European Stocks Priced Below Estimated Value For Savvy Investors

As European markets continue to show signs of steady economic growth, with the pan-European STOXX Europe 600 Index rising by 1.60%, investors are increasingly on the lookout for opportunities that may be undervalued amidst looser monetary policies. In such a climate, identifying stocks priced below their estimated value can offer potential benefits, particularly when economic indicators suggest stability and potential growth in key indices.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK18.58 | SEK36.47 | 49.1% |

| Sanoma Oyj (HLSE:SANOMA) | €9.21 | €18.33 | 49.7% |

| Redelfi (BIT:RDF) | €11.82 | €23.33 | 49.3% |

| PVA TePla (XTRA:TPE) | €21.88 | €43.62 | 49.8% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.266 | €8.51 | 49.8% |

| Jæren Sparebank (OB:JAREN) | NOK380.00 | NOK752.16 | 49.5% |

| Inission (OM:INISS B) | SEK48.80 | SEK96.05 | 49.2% |

| Dynavox Group (OM:DYVOX) | SEK101.80 | SEK202.79 | 49.8% |

| AutoStore Holdings (OB:AUTO) | NOK10.41 | NOK20.69 | 49.7% |

| Aker BioMarine (OB:AKBM) | NOK90.20 | NOK177.20 | 49.1% |

Let's review some notable picks from our screened stocks.

ACS Actividades de Construcción y Servicios (BME:ACS)

Overview: ACS Actividades de Construcción y Servicios is a Spanish multinational company engaged in construction, infrastructure development, and services with a market cap of approximately €21.70 billion.

Operations: The company's revenue segments include Cimic at €11.11 billion, Turner at €24.44 billion, Infrastructure at €241.67 million, and Engineering and Construction at €10.30 billion.

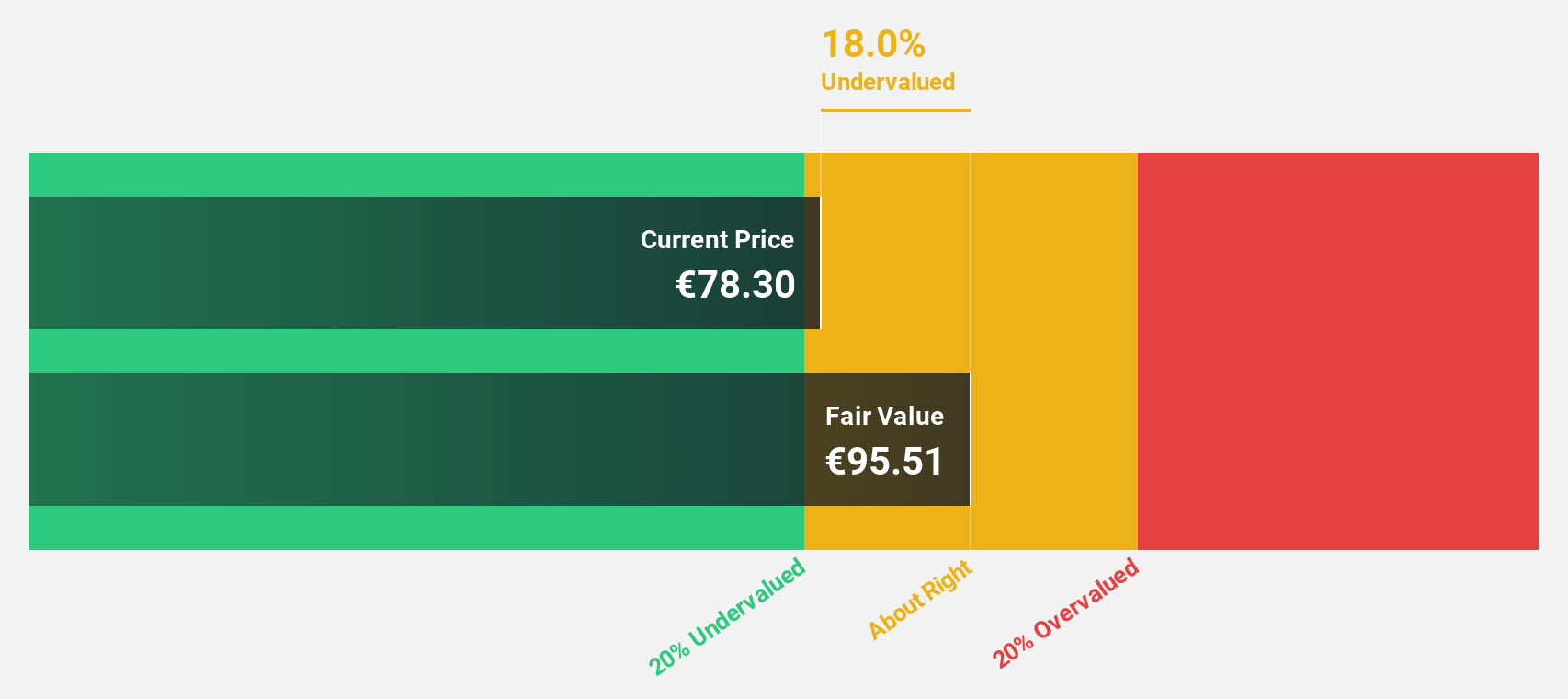

Estimated Discount To Fair Value: 13.1%

ACS, Actividades de Construcción y Servicios, S.A. shows potential as an undervalued stock based on cash flows, trading at €84.9 below its estimated fair value of €97.66. Recent earnings reported sales of €36.75 billion and net income of €655 million for the first nine months of 2025, indicating solid performance despite high debt levels not fully covered by operating cash flow. Earnings are forecast to grow faster than the Spanish market at 13% annually.

- Our expertly prepared growth report on ACS Actividades de Construcción y Servicios implies its future financial outlook may be stronger than recent results.

- Take a closer look at ACS Actividades de Construcción y Servicios' balance sheet health here in our report.

OHB (XTRA:OHB)

Overview: OHB SE is a space and technology company operating in Germany, the rest of Europe, and internationally, with a market cap of €2.07 billion.

Operations: The company's revenue segments include Digital (€145.95 million), Holding (€26.42 million), Space Systems (€929.07 million), and Access to Space (€157.71 million).

Estimated Discount To Fair Value: 16.9%

OHB appears undervalued based on cash flows, trading at €108, approximately 16.9% below its estimated fair value of €129.94. Despite high debt levels and lower profit margins than last year, earnings are forecast to grow significantly at 51.8% annually, outpacing the German market's growth rate. Recent third-quarter results showed increased sales and revenue compared to the previous year, with net income reaching €12.38 million from €12.01 million a year ago.

- Our growth report here indicates OHB may be poised for an improving outlook.

- Get an in-depth perspective on OHB's balance sheet by reading our health report here.

PNE (XTRA:PNE3)

Overview: PNE AG is involved in the planning, construction, and operation of wind farms and transformer stations both in Germany and internationally, with a market cap of €773.69 million.

Operations: The company's revenue is segmented into Services (€36.30 million), Power Generation (€79.80 million), and Project Development (€269.90 million).

Estimated Discount To Fair Value: 37.5%

PNE is trading at €10.1, over 37% below its estimated fair value of €16.15, suggesting potential undervaluation based on cash flows. Recent earnings show improved sales and revenue for the third quarter, though a net loss persists. The company secured multiple wind energy projects in France and Germany, enhancing future revenue prospects despite current debt challenges not well covered by operating cash flow. Analysts anticipate a 71% stock price increase aligning with expected profitability within three years.

- According our earnings growth report, there's an indication that PNE might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of PNE.

Where To Now?

- Navigate through the entire inventory of 194 Undervalued European Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal