Halliburton (HAL) Valuation Check as VoltaGrid Data Center Power Push Meets Mixed Earnings Expectations

Halliburton (HAL) just tied its latest stock swing to a big step in its VoltaGrid partnership, securing manufacturing for 400 MW of modular natural gas power that is aimed at hyperscale data centers across the Eastern Hemisphere.

See our latest analysis for Halliburton.

That backdrop helps explain why Halliburton’s $27.72 share price has seen a 30 day share price return of 7.36% and a 1 year total shareholder return of 8.70%, suggesting momentum is cautiously rebuilding despite a softer multiyear track record.

If this VoltaGrid move has you thinking about the broader energy transition, it could be a good moment to explore fast growing stocks with high insider ownership as potential next wave beneficiaries.

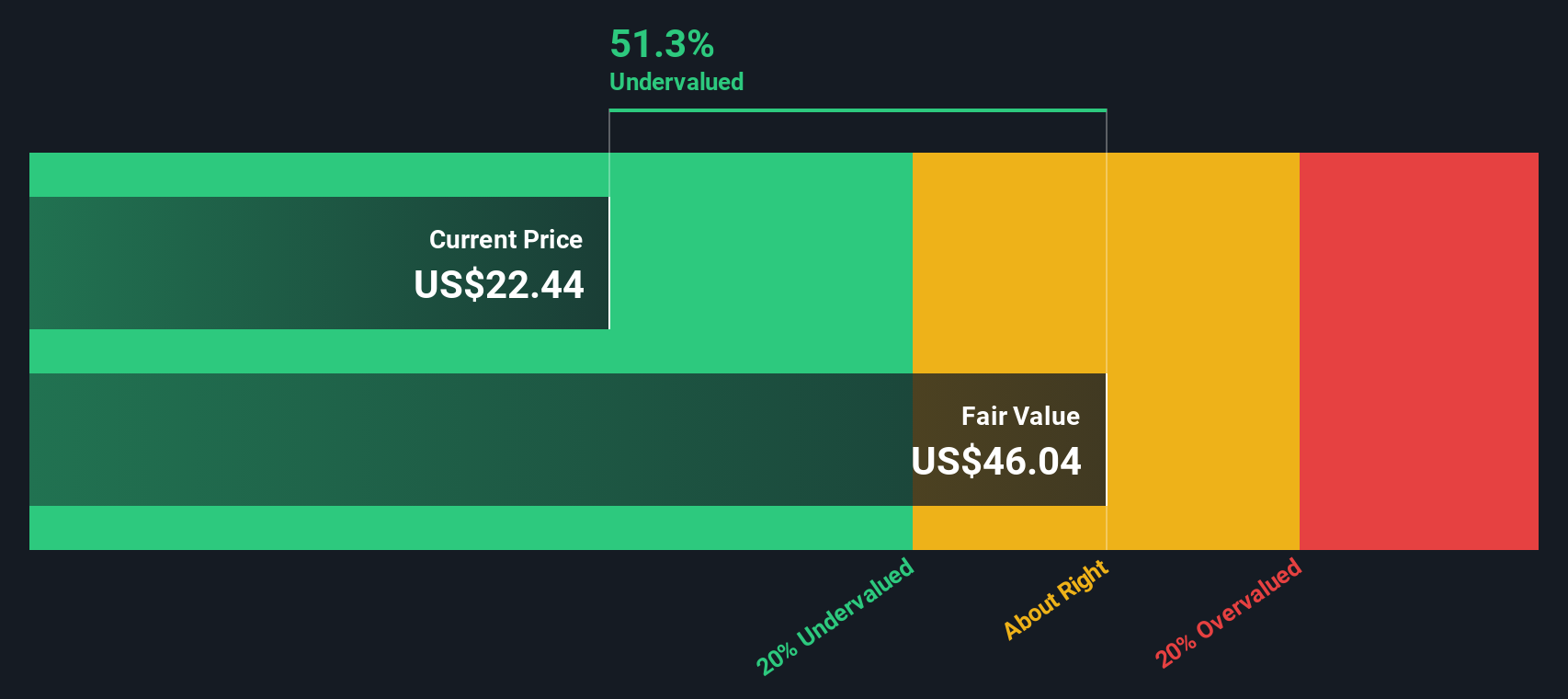

With shares still trading at a discount to analyst targets and a sizable intrinsic value gap, but earnings forecasts softening, is Halliburton quietly undervalued here, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 8.7% Undervalued

With Halliburton closing at $27.72 versus a narrative fair value near $30.38, the spread hints at modest upside if the long range roadmap holds.

The company's ongoing international diversification, growing faster in regions like Latin America, Africa, and the Middle East, and leveraging U.S. style unconventional expertise, creates a larger and more stable revenue base and reduces earnings cyclicality. This supports both top line growth and improved earnings predictability.

Curious what earnings power, margin lift, and future valuation multiple this narrative quietly bakes in, even with only muted revenue growth assumptions and cautious discounting?

Result: Fair Value of $30.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating decarbonization policies and weaker than expected upstream spending could cap long term demand, which may limit Halliburton’s ability to sustain higher margins and multiples.

Find out about the key risks to this Halliburton narrative.

Another Take On Valuation

While the narrative framework points to only modest upside, our DCF model is far more optimistic, suggesting Halliburton is about 44.9% undervalued versus its $50.30 fair value. If the cash flows are even roughly right, is the market mispricing long term execution risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Halliburton Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a complete narrative in minutes: Do it your way.

A great starting point for your Halliburton research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning fresh opportunities that could complement, strengthen, or even outperform your Halliburton thesis.

- Explore potential mispricings by targeting companies trading below their cash flow potential with these 910 undervalued stocks based on cash flows and position yourself ahead of a possible re rating.

- Look for the next wave of innovation by zeroing in on early stage innovators shaping artificial intelligence through these 24 AI penny stocks before the crowd fully catches on.

- Seek to boost your income stream by focusing on reliable payers with steady cash generation through these 12 dividend stocks with yields > 3% while others wait for yield to come to them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal