Anchoring the value revaluation opportunity for ecological upgrading, many brokerage firms are optimistic about the growth space of Huazhu Group (01179, HTHT.US)

If sound finance and excellent operation are the cornerstones of an enterprise's intrinsic value, then its performance in the capital market and position in the competitive landscape of the industry are the most direct external proof of this value.

Since 2025, the US stock price of Huazhu Group (01179, HTHT.US) has been rising steadily, breaking through $48 intraday on December 12, a new high since 2022. The positive feedback from the capital market not only acknowledged the company's operating performance in the past year, but also demonstrated investors' firm confidence in its clear path to building a business ecosystem and long-term development potential. This recognition is not an accident; it stems from Huazhu's solid accumulation in various areas such as performance growth, strategic implementation, and ecological upgrading. Its strategic transformation has continuously received double recognition from capital and industry.

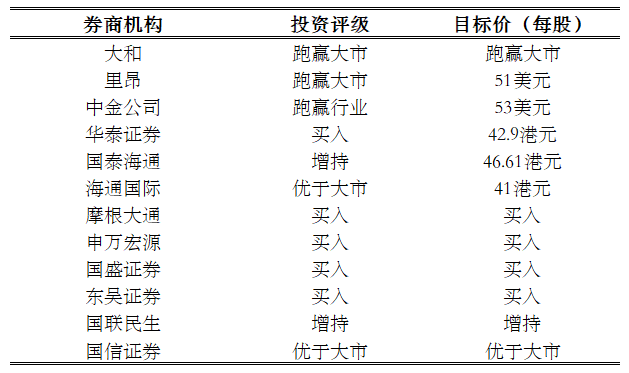

Recently, many brokerage firms have shown a high degree of consistency and optimism about Huazhu Group's ratings. Leading institutions such as J.P. Morgan Chase, CICC, Huatai, and Guoxin Securities have all issued updated reports, giving Huazhu investment ratings such as “increase in holdings” or “buy”.

(Updated incomplete statistics on brokerage ratings, tabulation: Zhitong Finance)

What is more noteworthy is that Huazhu's revenue and business development progress during the year exceeded market analysts' predictions, and this ability to “deliver on promises” or even “surpass promises” in a complex environment is the key to winning long-term capital trust. This also shows that the company's business strategy and development quality have exceeded the general expectations of the market, thereby driving the revaluation of valuations.

Across the industry cycle, RevPAR's flexible release drives performance recovery

In 2025, the structural adjustment of the domestic hotel industry continued to intensify, and the contradiction between supply and demand still exists. Affected by multiple factors such as the pace of consumer confidence restoration, changes in the growth rate of the business travel market, and the diversion of emerging accommodation methods, the overall industry is facing certain operating pressure. However, in this context, the “strong and powerful” pattern of the hotel industry is becoming more clear, resources are concentrated at leading chain brands, and structural opportunities for increasing the industry's linkage rate continue to be unleashed.

According to Guosheng Securities data, the hotel industry is at the bottom of the two-year adjustment period, and the supply-demand relationship is expected to be rebalanced in the future: leisure tourism is growing steadily, the demand base for business travel falls; leading reserve stores are falling to a higher level, and the business strategy is shifting from OCC priorities to optimal RevPAR to drive price stability. Looking at the long term, 46% of China's service consumption is still on the path of improvement, in line with the continued increase in the share of US accommodation spending in the 1980s. Supply-side structural opportunities are highlighted: as rent dividends weaken, franchisees have returned to investment attributes, and the estimated chain rate has increased from 40% (US 72%) to 60-70% corresponding to 30-109% housing space; among them, leading companies have the potential to double their market share in overseas TOP5.

In this context, as an industry leader, Huazhu's overall business performance has been steady, showing strong resilience through the industry cycle. Looking through Huazhu Group's latest financial report, a set of data confirms its growth momentum: while the scale grew steadily, the operating efficiency of single stores remained at a healthy level in the third quarter, ADR stabilized and surpassed year on year, OCC continued to maintain a high level of 84.1%, far higher than that of brands of the same type, and RevPAR remained basically flat year over year. This steady performance during the industry adjustment period reveals that the integration of Huazhu Group's strategic transformation and operational resilience has paid off.

According to CICC's research report, considering the contraction of the wine management company's reserve stores at the end of the third quarter, the bank expects the industry's supply growth rate to slow further in 26 years, and the industry's RevPAR is expected to stabilize; Huazhu's market share as the industry's leading market share is expected to continue to increase, and RevPAR and store opening may drive revenue growth more evenly.

Judging from long-term trends in the industry, the scale of domestic single hotel clearance will continue to expand in the next 5 years, and leading companies such as Huazhu are expected to continue to absorb market share and become core beneficiaries of structural changes in the industry with their core advantages such as brand influence, supply chain improvement, and professional operation empowerment.

The three major advantages build an industry moat and establish a long-term growth value base

Looking back on Huazhu's recovery path, the reason why it continues to be favored by the market and investors is also because the company has three major competitive barriers that are difficult to replicate, supporting the resilience of its performance. With the three core competencies of “brand, membership, and technology”, Huazhu has not only achieved continuous growth in performance, but also evolved from a traditional hotel operator to a high-value ecological platform enterprise.

At present, Huazhu Group has built the most competitive membership system in the industry with more than 20 years of accumulation. According to the latest data, by the end of the third quarter, the total number of Huazhukai members exceeded 300 million, an increase of 17.3% year on year, and the number of nights booked by members increased 19.7% year over year, exceeding 66 million nights, accounting for 74%. The characteristics of high stickiness and high repurchase rate were remarkable. A strong membership base brings a very high percentage of direct sales, which can reduce the dependence of its hotels on OTA platforms and increase the profit margin of individual stores.

Second, Huazhu's asset-light operation capability has set an industry benchmark. At present, group management franchise and franchise revenue has become one of the core engines driving overall revenue growth. Behind this achievement is the resonance between Huazhu's diverse product matrix and the franchise cooperation business, as well as the high recognition of its brand value and management model by franchisees.

Through supply chain integration, Huazhu adheres to the cooperative concept of “expanding the market cake together with franchisees”, provides integrated solutions for franchisees, and supports the whole process from property site selection and product design to digital tools to help reduce risk and improve efficiency. In actual operation, franchise hotels continue to enjoy Huazhu's brand premiums and member dividends. High occupancy rates bring stable cash flow, cost control and service standardization further guarantee returns, and also lay the foundation for Huazhu brand value release and deepening franchise cooperation strategies. Adequate reserves of hotels to be opened are direct recognition by the market of Huazhu's operating value.

Furthermore, digitalization is an important part of Huazhu's core competitiveness. According to the CITIC Securities Research Report, Huazhu drives the company's continuous digital product innovation through technological innovation and management processes, from the industry's first fully self-developed hotel management system, the digitization of easy guest room positions, the industry's first online self-service room selection, Huazhu's front desk model, to today's comprehensive GOP management products. The data-driven digital platform supports Huazhu's strategy of thousands of stores in thousands of cities, which not only controls hotel operating costs, but also takes into account customer experience innovation. In terms of the supply chain, Zebra Tesco relies on scale effects to provide franchisees with cost-effective preparation and operation materials. Currently, the franchisee procurement ratio in the construction process has reached 80% and the operating materials process has reached 100%, ensuring the standardized and efficient operation of stores.

It is easy to see that Huazhu's digital capabilities have formed a positive cycle of “reducing costs - increasing efficiency - improving user experience”, and has become an important support for it to move through the industry cycle. Dongwu Securities also claims that Huazhu Group acts as a benchmark in the hotel industry. The brand and membership system create competitive barriers, and structural upgrades drive operating data to outperform the industry.

Driven by medium- to long-term growth, the brand effect opens up potential for the future

If industry opportunities and fundamental resilience are the foundation of Huazhu's value, then clear growth drivers and reasonable long-term goals have further opened up room for future growth. Currently, Huazhu Group's brand matrix shows the characteristics of “deepening and full coverage”: the economical and mid-range markets, the “Golden Triangle” Hanting, full season, and orange firmly establish Huazhu's basic market, injecting strong impetus into the strategic goal of “Thousand Cities, Ten Thousand Stores 2.0.”

The sinking market is a core source of growth for Huazhu's future scale expansion. According to the CITIC Securities Research Report, the current linkage rate of China's different tier cities varies greatly, with 44% for the first tier, 36% for the second tier, 25% for the third tier, 14% for the fourth tier and below, while the linkage rate for mature markets such as the US and Europe generally exceeds 70%. It can be said that the sinking market has become the core battleground for increasing the chain chain rate. Currently, the hotel chain rate in third-tier cities and below in China is less than 20%, which is significantly lower than the level of Tier 1 and 2 cities. As the trend of consumption upgrading penetrates into lower-tier cities, and the disadvantages of individual hotels in terms of operational efficiency, brand awareness, and digital capabilities become prominent, the industry is accelerating into the “inventory integration” stage. While adhering to the basic economy, Huazhu innovated breakthroughs and launched Haiyou All-Self-Catering Hotel to restructure the “light investment and high turnover” model with fully digital operation.

Picture: Hi Inn Self-service Front Desk

Moreover, Huazhu has achieved breakthrough progress on the middle and high-end circuit, which has long been a monopoly of international high-end hotel brands. By the end of the third quarter, the number of high-end stores in operation and ready to open in Huazhuang had successfully surpassed 1,600, an increase of 25.3% over the previous year. At the 2025 Partner Conference, Huazhu unveiled the new high-end brand “Full Season View”, entering the high-end market with Oriental restraint and warmth, and embarking on a new journey to build a world-class Oriental brand.

Picture: Full season panorama guest room renderings

Guoxin Securities believes that after 20 years of the Huazhu cycle, the “product - traffic - return - scale” model has redefined the limited service hotel industry. In the 15 years since its launch, the store and performance CAGR exceeded 20%. Backed by the founder and management's strategic vision and efficient digital organization, the company pioneered a flywheel of growth in the limited-service hotel industry with Chinese characteristics: 1) Strong products: efficient iteration of multiple brands from economical to mid-range and high-end, growing against the trend, leading the mid-range throughout the season, and misplaced orange development to meet the needs of differentiated customer groups; 2) Strong traffic: leading the industry with a membership of more than 60%; 3) Strong returns: leading the same store with RevPAR Industry 30-80%, people The housing ratio was 0.17, and the supply chain cost was reduced by more than 20%, driving franchisees' willingness to invest; 4) Strong scale expansion: the growth rate of franchise stores remained 15-20%.

Guosheng Securities also pointed out in the research report that supply in the hotel market is still increasing, but there are signs of month-on-month improvement in hotel business operations. The company continues to strengthen its core competitive advantage through product upgrades, excellent service, and membership system construction. It has excellent expansion and operation capabilities, gradually phasing out economical hotels with low quality and poor operating performance, and continuously promoting the expansion of high-end high-quality hotels. The profit margin is expected to continue to increase under the asset-light strategy.

From a comprehensive market perspective, looking ahead to 2026, Huazhu Group's revaluation opportunities are clearly visible. In the short term, as the relationship between supply and demand in the industry gradually improves, the company's operational resilience through the cycle is expected to be further realized, RevPAR will release flexibility or drive performance repair to provide basic support for valuation; in the medium term, the trend of increasing industry linkage rate under supply-side reforms continues, and Huazhu's penetration or continues to increase in the integration of individual hotel stocks with synergetic effects of scale expansion and profit improvement; from a long-term perspective, the two-wheel drive of sinking market layout and the upgrading of middle- and high-end brands superimposes the digital construction of member ecosystems and superimposes the digital construction capacity of members moat, Or promote the continuous strengthening of the company's growth attributes. If the above logic is gradually implemented, the company's investment value may be further highlighted, which is worthy of long-term optimism among investors.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal