Asian Market Stocks That May Be Trading Below Estimated Value In December 2025

As of December 2025, the Asian markets are navigating a complex landscape, with Japan's recent interest rate hike marking its highest level in three decades and China's economic indicators reflecting subdued growth. In this environment, identifying stocks that may be trading below their estimated value requires careful consideration of factors such as economic stability and market trends.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥153.65 | CN¥303.05 | 49.3% |

| Sany Heavy Equipment International Holdings (SEHK:631) | HK$8.35 | HK$16.31 | 48.8% |

| Mobvista (SEHK:1860) | HK$15.56 | HK$30.71 | 49.3% |

| KoMiCo (KOSDAQ:A183300) | ₩84000.00 | ₩166235.75 | 49.5% |

| JINS HOLDINGS (TSE:3046) | ¥5560.00 | ¥10935.75 | 49.2% |

| Globe-ing (TSE:277A) | ¥2608.00 | ¥5084.63 | 48.7% |

| Global Security Experts (TSE:4417) | ¥2894.00 | ¥5707.10 | 49.3% |

| Daiichi Sankyo Company (TSE:4568) | ¥3300.00 | ¥6544.37 | 49.6% |

| Astroscale Holdings (TSE:186A) | ¥615.00 | ¥1206.38 | 49% |

| Andes Technology (TWSE:6533) | NT$243.50 | NT$483.77 | 49.7% |

Underneath we present a selection of stocks filtered out by our screen.

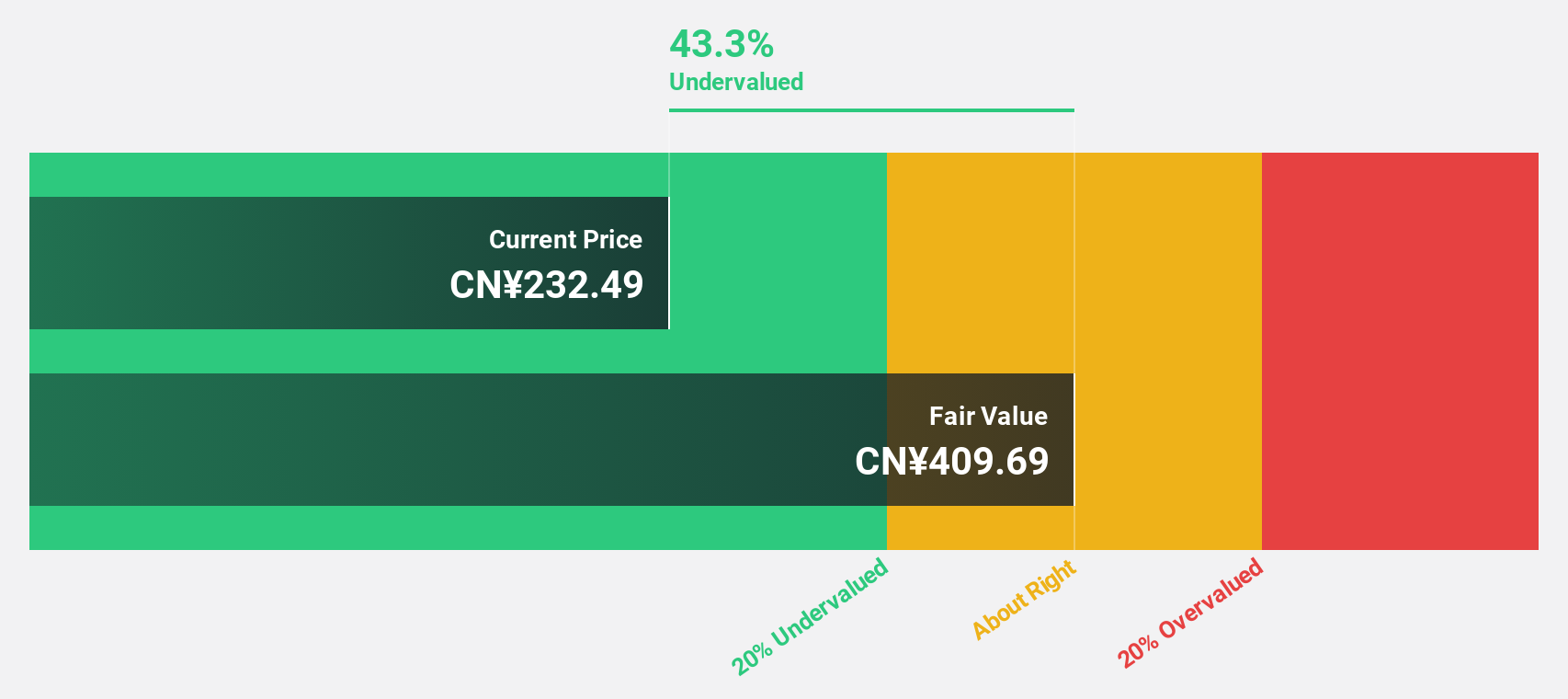

Zhejiang Cfmoto PowerLtd (SHSE:603129)

Overview: Zhejiang Cfmoto Power Co., Ltd, with a market cap of CN¥45.35 billion, is involved in the development, manufacture, marketing, and delivery of motorcycles, off-road vehicles, engines, frames, parts, apparel, and accessories across various global markets including China.

Operations: The company generates revenue from the development, manufacture, marketing, and delivery of motorcycles, off-road vehicles, engines, frames, parts, apparel, and accessories across China and international markets including Asia, North America, Oceania, Africa, South America, and Europe.

Estimated Discount To Fair Value: 23.5%

Zhejiang Cfmoto Power Ltd. is trading at CN¥297.21, significantly below its estimated fair value of CN¥388.62, representing a 23.5% discount based on discounted cash flow analysis. The company reported strong revenue growth for the first nine months of 2025, with sales reaching CN¥14.9 billion compared to CN¥11.45 billion last year and net income increasing to CN¥1.42 billion from CN¥1.08 billion, highlighting its undervaluation potential despite slower earnings growth forecasts relative to the broader Chinese market.

- According our earnings growth report, there's an indication that Zhejiang Cfmoto PowerLtd might be ready to expand.

- Click here to discover the nuances of Zhejiang Cfmoto PowerLtd with our detailed financial health report.

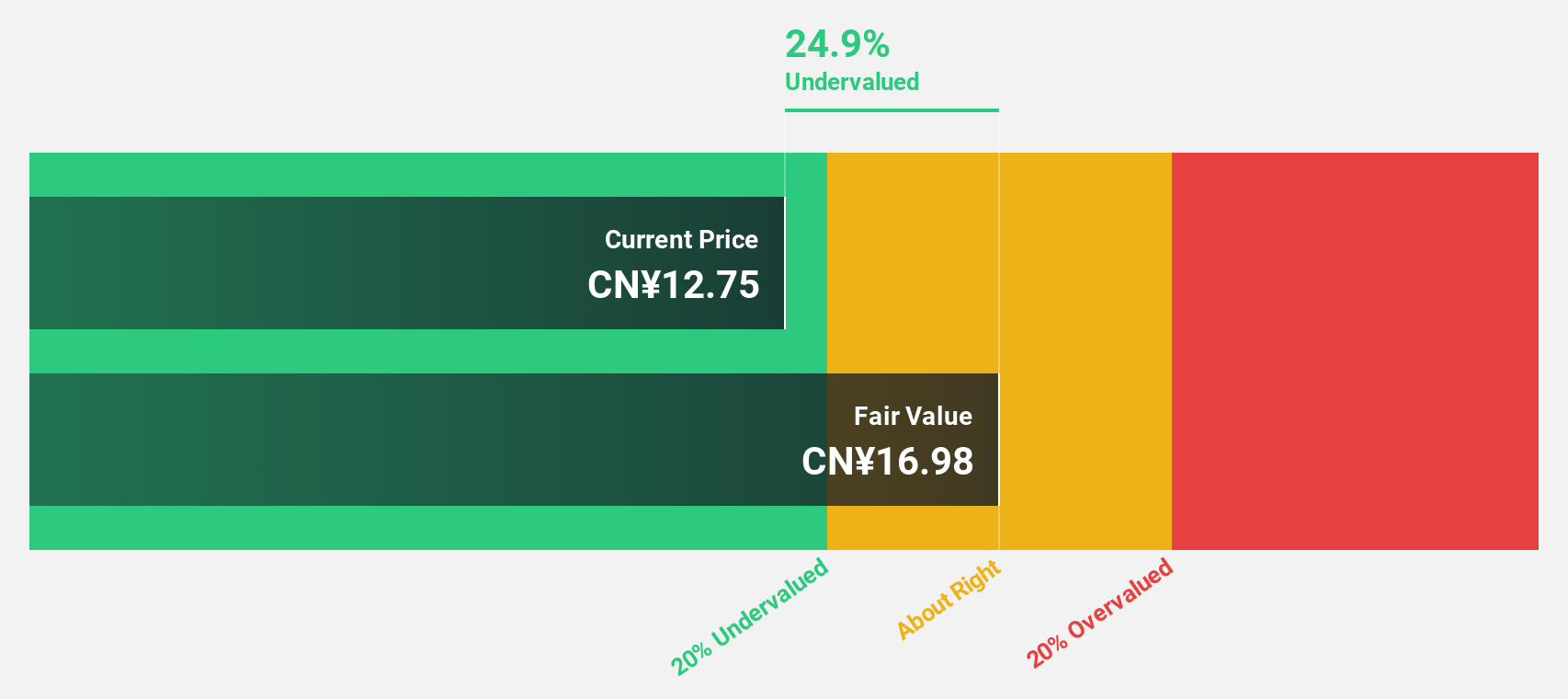

YouYou Foods (SHSE:603697)

Overview: YouYou Foods Co., Ltd. operates in China, offering a range of food products, with a market capitalization of CN¥5.59 billion.

Operations: The company generates revenue primarily from its food processing segment, totaling CN¥1.54 billion.

Estimated Discount To Fair Value: 23%

YouYou Foods is trading at CN¥13.07, below its fair value estimate of CN¥16.98, indicating a discount of more than 20% based on discounted cash flow analysis. The company's earnings for the first nine months of 2025 grew to CNY 173.8 million from CNY 121.25 million a year ago, reflecting strong profit growth despite an unstable dividend track record and low future return on equity forecasts. Revenue is expected to grow faster than the Chinese market average.

- Insights from our recent growth report point to a promising forecast for YouYou Foods' business outlook.

- Get an in-depth perspective on YouYou Foods' balance sheet by reading our health report here.

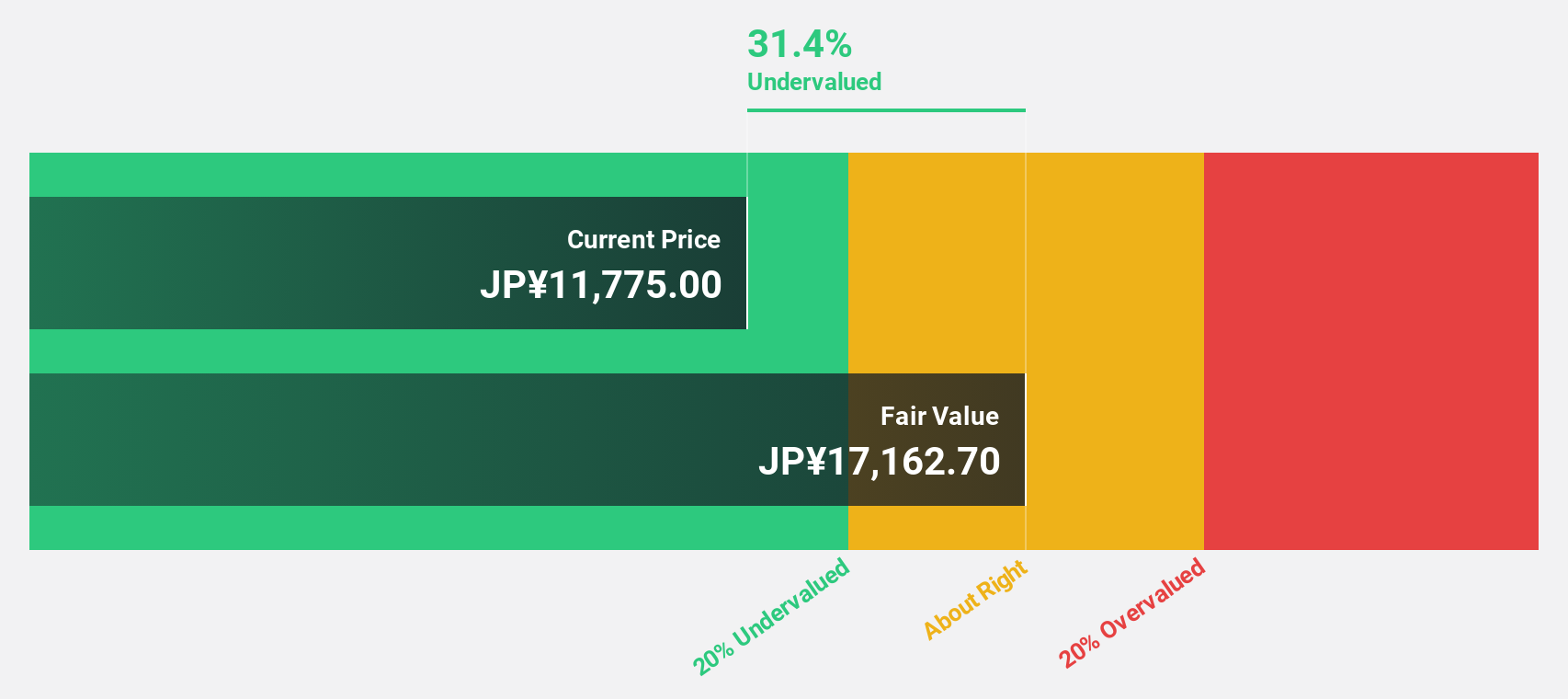

Visional (TSE:4194)

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market cap of ¥432.27 billion.

Operations: The company's revenue is primarily derived from its HR Tech segment, which accounts for ¥81.24 billion, with an additional contribution of ¥3.70 billion from its Incubation segment.

Estimated Discount To Fair Value: 44.4%

Visional is trading at ¥10,770, significantly below its estimated fair value of ¥19,374.11, presenting a potential opportunity based on discounted cash flow analysis. The company's earnings grew by 28.2% over the past year and are forecast to grow annually at 13.4%, outpacing the Japanese market's average growth rate. Analysts agree that the stock price could rise by 20.1%. Revenue growth is also expected to surpass market averages at 13.8% per year.

- Our comprehensive growth report raises the possibility that Visional is poised for substantial financial growth.

- Take a closer look at Visional's balance sheet health here in our report.

Seize The Opportunity

- Embark on your investment journey to our 271 Undervalued Asian Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal