Is It Too Late To Consider Willis Towers Watson After Strong Multi Year Share Price Gains

- Wondering if Willis Towers Watson at around $329 a share is still worth buying, or if most of the upside has already been priced in? You are not the only one trying to figure out whether this insurance and advisory giant still offers genuine value.

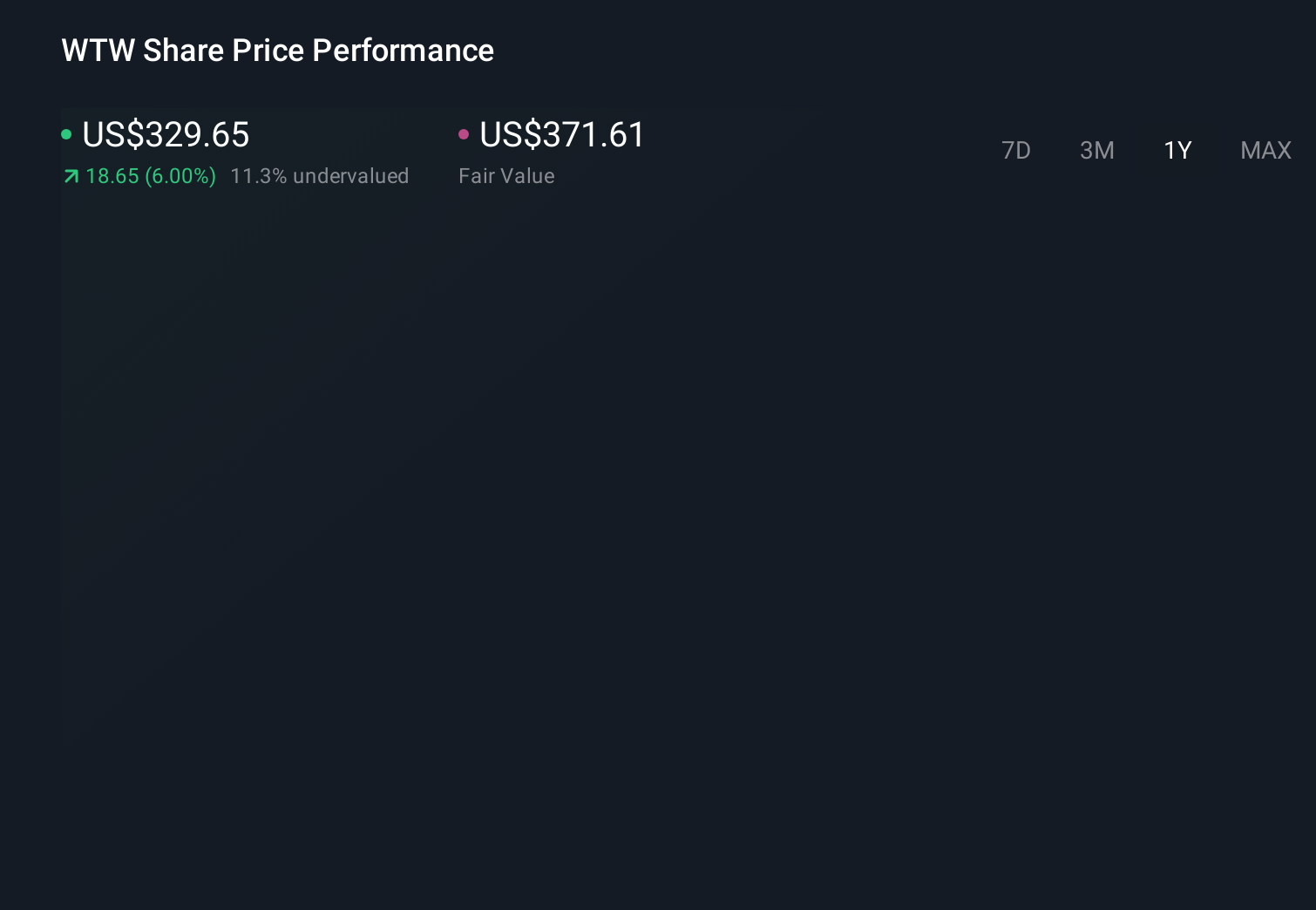

- Over the last week the stock is up 1.3%, and it has climbed 3.2% over the last month. Zooming out, it is up 6.6% year to date and 7.2% over the past year, building on a strong 41.5% gain over three years and 66.3% over five years.

- Those steady gains have come as investors digest ongoing strategic moves, including portfolio refinements in its risk and broking operations and continued investment in its data driven advisory capabilities. Together, these have helped frame Willis Towers Watson as a more focused, higher quality compounder in the insurance and consulting space, which can shift how the market prices its future cash flows.

- On our scorecard, Willis Towers Watson currently earns a 2 out of 6 valuation score. This means it screens as undervalued on only a couple of checks and fairly priced or expensive on the rest. Next we will walk through the main valuation approaches behind that score, then finish with a more holistic way to judge what this price really implies about the company’s long term story.

Willis Towers Watson scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Willis Towers Watson Excess Returns Analysis

The Excess Returns model looks at how much value Willis Towers Watson can create above the return that investors require on its equity, then capitalizes those surplus profits into an intrinsic value per share.

Starting with book value of $80.53 per share and a stable book value estimate of $90.90 per share, analysts expect the business to keep reinvesting at an average return on equity of 20.80%. That supports a stable earnings power of about $18.91 per share, based on forward-looking ROE estimates from four analysts.

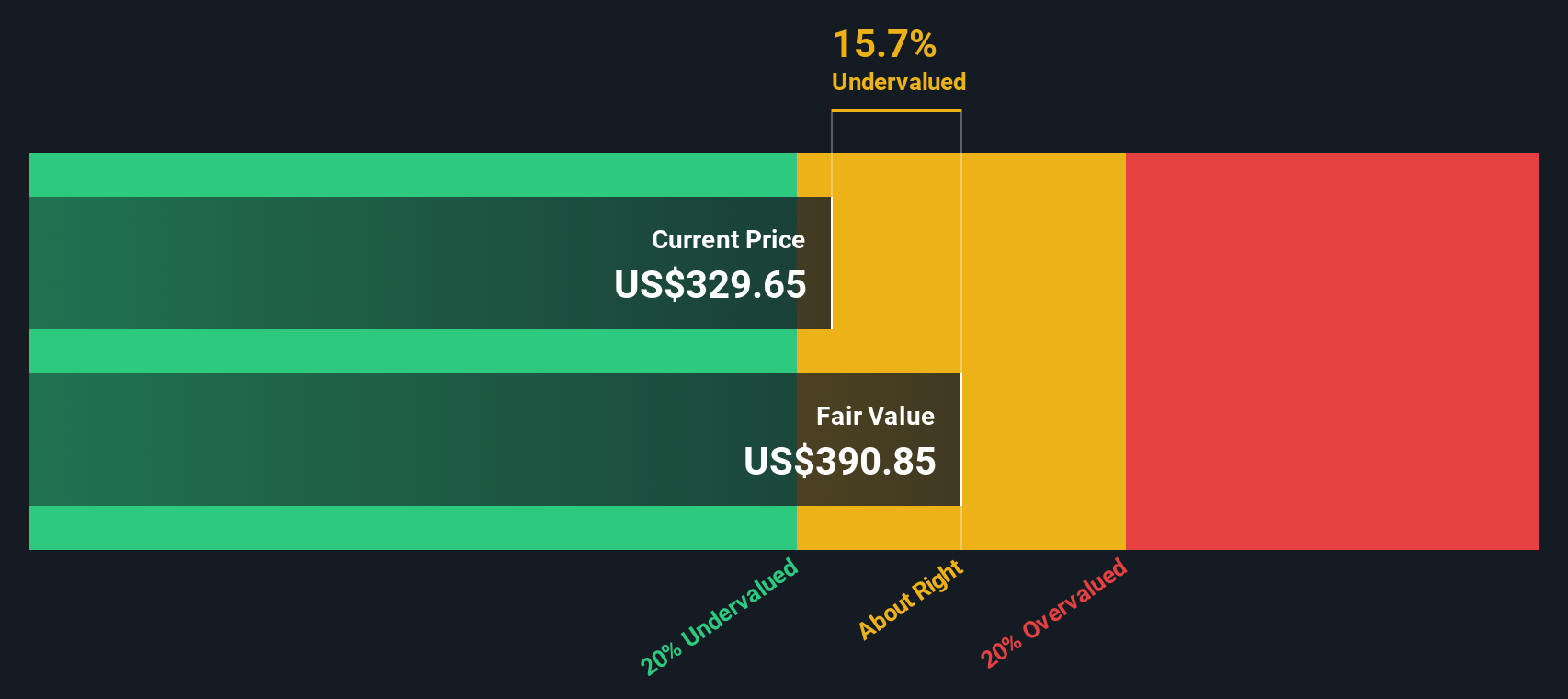

After subtracting the required cost of equity, estimated at $6.67 per share, the model arrives at an excess return of $12.24 per share. Capitalizing these excess returns over time yields an intrinsic value around $390.85 per share. Compared with the current price near $329, the Excess Returns model implies the stock is roughly 15.7% undervalued and indicates that investors may not be fully pricing in its ability to compound equity at above-average rates.

Result: UNDERVALUED

Our Excess Returns analysis suggests Willis Towers Watson is undervalued by 15.7%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Willis Towers Watson Price vs Earnings

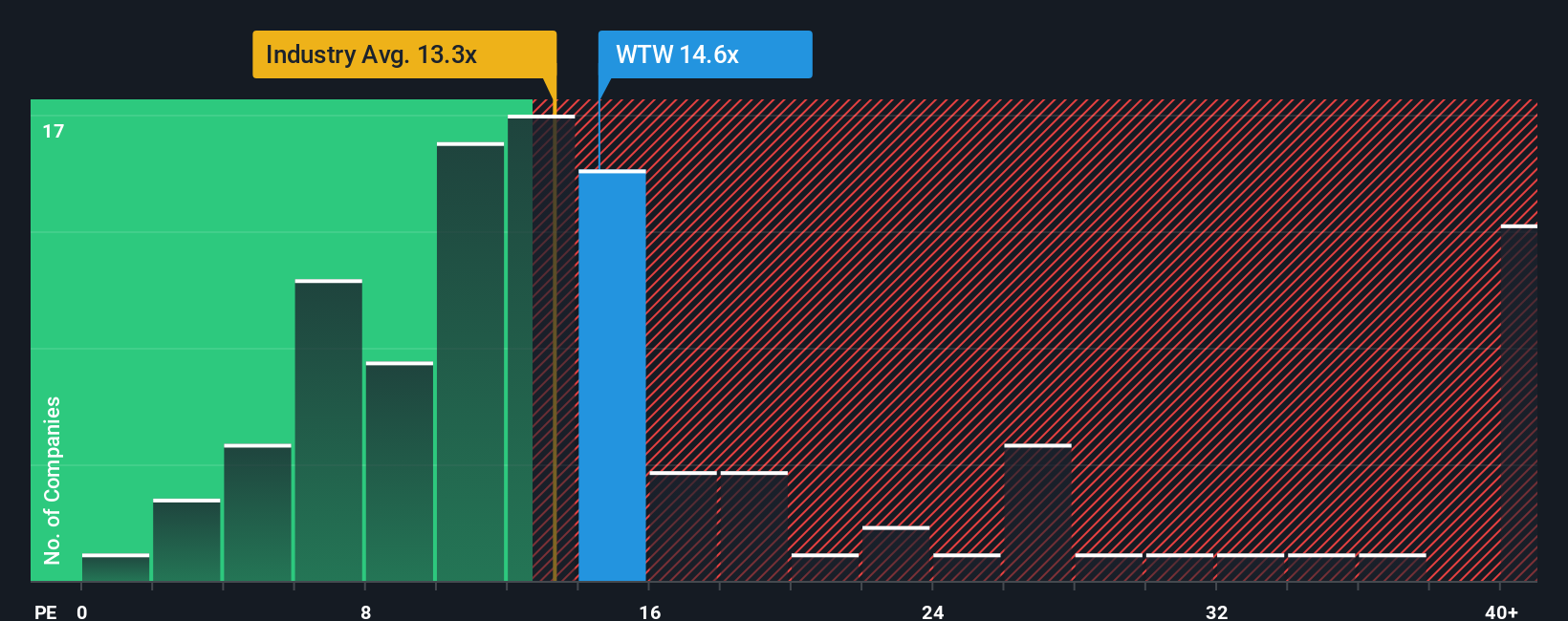

For consistently profitable businesses like Willis Towers Watson, the price to earnings, or PE, ratio is a practical way to gauge how much investors are paying for each dollar of current earnings. In broad terms, faster growth and lower perceived risk can justify a higher PE, while slower growth or higher uncertainty usually call for a discount.

Willis Towers Watson currently trades on a PE of around 14.9x, which is modestly above the Insurance industry average of about 13.4x, but well below the broader peer group average near 48.8x. To refine that comparison, Simply Wall St uses a proprietary “Fair Ratio” that estimates what PE a company should trade on given its earnings growth profile, profitability, industry, market value and risk factors. This is more targeted than simply lining the stock up against peers, which may have very different growth runways or risk profiles.

For Willis Towers Watson, the Fair Ratio is 11.5x, noticeably below the current 14.9x market multiple. That gap suggests the shares are pricing in more optimism than our fundamentals based framework would support at this point.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Willis Towers Watson Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply the stories investors tell about a company, linking their view of its future revenues, earnings and margins to a financial forecast and then to a fair value estimate. On Simply Wall St’s Community page, which is used by millions of investors, Narratives make this process easy and accessible by helping you write down your assumptions, automatically turning them into a forecast, calculating a Fair Value and then comparing that to today’s share price so you can decide whether Willis Towers Watson looks like a buy, a hold, or a sell. These Narratives are dynamic, updating when new information like earnings, guidance or major news hits the market, so your valuation view stays current without you having to rebuild everything from scratch. For example, one investor might create a bullish Willis Towers Watson Narrative that supports a fair value around $408, while a more cautious investor may land closer to $305, yet both can clearly see how their different assumptions drive those outcomes.

Do you think there's more to the story for Willis Towers Watson? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal