Discover 3 UK Penny Stocks With Market Caps Over £100M

The UK market has recently faced challenges, with the FTSE 100 index closing lower amid weak trade data from China, highlighting concerns about global economic recovery. Despite these broader market uncertainties, investors often seek opportunities in less conventional areas such as penny stocks. While the term 'penny stock' might seem outdated, it continues to represent potential in smaller or newer companies that possess strong financial foundations. Here, we explore three UK penny stocks that stand out for their financial strength and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.14 | £474.95M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.95 | £157.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.75 | £133.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.82 | £12.38M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.685 | $398.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.49 | £180.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.49 | £71.95M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.445 | £38.36M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.115 | £179.44M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 303 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Impax Asset Management Group (AIM:IPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Impax Asset Management Group Plc is a publicly owned investment manager with a market cap of £180.46 million.

Operations: The company's revenue segment includes Impax LN, which generated £141.87 million.

Market Cap: £180.46M

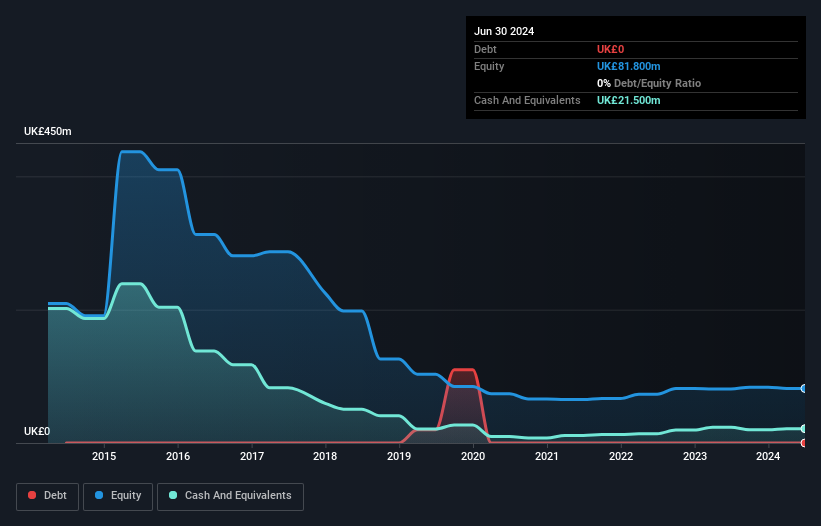

Impax Asset Management Group, with a market cap of £180.46 million, reported a decline in revenue and net income for the fiscal year ending September 30, 2025. Sales decreased to £141.87 million from £170.11 million the previous year, while net income fell to £20.29 million from £36.48 million. Despite this downturn, the company maintains high-quality earnings and operates debt-free with strong asset coverage for liabilities. However, its dividend track record is unstable as evidenced by a reduced final dividend proposal for 2025 compared to 2024 levels. The management team is seasoned but recent negative earnings growth poses challenges amidst forecasted recovery efforts.

- Unlock comprehensive insights into our analysis of Impax Asset Management Group stock in this financial health report.

- Examine Impax Asset Management Group's earnings growth report to understand how analysts expect it to perform.

NIOX Group (AIM:NIOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NIOX Group Plc focuses on designing, developing, and commercializing medical devices for asthma diagnosis, monitoring, and management globally with a market cap of £286.67 million.

Operations: The company generates revenue primarily from its NIOX® segment, amounting to £46 million.

Market Cap: £286.67M

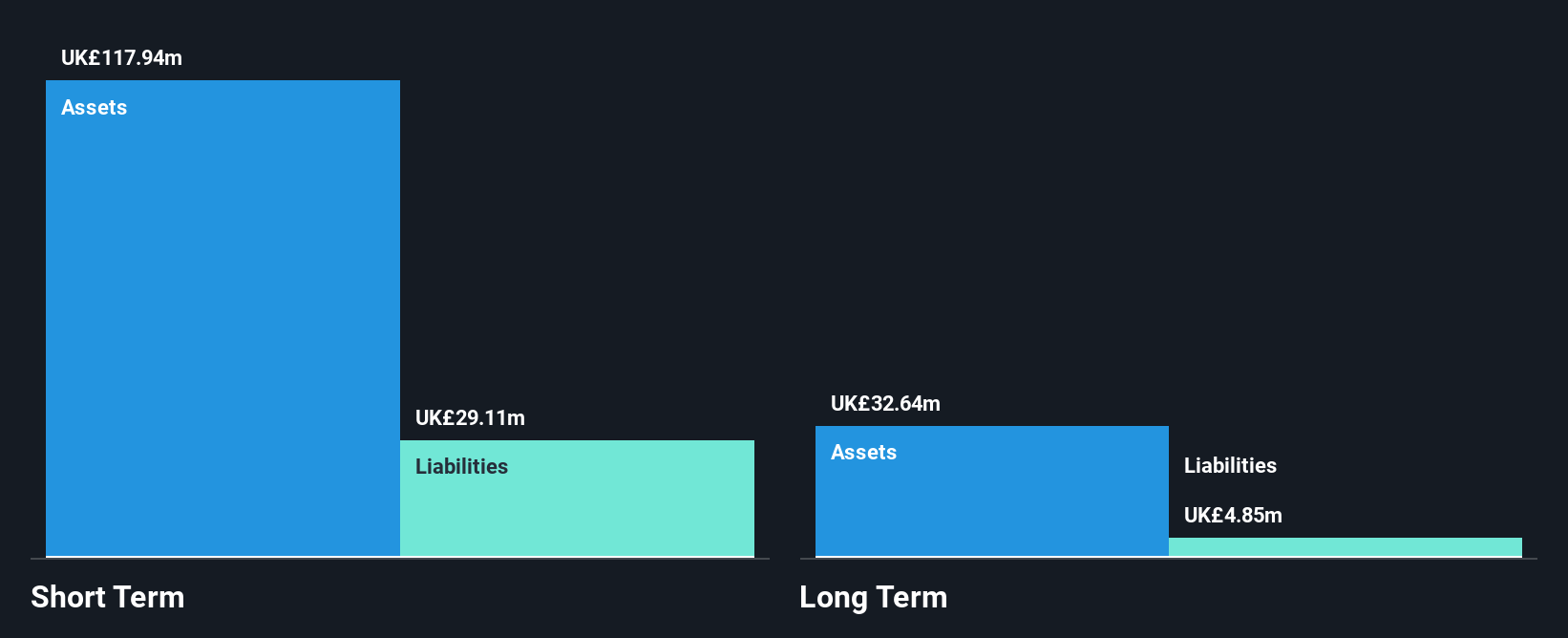

NIOX Group, with a market cap of £286.67 million, has shown mixed performance as a penny stock. Despite negative earnings growth over the past year and declining profit margins from 28.2% to 10.7%, the company remains debt-free with strong asset coverage for both short and long-term liabilities. Recent financials reveal increased sales to £25.2 million for the half-year ending June 2025, alongside improved net income of £5.9 million compared to £4.4 million last year, indicating potential resilience in its core operations despite challenges in earnings growth relative to industry averages.

- Navigate through the intricacies of NIOX Group with our comprehensive balance sheet health report here.

- Assess NIOX Group's future earnings estimates with our detailed growth reports.

Vertu Motors (AIM:VTU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vertu Motors plc is an automotive retailer operating in the United Kingdom with a market cap of £195.38 million.

Operations: The company's revenue is primarily derived from its retail segment focused on gasoline and auto dealerships, generating £4.80 billion.

Market Cap: £195.38M

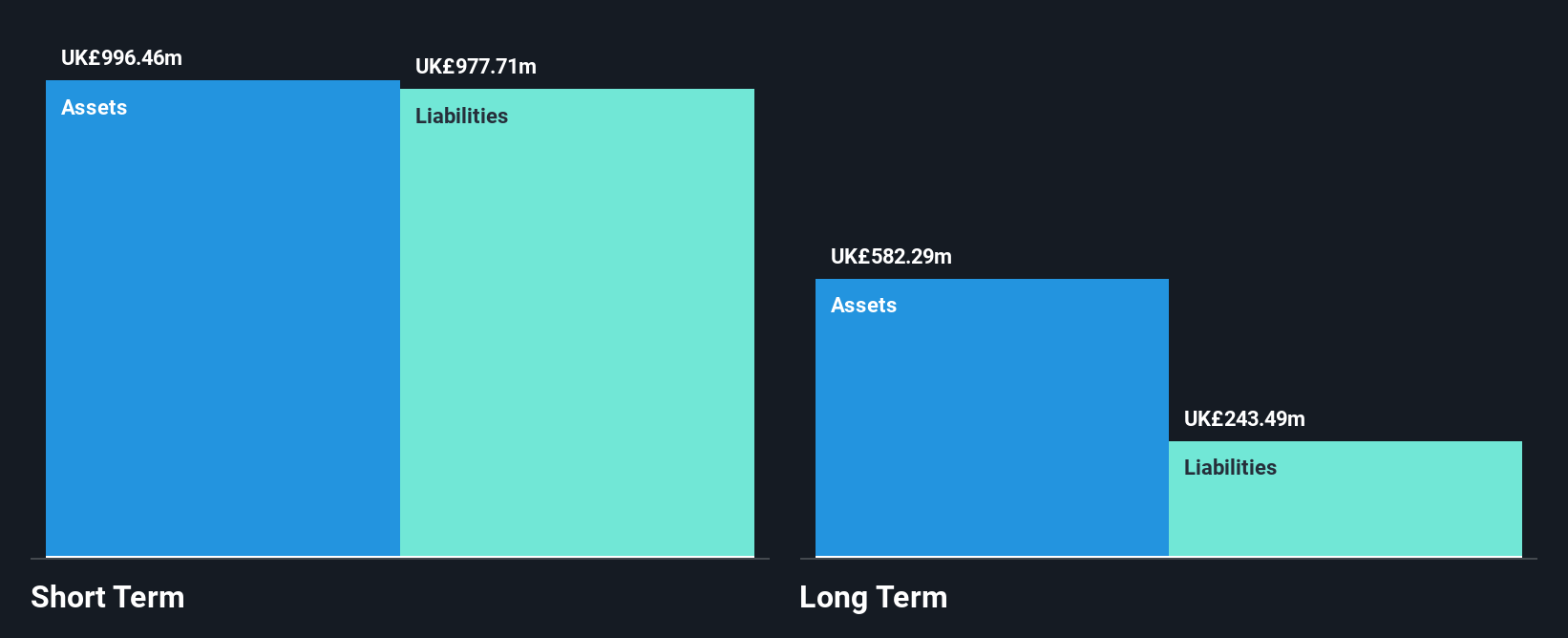

Vertu Motors, with a market cap of £195.38 million, has faced challenges typical of penny stocks, including a one-off loss impacting recent earnings. Despite this, the company maintains satisfactory debt levels with net debt to equity at 21.5% and covers interest payments well through EBIT. Recent buyback activities have seen the repurchase of 3.35% shares for £6.38 million, reflecting management's confidence in its valuation. The interim dividend remains stable at 0.90p per share despite unstable historical dividends, while short-term assets cover both short and long-term liabilities effectively amidst declining profit margins from 0.4% to 0.3%.

- Click here and access our complete financial health analysis report to understand the dynamics of Vertu Motors.

- Gain insights into Vertu Motors' outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Access the full spectrum of 303 UK Penny Stocks by clicking on this link.

- Curious About Other Options? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal