A look at American Superconductor’s valuation as Clear Street reiterates ‘Strong Buy’ after big earnings beat

American Superconductor (AMSC) caught investors' attention after a Clear Street analyst reiterated a bullish stance, just as the company delivered earnings more than 33% above expectations and continued to post improving financial metrics.

See our latest analysis for American Superconductor.

Those bullish earnings and the upbeat Clear Street call come after a choppy stretch, with a 90 day share price return of minus 50.2% but a three year total shareholder return of about 801%. This suggests long term momentum remains powerful despite recent volatility.

If this kind of turnaround story has your attention, it could be a good moment to see what else is out there among fast growing stocks with high insider ownership.

With shares still trading at roughly half of some analyst targets and profitability metrics trending higher, is American Superconductor a misunderstood value hiding in plain sight, or is the market already discounting years of future growth?

Most Popular Narrative Narrative: 51.3% Undervalued

American Superconductor's most followed narrative pegs fair value near $63 per share, roughly double the last close around $30. This sets up an aggressive upside case built on growth and margin expansion.

Ongoing development and successful deployment of proprietary, higher margin grid and materials technologies, including integration of recent acquisitions, are increasing content per project. This supports gross margin expansion and scalable earnings. High factory utilization and capacity expansion plans, combined with operational leverage from past and potential acquisitions, are driving improved efficiency and a stronger margin profile, with the potential for further net income growth as scale increases.

Curious how stronger margins, faster earnings growth and a rich future valuation multiple all come together in one story? The narrative lays out an ambitious financial roadmap built on specific revenue ramps, margin assumptions and a premium earnings multiple that would not look out of place in a high growth tech name. Want to see exactly how those moving parts are modeled to justify nearly double the current share price?

Result: Fair Value of $63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, recent strength relies on one-off semiconductor orders and an ideal product mix, so any slowdown or weaker utilization could quickly pressure margins.

Find out about the key risks to this American Superconductor narrative.

Another View on Valuation

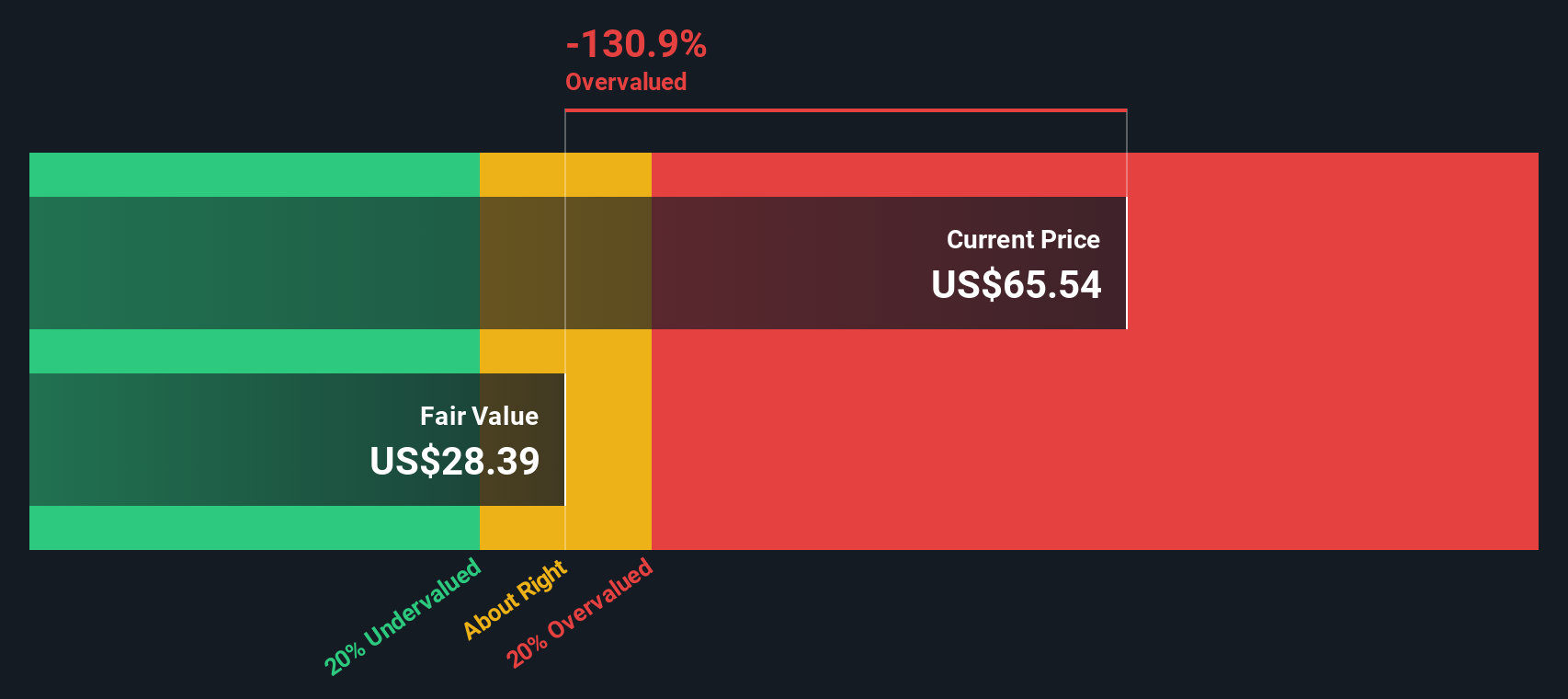

While our DCF work suggests American Superconductor trades about 48.5% below fair value at roughly $59.57 per share, the market’s current price implies plenty can still go wrong. If cash flows disappoint or growth slips, how quickly could that theoretical upside evaporate?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Superconductor Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your American Superconductor research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by using the Simply Wall Street Screener to uncover fresh, data driven ideas that most investors overlook.

- Capture potential bargains early by reviewing these 914 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows and fundamentals.

- Ride powerful long term trends by scanning these 25 AI penny stocks that are building real businesses around artificial intelligence and automation.

- Strengthen your income game by assessing these 13 dividend stocks with yields > 3% that combine attractive yields with the financial health to support ongoing payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal