IPO News | JINP Hong Kong Stock Exchange ranks third in China's precision diagnostic solutions industry

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 21, Jiinga Technology (Shaoxing) Co., Ltd. (abbreviation: Jiinga) submitted a listing application to the main board of the Hong Kong Stock Exchange, with CCB International and CMBC Capital as co-sponsors. According to Insight Consulting, the company ranked third in the accurate diagnosis solutions industry in China in terms of revenue in 2024.

Company profile

According to the prospectus, Jiinga is a leading precision medicine company in China, deeply embedding AI capabilities into every core link in the biomarker value chain. The company is committed to accelerating the large-scale clinical application of AI-driven multiomics technology through an innovative framework for collaborative integration of multiomics and AI to better serve the growing major unmet medical needs of the vast majority of patients in China.

Based on a self-developed multi-omics platform, combined with basic large-scale models and intelligent AI, GenPlus has built a full chain of capabilities from discovery, verification, product development, and commercialization of multi-omics biomarkers and targets. As a result, the company provides three major solutions for hospitals, pharmaceutical and biotechnology companies, medical research institutions, etc.: accurate diagnosis, enabling drug development, and clinical research and transformation.

According to Insight Consulting materials, Jiinga has built one of the earliest large-scale multiomics baseline databases in the industry. With this strong data moat, a stable first-mover advantage and a continuous innovation cycle, and adhering to a development strategy centered on the deep integration of AI technology and clinical value insight, the company will continue to consolidate its competitive advantage in the Chinese precision medicine market.

The following image shows Jiinga's key achievements:

According to Insight Consulting, Jiinga operates the only integrated platform in China covering the entire chain of multi-omics biomarker discovery, verification, product development and commercialization. Currently, the company's MRD solution is being put into use in head hospitals through the HDT model, and has become the first MRD testing product in China to be included in the China Drug Administration's special review procedure for innovative medical devices. According to Insight Consulting, this development enables the company to launch the first commercial MRD kit in China, fully demonstrating the integration and execution capabilities of the full-chain platform.

The company's self-developed AI multiomics architecture can achieve deep AI coverage of the entire workflow, covering omics factories (for large-scale data production), bioinformation cloud platforms and databases (for data analysis and management), and large models and agents (for insight mining and clinical decision support). The integrated technology base enables the company to independently discover and complete clinical verification of novel biomarkers, clearly differentiating itself from peers focusing on known targets or single functional analysis.

Jiinga's three business lines complement each other. As of the last practical date, the company has served more than 1,000 hospitals (including 30 of China's top 100 hospitals) and established cooperation with more than 200 pharmaceutical companies and more than 500 clinical research institutions. These long-term partnerships confirm the company's ability to transform scientific breakthroughs into clinical applications and commercial value.

Jiinga has achieved many pioneering breakthroughs in the field of precision medicine. According to Insight Consulting, in terms of revenue in 2024, the company ranked third in the market for accurate diagnosis solutions in China; in the field of drug research and development, the company provides full life cycle services built around diagnosis, which is a key support for promoting the commercialization of targeted treatments; the company's clinical research and transformation platform ranks among the leading companies in China. According to Insight Consulting's data, the company is the first company to commercialize biomarkers in the field of organ health.

Financial data

revenue

The company's revenue mainly comes from providing accurate diagnostic solutions (including providing clinical laboratory testing services, selling IVD products, and providing COVID-19 nucleic acid testing services); clinical research and transformation solutions; and drug development enabling solutions. In 2022, 2023, 2024, and 2025 for the six months ended June 30, the company recorded revenue of 1,815 billion yuan (RMB, same below), 473 million yuan, 557 million yuan, and 285 million yuan respectively.

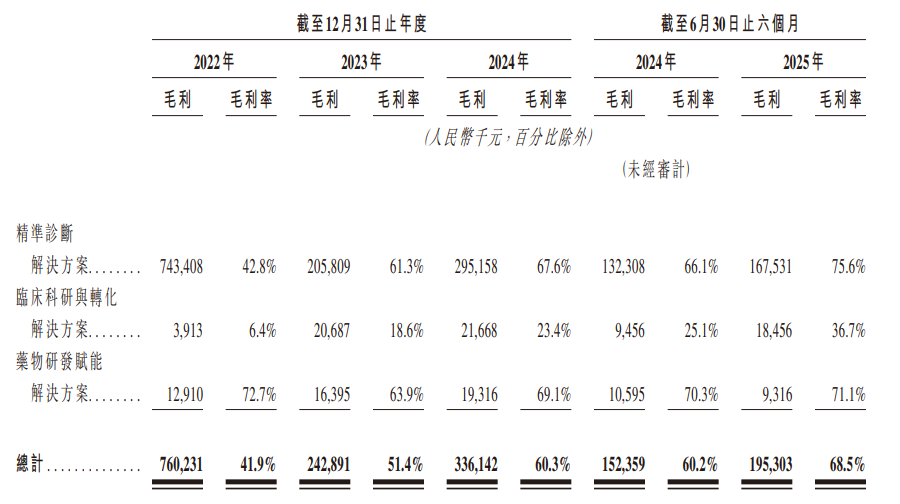

Gross profit and gross profit margin

In 2022, 2023, 2024, and 2025 for the six months ended June 30, the company recorded gross profit of 760 million yuan, 243 million yuan, 336 million yuan, and 195 million yuan respectively, with corresponding gross margins of 41.9%, 51.4%, 60.3%, and 68.5%.

Net profit/net loss

In 2022 and 2023, the company recorded net profit of 372 million yuan and $54.127 million respectively; in 2024 and 2025 for the six months ended June 30, the company recorded net losses of 424 million yuan and 414 million yuan respectively.

Industry Overview

AI multiomics solutions use artificial intelligence (AI) technology to integrate, analyze, and interpret multi-omics biological data. The aim is to understand life processes and disease mechanisms more deeply, and ultimately achieve more accurate medical and health applications. The application scenarios of AI multiomics solutions mainly cover accurate diagnosis, drug development enablement, clinical research and transformation, and other healthcare scenarios.

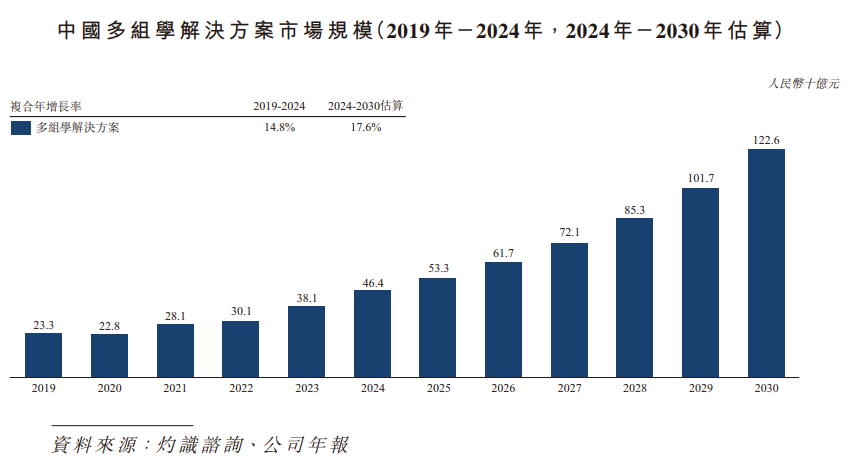

The multiomics solutions market in China expanded from RMB 23.3 billion in 2019 to RMB 46.4 billion in 2024, with a compound annual growth rate of 14.8% from 2019 to 2024, and is expected to reach RMB 122.6 billion in 2030, with a compound annual growth rate of 17.6%.

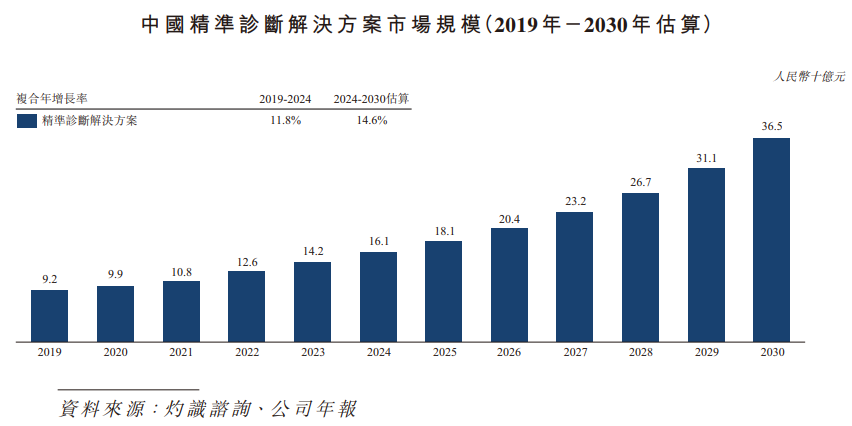

Accurate diagnosis refers to a diagnostic method for accurately and timely identification of a patient's health status through detailed tests at the cellular and molecular levels (such as biomarker testing). Taking cancer screening as an example, biomarker tests analyze genes, proteins, and other substances. These substances can provide information about a patient's cancer and related signaling pathways, thereby helping doctors choose the most appropriate treatment plan for each patient. Some biomarkers can help doctors diagnose and monitor cancer during and after treatment, while others may indicate the possibility of cancer forming or progressing before malignant disease develops.

The market size of accurate diagnostic solutions in China expanded from RMB 9.2 billion in 2019 to RMB 16.1 billion in 2024. The compound annual growth rate between 2019 and 2024 reached 11.8%. It is expected to reach RMB 36.5 billion by 2030, and the compound annual growth rate between 2024 and 2030 will reach 14.6%.

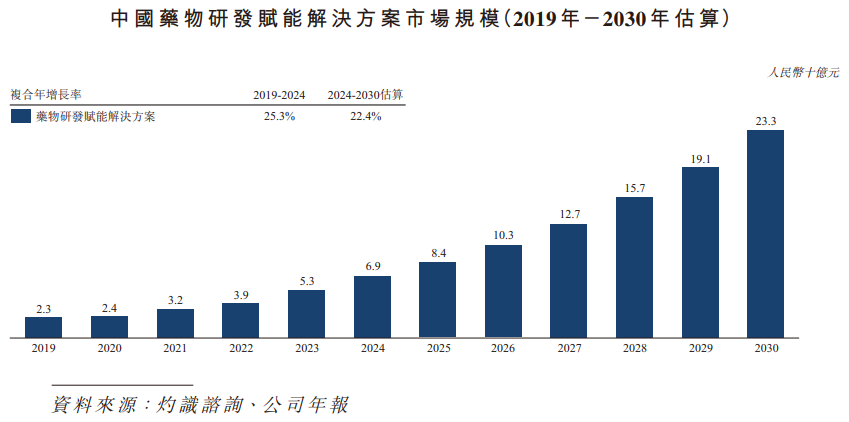

Drug development enabling solutions refer to innovative medical models for developing targeted drugs based on molecular research results such as genomics and proteomics. Its core is to design intervention plans for specific molecular mechanisms of disease occurrence through technical means such as biomarker discovery and verification and pharmacogenomics applications, so as to achieve treatment goals with higher efficacy and lower toxicity. These solutions cover the entire process from targeted drug development to concomitant diagnostic development, and represent a high level of modern drug development.

The market size of China's drug development enabling solutions expanded from RMB 2.3 billion in 2019 to RMB 6.9 billion in 2024. The compound annual growth rate between 2019 and 2024 reached 25.3%, and is expected to reach RMB 23.3 billion by 2030, with a compound annual growth rate of 22.4% between 2024 and 2030.

Clinical research and translational solutions provide end-to-end support for evidence generation. This market generally covers high-throughput multiomics production and testing services, including centralized sample logistics, standardized sample preparation, genetic sequencing, and clinical research platforms equipped with artificial intelligence technology. The platform can collaborate with hospitals to carry out research design, build multi-disease cohorts, and promote the transformation of research results into clinical decision-making tools and real-world evidence. Together, these solutions can output reproducible and multi-center consistent research results to support biomarker discovery and verification, patient pre-screening and stratification, and clinical decision-making based on real-world evidence.

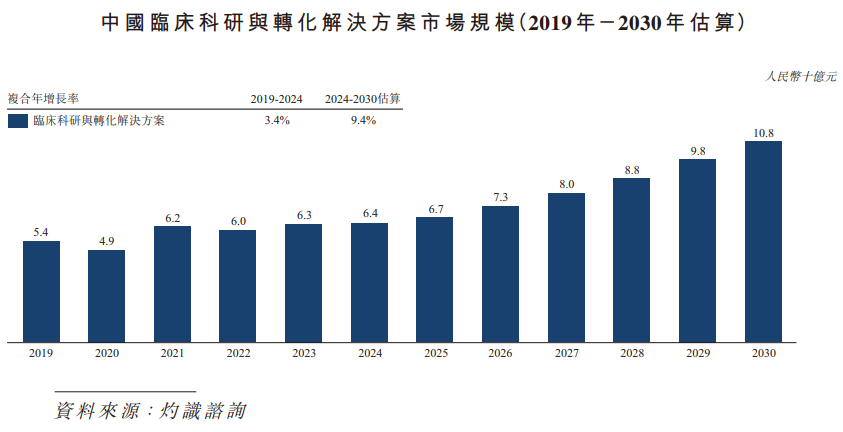

The market size of clinical research and translational solutions in China expanded from RMB 5.4 billion in 2019 to RMB 6.4 billion in 2024, and is expected to reach RMB 10.8 billion by 2030, with a compound annual growth rate of 9.4% between 2024 and 2030.

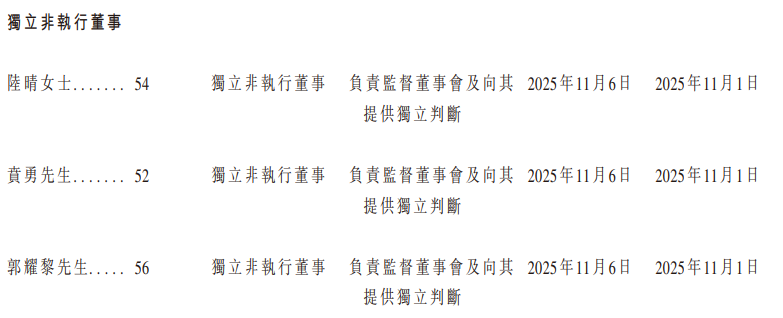

Board Information

After the IPO, the board of directors will be composed of seven directors, including four executive directors and three independent non-executive directors. The term of office of directors is three years, and they can be re-elected.

Shareholding structure

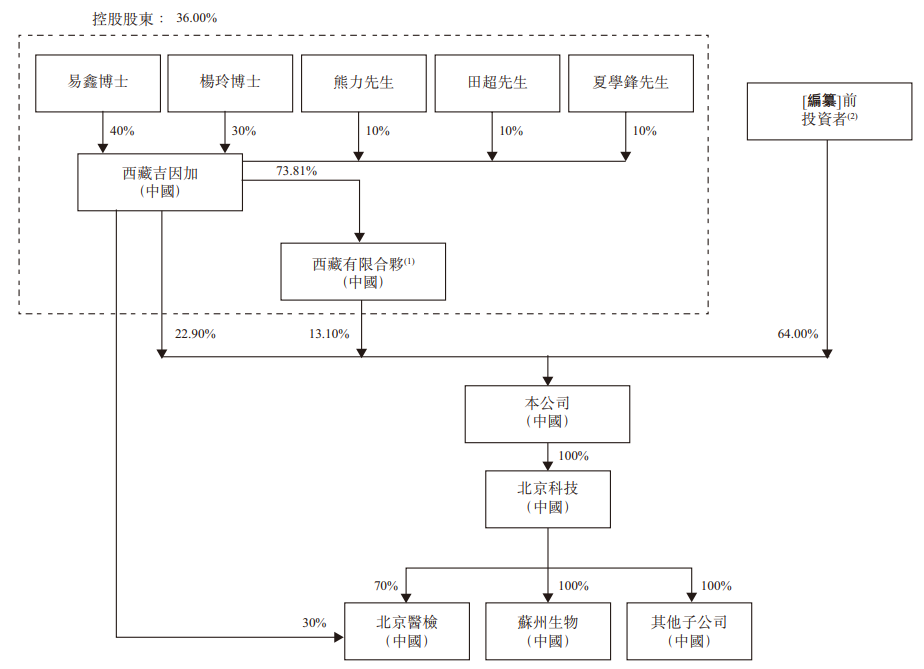

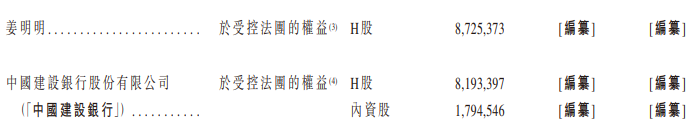

As far as listing rules are concerned, Tibet Jiyinga, Tibet Limited Partnership, Dr. Yi Xin, Dr. Yang Ling, Mr. Xiong Li, Mr. Tian Chao, and Mr. Xia Xuefeng are assumed to be a group of controlling shareholders, holding a total of 36.00% of the shares; pre-listing investors hold a total of 64% of the shares.

According to the agreement of the concerted actors, Dr. Yi Xin, Dr. Yang Ling, Mr. Xiong Li, Mr. Tian Chao, and Mr. Xia Xuefeng agreed to take concerted action with all parties in exercising their shareholders' rights at the level of Tibet. Therefore, according to securities and futures

According to the regulations, Dr. Yi Xin, Dr. Yang Ling, Mr. Xiong Li, Mr. Tian Chao, and Mr. Xia Xuefeng are each deemed to have an interest in all of their shares in Tibet's Jiinga.

Tibet Limited Partnership was established in China as an employee incentive platform for the company, with Tibet Jiinga as its general partner.

Intermediary team

Co-sponsors: CCB International Finance Co., Ltd., and CMBC Capital Co., Ltd.

Company Legal Advisors: Related to Hong Kong and US Law: Clyde Hong Kong Law Firm; Related to Chinese Law: Haiwen Law Firm.

Co-sponsor Legal Adviser: Relevant Hong Kong Law: Jingtian Gongcheng Law Firm Limited Liability Partnership; Related Chinese Law: Jingtian Gongcheng Law Firm.

Reporting accountant and independent auditor: Deloitte Guan Huang Chen Fang

Industry Advisor: Insight Investment Consulting (Shanghai) Co., Ltd.

Compliance Advisor: CBC Capital Co., Ltd.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal