3 Stocks Estimated To Trade At Discounts Of Up To 49.7%

As the U.S. stock market experiences a notable downturn, with major indexes like the S&P 500 and Dow Jones Industrial Average posting consecutive losses amid tech sector retreats and AI bubble concerns, investors are increasingly on the lookout for opportunities in undervalued stocks. In such turbulent times, identifying stocks that are trading at significant discounts can offer potential value, especially when broader market conditions have led to price corrections across various sectors.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zymeworks (ZYME) | $26.40 | $52.50 | 49.7% |

| UMB Financial (UMBF) | $119.79 | $233.99 | 48.8% |

| Sportradar Group (SRAD) | $22.92 | $45.71 | 49.9% |

| QXO (QXO) | $21.88 | $43.36 | 49.5% |

| Perfect (PERF) | $1.77 | $3.43 | 48.4% |

| DexCom (DXCM) | $65.91 | $127.52 | 48.3% |

| Community West Bancshares (CWBC) | $23.31 | $45.31 | 48.6% |

| Columbia Banking System (COLB) | $28.86 | $57.13 | 49.5% |

| BioLife Solutions (BLFS) | $25.34 | $50.06 | 49.4% |

| American Superconductor (AMSC) | $30.59 | $59.58 | 48.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Legence (LGN)

Overview: Legence Corp. offers engineering, installation, and maintenance services for mission-critical systems in buildings across the United States, with a market cap of approximately $4.58 billion.

Operations: The company's revenue is derived from two main segments: Engineering & Consulting, which contributes $710.59 million, and Installation & Maintenance, accounting for $1.65 billion.

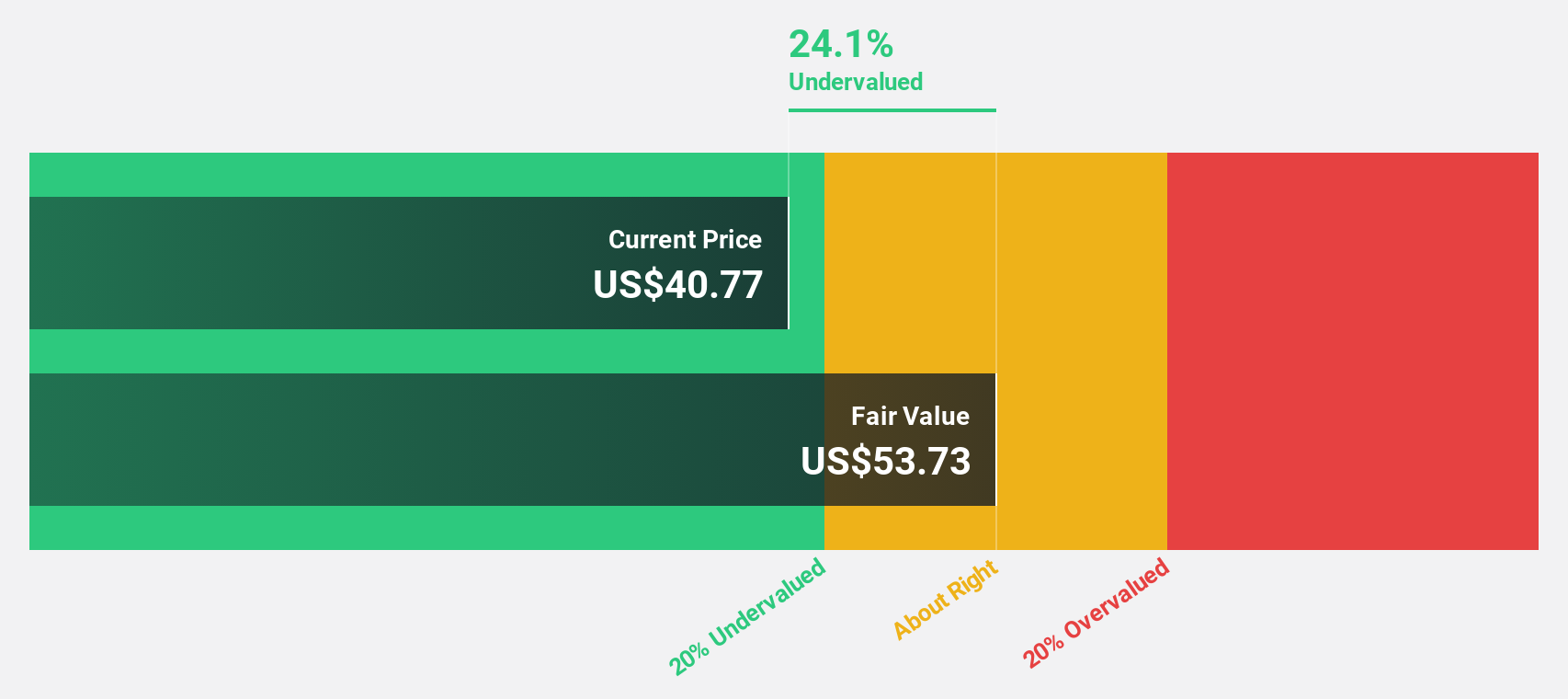

Estimated Discount To Fair Value: 18.6%

Legence Corp. recently completed a $378 million equity offering, potentially strengthening its cash position. Despite a net loss of $27.06 million for the first nine months of 2025, revenue grew by 19.4% year-over-year to $1.81 billion, suggesting operational improvements. Trading at US$43.50, Legence is undervalued based on discounted cash flow analysis with an estimated fair value of US$53.46 and forecasts indicate strong future revenue growth exceeding market averages at 20% annually.

- Our expertly prepared growth report on Legence implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Legence with our detailed financial health report.

Zymeworks (ZYME)

Overview: Zymeworks Inc. is a clinical-stage biotechnology company focused on discovering, developing, and commercializing biotherapeutics for cancer and autoimmune and inflammatory diseases, with a market cap of $1.92 billion.

Operations: The company's revenue is primarily derived from the development of next-generation multifunctional biotherapeutics, amounting to $134.48 million.

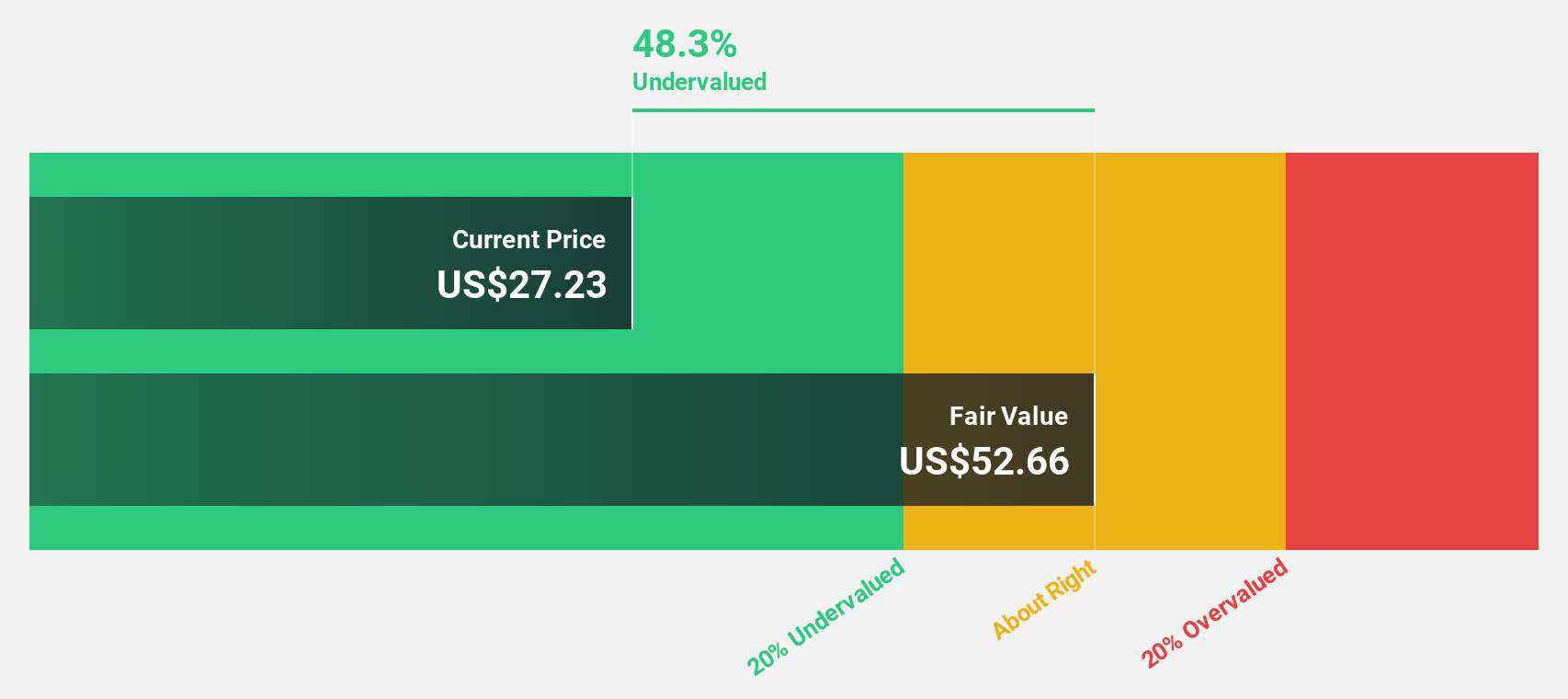

Estimated Discount To Fair Value: 49.7%

Zymeworks Inc. is trading at US$26.4, significantly below its estimated fair value of US$52.5, highlighting potential undervaluation based on discounted cash flow analysis. The company has announced a US$125 million share repurchase program and reported reduced net losses for the third quarter of 2025 compared to the previous year. With revenue forecasted to grow at 19.4% annually, Zymeworks shows promising signs of improving financial health and future growth prospects in the healthcare sector.

- Our earnings growth report unveils the potential for significant increases in Zymeworks' future results.

- Click to explore a detailed breakdown of our findings in Zymeworks' balance sheet health report.

HubSpot (HUBS)

Overview: HubSpot, Inc. offers a cloud-based customer relationship management (CRM) platform for businesses across the Americas, Europe, and the Asia Pacific with a market cap of approximately $20.31 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling $2.99 billion.

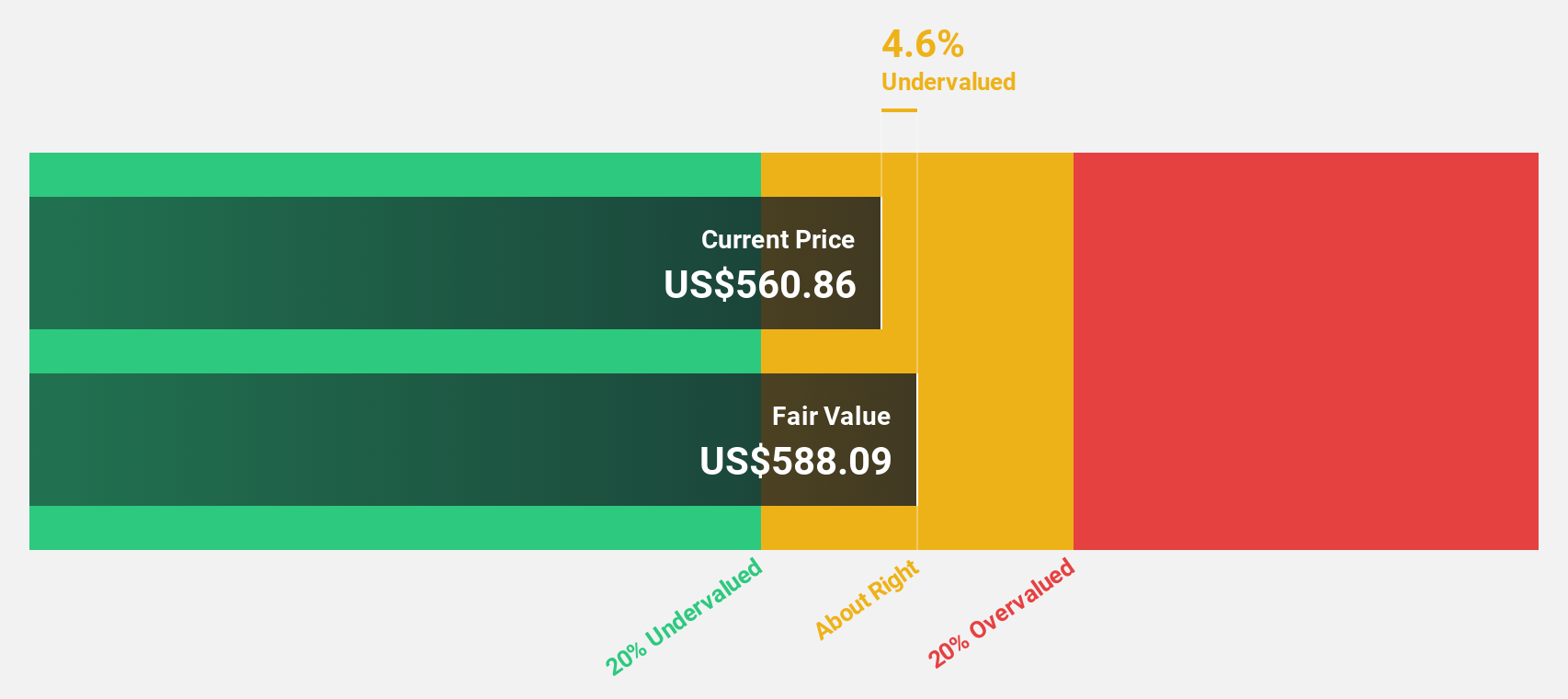

Estimated Discount To Fair Value: 33.2%

HubSpot is trading at US$390, well below its estimated fair value of US$583.94, suggesting potential undervaluation based on discounted cash flow analysis. Recent earnings showed significant revenue growth to US$809.52 million in Q3 2025 from US$669.72 million a year ago, with net income doubling to US$16.54 million. The company's strategic share repurchase and leadership in AI innovation further enhance its attractiveness as an investment opportunity amidst forecasted profit growth above market rates.

- According our earnings growth report, there's an indication that HubSpot might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of HubSpot.

Where To Now?

- Investigate our full lineup of 213 Undervalued US Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal