Fitch sounded the alarm: the rebound in lithium prices is just a “false fire” and oversupply is likely to spread throughout 2026

The Zhitong Finance App learned that Fitch expects that although lithium prices have rebounded to more than $11,500 per ton in late November (up 38% in the second half of 2025), the weak trend in lithium prices will continue until 2026. Fitch added that given that in a fragmented and maturing market, production is affected by multiple complex factors such as economy, operations, and strategy, the short-term outlook is still uncertain. The agency said that prices, which are still sluggish compared to historical highs, have caused marginal producers to lose money, but this is not enough to trigger large-scale production capacity cuts.

Oversupply will continue

Fitch expects the lithium market to remain oversupplied in 2026 unless there is a significant and continuing reduction in production capacity. Wood Mackenzie (Wood Mackenzie) predicts that the excess amount of battery-grade lithium chemicals will expand to 153,000 tons (in terms of lithium carbonate equivalent) in 2026, and further increase to 207,000 tons in 2027. At the critical inflection point, as demand for electric vehicles lags behind and policy uncertainty continues, the short-term balance between supply and demand depends on supply cuts.

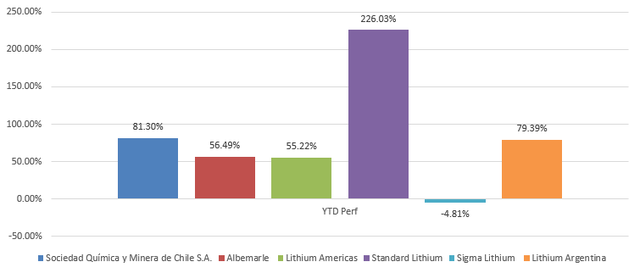

Since the beginning of the year, trends in lithium-related stocks have diverged. The stock price of Canadian lithium developer Standard Lithium (SLI.US) rose by nearly 250%, while larger producers such as Lithium Americas (LAC.US) and Chilean Mining Chemicals (SQM.US) also achieved considerable increases. Meanwhile, industry giants such as America's Yabo (ALB.US) are lagging behind against the backdrop of weak lithium prices and increased sector fluctuations. The Global X lithium and battery technology ETF had a cumulative increase of 56% during the year, partly driven by news related to tariffs and trade wars.

Supply chain dynamics

Fitch notes that the rapidly changing market for battery technology, including alternatives to lithium, could erode anticipated stable demand. The agency said, “China is still likely to be both the largest terminal market (64% of total demand) and the dominant processing center. Despite new market entrants, including strategic partnerships with governments seeking access to critical mineral resources, this situation is expected to continue.”

Capital allocation discipline

Fitch tracked lithium producers are prioritizing balance sheet resilience and rating buffer space until 2026. American Yabao (rated BBB- with a “stable” outlook) has issued convertible bonds, which can be repaid by issuing shares during the market cycle. Chile Mining & Chemical (rated “AA (cl)”) coped with the pressure by slowing growth capital expenditure, limiting free cash flow consumption, and issuing hybrid notes. Meanwhile, Mineral Resources (MALRF.US) (rated BB- with a “stable” outlook) sold 15% of its lithium assets, seeking to raise cash to repay debts early while cutting capital expenses.

M&A opportunities?

According to Fitch, the challenging industry environment continues to create opportunities for large mining companies with strong capital strength, which are seeking to diversify their business or secure access to critical mineral resources. For example, Rio Tinto (RIO.US) has been quite active in terms of lithium project opportunities. It is now close to being among the top five global lithium producers, and is continuously narrowing the gap with America's Abbott and Chilean mining and chemical industries.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal