 million in the same period last year, revenue increased and losses narrowed slightly.

As a company spun off from Medtronic, MiniMed focuses on comprehensive diabetes management. Its products include insulin delivery devices, continuous glucose monitors (CGM), infusion devices, drug storage devices, pen systems, and related software and services. As of October 2025, the company had more than 640,000 insulin pump users; in the six months up to October 24, 2025, its CGM installation rate reached 65%, compared to 58% in the previous cycle. Approximately 83% of total revenue comes from CGM, other supplies, software, and services, reflecting the stability of the continuous sales model.

The new company will still be headquartered in Northridge, California, and will have more than 8,000 employees. In fiscal year 2025, Medtronic's diabetes business had sales of US$2.75 billion, accounting for only 8% of the company's total revenue of US$33.63 billion. Although the business achieved 10.7% revenue growth in fiscal year 2025, it only contributed 4% of the company's division's operating profit. After the spin-off, Medtronic expects the overall adjusted gross margin to increase by 50 basis points and the operating profit margin by 100 basis points.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal